Wild’s Winter Portfolios return for 2020-21

A six-year winning streak has ended, but the portfolios have generated stunning returns since inception.

21st October 2020 10:41

by Lee Wild from interactive investor

A six-year winning streak has ended, but the portfolios have generated stunning returns since inception.

Everything was going so well last winter. Financial markets were in rude health and, in January, even the comparatively dull FTSE 100 index was within striking distance of a record high. For a moment it was like the bull market was back in full swing, with plenty of wise heads betting the blue-chip index would top 8,000 for the first time by year-end, or sooner. We all know what happened next.

In a flash, coronavirus destroyed years of hard-won gains.

Of course, there were repercussions for our hugely successful seasonal trading strategy, one that has demonstrated it can consistently beat the market over not just days, weeks and months, but over decades.

As well as an incredible track record, the strategy is beautifully simple, which is why we began running a pair of portfolios based on the principle in 2014. And, despite a wobble during the pandemic, it remains a trading tactic I believe is worth pursuing for a seventh year.

The rationale

Our interest was piqued by an anomaly in the stock market which demonstrates that buying and selling at two specific dates of the year has historically generated better returns than if you had stayed invested all year round.

Buying a portfolio of shares on 1 November and selling them on 30 April has significantly outperformed the wider stock market over the last 25 years, providing investors with a clear strategy that’s simple to execute and enjoys a successful performance history.

Data provided by Stephen Eckett, mathematician and co-founder of Harriman House, the publisher behind The UK Stock Market Almanac, shows that £100 invested in 1994 and held continuously for the past 25 years would have grown to £206 (excluding dividends). However, if they had only invested in the market between 1 November and 30 April every year, then that £100 would be worth £278. Conversely, if they had chosen to only invest over the summer months, they would have lost money; their original £100 would be worth just £68.

“This anomaly, sometimes called the Sell in May Effect, has been known about for a long time,” explains Mr Eckett. “The first mention of it was in the Financial Times in 1935; and one academic paper claimed to have found evidence of the effect in data from 1694. Another paper found that the effect could be seen in the share markets of 81 countries - so it is not limited to the UK.”

Of course, this strategy is not without risk, none are. But the theory is compelling.

How do we do it?

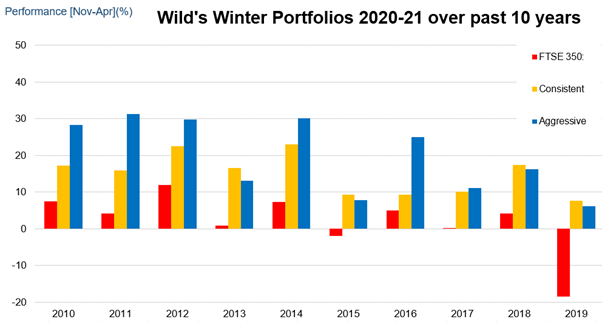

Using the data, each year we build two portfolios. Screening only stocks listed in the FTSE 350 index for a greater level of liquidity, the five most reliable winter performers of the past 10 years form the Consistent Winter Portfolio. A basket of five higher risk/higher return stocks which still exhibit impressive consistency over the winter months become the Aggressive Winter Portfolio.

Every constituent in the new 2020-21 consistent portfolio has risen during the six winter months for at least the past decade. The average return for the period November to April, excluding dividends, is 14.9% versus an average gain of just 2.1% for the FTSE 350 benchmark index.

To access even greater potential returns, we relaxed the entry criteria for the aggressive portfolio for 2020-21. That makes it a little riskier, but even now it includes two stocks that have risen in each of the past 10 winters, while the other three have a 90% success rate. The average winter return since 2010 of 19.9% exceeds the consistent portfolio, as you would expect, but not by as much as in previous years. That’s because 2009-10, a winter when share prices began a rapid recovery from the financial crisis, drops out of the 10-year track record, while 2019-20, a particularly weak winter for stocks, is included.

Source: interactive investor. Past performance is not a guide to future performance.

The five stocks in each of the 2020-21 winter portfolios will be announced on Friday 30 October.

Historic performance

Last year was a difficult one for the constituents of both portfolios. However, the consistent portfolio fell by a modest 6.1% for the six winter months, compared with an 18.4% decline for the FTSE 350. The aggressive portfolio ended the strategy down 18.6%, in line with the wider stock market.

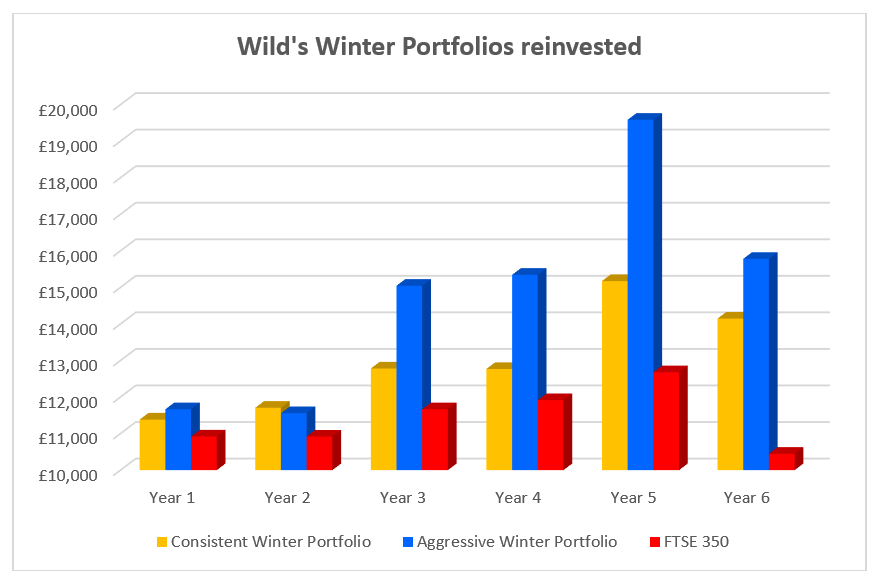

Yet any investor who had bought the maiden Aggressive Winter Portfolio at the end of October 2014 and sold the following 30 April, then reinvested the proceeds into the 2015-16 portfolio and repeated the process each year, would still have generated a return, including dividends, of 57.8% over six years. Doing the same with the Consistent Winter Portfolio would have returned 41.5% including dividends, compared with just 5% for the FTSE 350 index. Prior to last year, gains were 95.9%, 51.7% and 26.8% respectively. This performance data, except for the FTSE 350, also includes dealing costs and stamp duty.

Of course, seasonal strategies like this have their critics, and there’s a well-known saying, especially among fund managers, that it’s all about "time in the market rather than timing the market." In many circumstances, they’re right. But the statistics don’t lie, and the proven consistency of our baskets of winter shares makes them worth considering as part of a well-diversified investment portfolio.

Total returns based on £10,000 lump sum at 31 October 2014, sold at the end of April 2015, reinvested the proceeds into the 2015-16 portfolio and repeated the process each year

Source: interactive investor. Includes buying/selling costs and stamp duty. Past performance is no guide to future performance. Investments and the income from them can go down as well as up and you may not get back the original investment.

Why does the winter portfolio strategy work?

While there are no conclusive studies that neatly explain the outperformance of stock markets during the winter months, there are plenty of theories, some more plausible than others. There are also some obvious reasons why individual stocks do better at this time of year.

“One theory attributes the anomaly to seasonal affective disorder (SAD),” Mr Eckett tells us. “This argues that as nights lengthen in the autumn investors become more risk averse, which drives prices down such that by the end of October prices are artificially depressed and ready to bounce back, reverting to their “normal” levels. The opposite happens in the spring: as days lengthen investors become less risk averse, which drives prices up, such that by the end of April prices are artificially high and ready to correct back to their normal levels. It’s an interesting hypothesis. Although, if it was true, one might expect the same to apply in the antipodes (e.g. Australia) but with a timescale shifted by six months - but this does not happen.”

Perhaps more likely is that far more money flows into the market over the winter months. This occurs at the end of long summer holidays for big players at financial institutions on Wall Street and the Square Mile. While the City no longer shuts down for the cricket, horse racing and rowing at Henley, it is probable that some of the big trading decisions are left until everyone is back in the office. Investment strategies deployed in the following months increase liquidity and boost sentiment.

Most investors will have heard of the Santa rally, when equity markets historically have done well in the weeks leading up to Christmas. You could attribute this to seasonal optimism, or, more likely, end of calendar-year window dressing of portfolios by funds and investment houses. Selling losers and buying successful stocks flatters the numbers that determine City bonuses.

Then, in the spring, at the end of the financial winter, investors take advantage of tax-efficient products in the run up to tax year-end. In what is often referred to as ISA season, many investors rush to use their tax-free allowance in the final days, weeks and months of the tax year. So-called ‘early birds’ then use their ISA allowance as soon as the new tax year begins.

Among obvious drivers of individual stocks or sectors is the retail industry, where investors will guess whether or not consumers are spending heavily on Christmas presents. There are often seasonal swings for the pubs sector too, often dependent on results demonstrating the financial impact of weather, good or bad, on our drinking habits over the summer.

The ongoing coronavirus crisis means this year might be very different. And, as usual, there will be some significant and potentially market-moving events occurring during this winter season.

Events to monitor over the next six months

Every year I issue a sensible warning about the risk involved in stock market investing, and how a number of events in the diary could cause share prices to reverse. This year is no different.

Just three days into this year’s strategy we have the US presidential election on 3 November, when Donald Trump will discover if Americans have the stomach for another four years of his unique approach to the presidency. Currently, pro-regulation Democrat Joe Biden leads the opinion polls. This might not normally be well-received by financial markets, but that could all change if Biden decides to push the button on massive fiscal stimulus.

Meanwhile, as US presidential candidates prepare for their final TV debate, UK politicians are testing the nerve of EU negotiators as Brexit trade talks remain on a knife edge. The outcome of last-ditch discussions will have repercussions for UK-focused stocks.

So will Covid-19 and the search for a vaccine. A magic cure might be many months away and, in the meantime, lockdowns will continue to have a significant impact on UK unemployment and economic growth. Expensive job support schemes will also need funding, so expect talk of tax hikes to be a common theme. However, on the flipside, a viable vaccine and mass vaccination programme would be a major catalyst for the global economy and financial markets.

Of course, other potential banana skins await unsuspecting investors, among them US-China relations, conflict in the Middle East, North Korea, Russian hackers, the list goes on. However, we’ve been here before, and this is the time of year when stock markets do best.

We’ll be unveiling the constituents of both winter portfolios on Friday 30 October and will issue monthly updates until the strategy ends in April.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.