ii Winter Portfolios 2019-20: beating the market in a crash

Even after one of the worst stock market crashes, our seasonal strategy has proved its value again.

6th May 2020 12:46

by Lee Wild from interactive investor

Even after one of the worst stock market crashes, our seasonal strategy has proved its value again.

The past few months have been some of the most turbulent in stock market history. None will need reminding of the human cost of the coronavirus pandemic, and most investors will be nursing some level of financial loss after the global health crisis wiped trillions of dollars off global asset prices.

Between the 20 February, when selling began in earnest, and 23 March, when many global stock markets reached their nadir, the domestic indices FTSE 100, FTSE 250 and AIM had fallen 33%, 40% and 39% respectively. Overseas, the Dow Jones and German Dax slumped by 36%, the S&P 500 34%, Nasdaq Composite nearly 30% and Japanese Nikkei 28%.

While there remains great debate about the shape of any recovery – a V-shaped appears to have been dismissed, so will it be U-shaped or W-shaped? – there is little doubt that April was one of the best months for returns that many can remember, certainly for hard-hit small-caps and tech stocks.

The AIM All-Share index topped the table of global markets, rising 18.8% last month, and the Nasdaq was up over 15%. The FTSE 100 managed a modest 4% improvement, with gains capped by losses among index heavyweights BP (LSE:BP.), Royal Dutch Shell (LSE:RDSB) and HSBC (LSE:HSBA).

How our winter portfolios performed this time

It is important to examine the current circumstances before analysing the performance of the two interactive investor Winter Portfolios. Regular readers will know that we launched our pair of data-driven seasonal strategies six years ago, and that both had outperformed the FTSE 350 benchmark index every year until the beginning of the 2019-2020 winter season.

Both the Consistent Winter Portfolio and higher-risk Aggressive Winter Portfolio, which relaxes the entry criteria only very slightly in return for much higher potential returns, have endured the toughest market conditions ever encountered, yet have emerged with respectable performances for the winter period 31 October to 30 April.

| Consistent Winter Portfolio |

|---|

| Compiling the two winter portfolios is straightforward. The Consistent portfolio is a basket of five FTSE 350 stocks with the most stable track record of returns over the past decade. Each has risen every year for the past 10 years. |

| Aggressive Winter Portfolio |

|---|

| For the Aggressive Winter Portfolio, the FTSE 350 constituents must have delivered the highest average annual returns over the winter. While average returns are our primary criterion, stocks must also have risen over the winter months in at least nine of the past 10 years. |

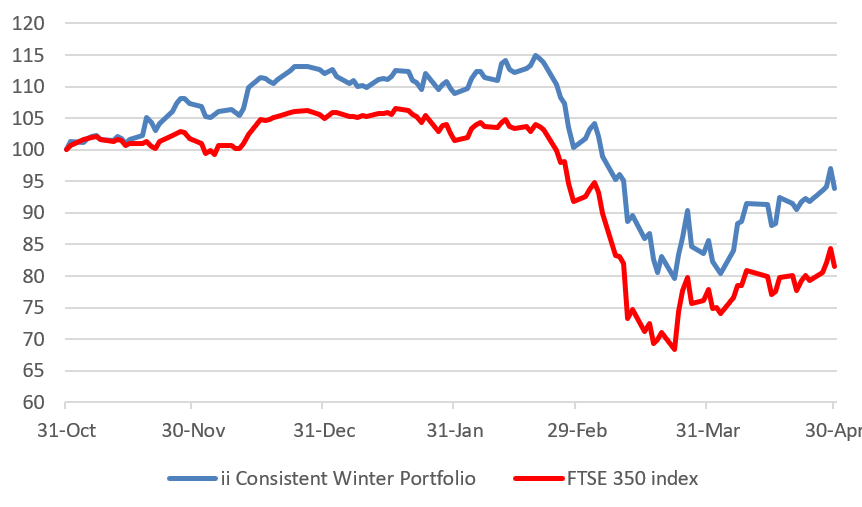

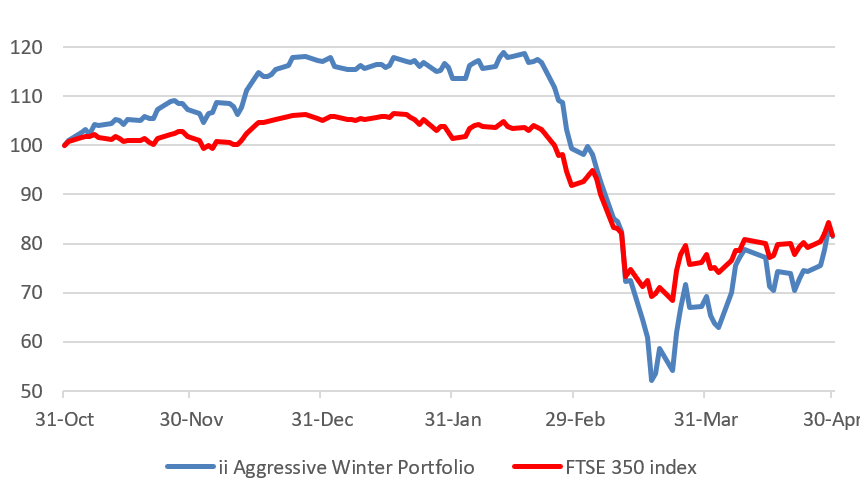

Until the coronavirus crash toward the end of February, both portfolios were thrashing the FTSE 350 index. The consistent basket of shares was up 14.9% on 20 February versus just 3.9% for the benchmark index. The aggressive portfolio was up 17% but had been even higher earlier in the strategy.

Clearly, March did significant damage. Our Consistent Winter Portfolio fell 14.7% during the months, slightly less than the FTSE 350’s 15.2% decline. But growth stocks were hit hardest in the market rout, leaving our aggressive portfolio down over 30% in March, twice as much as the benchmark index. At its worst, the portfolio was down 48% based on closing prices versus the FTSE 350’s 32% plunge.

Sticking to the rules pays off

This is a six-month portfolio designed to be bought on one date (31 October or 1 November), then held until being sold on 30 April the following year. And by not panicking, investors who followed the strategy as intended would have seen the final month in our seasonal strategy repair a lot of the damage done in March.

As world central banks took a “whatever it takes” approach to propping up economies and the global financial system, the consistent portfolio rallied 9.6% in April and the aggressive portfolio a stunning 17.7%, far exceeding the FTSE 350’s 4.8% rise.

That left the consistent portfolio down a modest 6.1% for the six-month winter period, compared with an 18.44% decline for the FTSE 350. At one stage on 30 April, the final day of the strategy, the consistent portfolio was down just 1%. Include dividends, it was down 5.7% overall.

The aggressive portfolio was just a fraction behind with a drop of 18.63% - it was down as little as 14% on the last day of the strategy - so no worse than the wider stock market.

While both portfolios posted a loss for the first time in their six-year history, it is perhaps worth reminding ourselves that the consistent portfolio’s -5.7% total return would have put it among the best-performing funds during the six-month period, and the capital loss of 6.1% ahead of most of the main global indices – France fell 20%, Germany 16%, Nikkei 12% and the Dow Jones 10%.

Winter Portfolio loyalists still boast big profits

And long-term fans of interactive investor’s Winter Portfolios, who invested for each of the first five seasons and invested in the 2019-20 portfolios - will still be quids in, even after this year’s plunge.

Buying the maiden Aggressive Winter Portfolio at the end of October 2014 and selling the following 30 April, reinvesting the proceeds into the 2015-16 portfolio and repeating the process each year, would have generated a return of 96.7%, including all commission and stamp duty, prior to the 2019-20 portfolios. Doing the same with the consistent portfolio would have returned 52.7%. For the FTSE 350, it was 26.8% including dividends.

If you had reinvested the proceeds of each winter portfolio in the following year’s equivalent basket of shares, then invested in the 2019-20 portfolios, owners of the Aggressive Winter Portfolio would still be sitting on a profit of 58.2% over the six years. The Consistent Winter Portfolio is up 42.3%.

Consistent Winter Portfolio

Source: Morningstar. Past performance is no guide to future performance. Investments and the income from them can go down as well as up and you may not get back the full amount invested.

Star of the show in its first appearance in the Consistent Winter Portfolio was technology conglomerate Halma (LSE:HLMA), proof if it were needed of the benefits of diversification across geographies and safety sectors. The shares were rarely in negative territory and, after an 8.8% rally in April, ended the winter up 11.5%.

Steady rather than spectacular describes FTSE 100 chemicals firm Croda's (LSE:CRDA) contribution to this year’s portfolio. However, it ended in positive territory – up 1.4% - for at the least the 16th winter in a row, cementing its place in the Winter Portfolio Hall of Fame.

Domestic darlings Hill & Smith (LSE:HILS) and Howden Joinery (LSE:HWDN) had a stunning winter until the coronavirus outbreak, with both registering big double-digit percentage rises, and Howden up as much as 27% in February. A month later the kitchen supplier was down 30% as Covid-19 lockdown caused premises to close and custom to dry up.

However, Howden improved to end the winter strategy down just under 9%, and a 21% rally for motorway barriers firm HILS in April meant it ended the six-month period down 11.9%.

But for the stock that really torpedoed the portfolio’s chances of making a sixth consecutive positive seasonal return, look no further than Holiday Inn and Crowne Plaza owner InterContinental Hotels Group (LSE:IHG).

Returning a 10% profit for the consistent portfolio as recently as 20 February, the global lockdown and crash in demand for hotel rooms caused IHG shares to almost halve in value within a month. With a return to normality potentially years away, numerous attempts at a rally came to nothing, leaving the shares down 22.6% for this winter portfolio.

Aggressive Winter Portfolio

Source: Morningstar. Past performance is no guide to future performance. Investments and the income from them can go down as well as up and you may not get back the full amount invested.

There was just a single riser in this year’s Aggressive Winter Portfolio – Synthomer (LSE:SYNT). Up 31% after the first two months of our six-month portfolio, the maker of chemicals used in coatings, textiles and synthetic latex gloves ended the period with a 1.6% profit.

Of the remaining four constituents, only Ashtead (LSE:AHT) got close to positive territory. The US-focused equipment rental firm ended the six months down 7.4%, but had been down 45% on its worst day, as an 18% four-month gain in February went up in smoke. A 23% rally in April made for a respectable outcome in the circumstances.

Heat treatment mid-cap Bodycote (LSE:BOY) had been quick out of the blocks this season, surging more than 20% in the first few weeks of October. It was up over 30% before Christmas. However, despite its obvious qualities and leadership in its field, a lockdown affecting key aerospace and automotive industries prevented a more substantial recovery, leaving the shares down 18.5% this winter.

And finally, there are the two worst performers across both our 2019-20 winter portfolios.

With offices shut across the country and few businesses looking for new premises, it is little surprise to see workspace provider IWG (LSE:IWG) down 37.9% this winter. And the fall was quite dramatic, much like pulling the rug away. Up 16% for the winter to 21 February, the shares were down as much as 70% on 18 March until a 38% rally in April.

It wasn’t much better for JD Sports (LSE:JD.). After looking like another great season for our winter portfolio regular, closing its chain of high street sportswear was the death knell. The shares halved in value and, with few signs that stores will be opening properly any time soon, they ended the period down 31%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.