Will value make a sustained comeback in 2020?

There is a growing sense that some kind of correction is overdue, writes Faith Glasgow.

6th January 2020 10:45

by Faith Glasgow from interactive investor

There is a growing sense that some kind of correction is overdue, writes Faith Glasgow.

It’s that time of year again. Putting together the annual Wealth Creation Guide tends to act as a personal call to action for a spot of financial spring-cleaning, and this year is no exception.

I’m well aware that while my SIPP and ISA portfolios are well diversified in terms of market capitalisation and geography, there’s still a clear tilt towards growth-focused funds and trusts. Western markets have resumed their upward trajectory apparently regardless of the numerous geopolitical uncertainties clouding the global horizon, but as half an hour spent reading some of the features in the January issue of Money Observer makes clear, there is a growing sense that some kind of correction is overdue and that value stocks could then come back into their own.

Cover all the bases

Of course it’s a mug’s game to try and call the macro-economic events that will precipitate such a sea change. Commentators have been banging on about a return to value for a couple of years, yet until the past few months there has been little sign of any real rotation. But a failure to cover all bases leaves my portfolio potentially vulnerable.

As Alex Wright, the respected contrarian fund manager of Fidelity's Special Situations fund and Special Values investment trust (LSE:FSV), observed in a recent note:

“Investors who want to be properly diversified should own a mixture of value and growth stocks in their portfolio.”

Doing so should mean they’ll be prepared for a range of future economic scenarios. That’s particularly important in the case of value, he says:

“One of the reasons that value tends to outperform over the very long term is that when things change in the market, it often happens in unexpected ways that surprise the consensus.”

I was interested to learn more about another way of looking at risk a few weeks ago, when two of Sanlam Investment’s equity fund managers explained the group’s approach. Sanlam managers hold a concentrated portfolio of the kind of high-quality businesses that any growth manager would be proud to own, but impose a strict valuation discipline on the whole process.

They only buy from a modest universe of qualifying stocks when they are relatively cheap, and avoid being in thrall to the expensive momentum-driven rally by moving money out of more highly valued holdings and into those with relatively attractive valuations. “We don’t want to become momentum junkies,” explained Sanlam’s Pieter Fourie.

As with any value-focused strategy, market volatility then becomes the driver of opportunity rather than a setback for investors. And with the focus on high-quality holdings, risk becomes “the chance something can go substantially wrong with the business over the next five years, not what happens to the share price in the next three months”.

Given the popularity of quality stocks with bond-like characteristics since the financial crisis, you might assume that opportunities to put that value-driven strategy into practice would be scant. But you’d be wrong, according to Sanlam’s data.

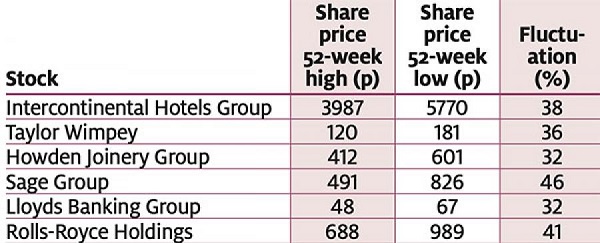

As the table below shows, in the first half of 2019, the qualifying UK stocks shown - all of which are holdings of Sanlam’s Active UK fund, and some of which also appear in the Sanlam Global High Quality - saw fluctuations of up to 46% between their 52-week high and low share prices.

At a time when there’s an underlying sense that market change is bound to happen sooner or later, this businesslike approach of looking for quality at good value could be a reassuring proposition for long-term investors able to embrace the benefits of volatility.

Wild swings for quality stocks in 2019

Source: Sanlam, share price fluctuation over first half of 2019

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.