Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. Tax treatment depends on your individual circumstances and may be subject to change in the future. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

You could keep more money for your future with our low, flat-fee Personal Pension (SIPP) and enjoy a cashback boost.

Get £100 to £3,000 cashback when you add a SIPP and deposit or transfer a minimum of £20,000. See more details on this offer.

Offer ends 28 February 2026. Terms and fees apply.

Important information: It’s important to take your time before transferring your pension. Make sure to consider what the best option is for you. Don’t transfer just to qualify for the offer, and don't rush any decision to meet the offer deadline. We periodically run offers, and there will likely be other opportunities in the future.

Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as, guaranteed annuity rates, lower protected pension age or matching employer contributions.

The ii Personal Pension is a SIPP (Self-Invested Personal Pension), a tax-efficient pension account offering you a wider choice of investments and flexibility.

Whatever your investing experience, a personal pension can help you reach your goals. Hand-pick your own investments from the UK and global markets or leave it to our experts with our managed portfolios.

Investing with a low-cost SIPP, like the ii Personal Pension, gives you a greater opportunity to grow your savings for the retirement you want.

Like all pensions, the ii Personal Pension has great tax benefits, but the main features that set it apart are choice and flexibility. From taking control of your pension savings, to choosing what to invest in, you can prepare your retirement income on your terms.

Don’t feel limited by your retirement saving options. With a SIPP you’re in control of how much and when you save.

Personal pensions can be a great choice for the self-employed, someone consolidating their pensions, or anyone who values a bit of flexibility.

Have the freedom to choose exactly what to invest your retirement savings in, and adjust your investments anytime.

If you aren't sure where to begin, you can take a hands-off approach with expert managed investment options.

Unlike some other pensions, when you’re ready to start taking an income from your pension, you have a range of retirement options to choose from.

Withdraw your savings from your SIPP using lump sums, income drawdown, and other flexible options.

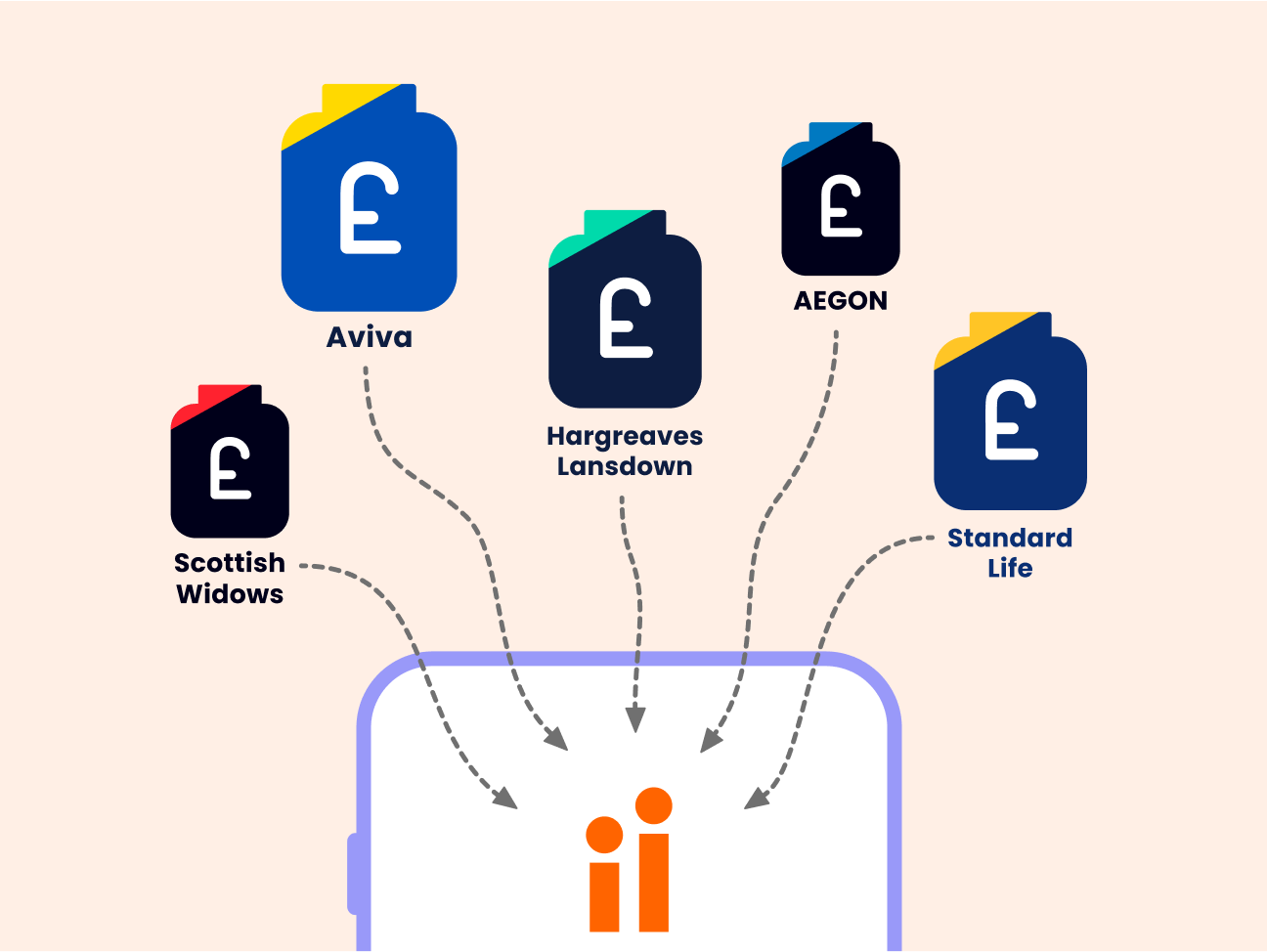

Bring all of your pensions under one roof and see if you could save. Other providers usually charge a percentage of your pot. That means you’ll be charged more as your pension grows. The ii SIPP is different. You can rely on our flat fee and can keep more of what’s rightfully yours.

The ii SIPP offers a wide range of investments and flexible retirement options to suit most people’s needs. More choice doesn’t have to mean more complexity. Our expert picks and SIPP investment ideas can do the hard work for you.

It’s easy to keep track of your pension via our website and secure mobile app. But if you’re ever in need of Personal Pension support, you can count on us. We’re happy to say that ii has more 5-star Trustpilot reviews than any other UK SIPP provider.

All our price plans give you access to ii’s award-winning range of accounts; Personal Pension (including a Managed Portfolio), Stocks and Shares ISA (including a Managed ISA) and Trading Account.

If you’re on our Core plan you can invest up to £100,000 across all of your ii accounts. On Plus and Premium, there’s no limit to how much you can invest and you’ll enjoy a wider range of benefits and features.

| Invest up to | Monthly fee | Plan |

|---|---|---|

| £100,000 | £5.99 | Core |

| No limit | £14.99 | Plus |

It's easy to consolidate a pension with ii. From old workplace pensions to SIPPs, even with traditional pension providers like Aviva and Standard Life, transferring to ii gives you more control over your money and, possibly, lower fees.

You can do this quickly, easily and entirely online once you open an ii Personal Pension.

Find out more about consolidating your pensions with ii and check out how our prices compare to other SIPP providers.

“ii are night and day compared to other providers. We were looking for fairer charges, good reviews and what other people experienced. And they ticked every box. That’s why we’re with ii.”

Rhian and Julian, 62 and 64, switched to ii and now feel confident in their financial future. Hear why they’ve joined over 500,000 investors taking greater control of their money with ii.

You can make personal contributions to your Personal Pension of up to 100% of your annual income each tax year, up to the maximum annual allowance of £60,000. This annual allowance includes personal contributions, employer contributions and tax relief. Employer contributions count towards your £60,000 annual allowance but are not limited by your income.

You can also use the pension carry forward rule to take advantage of unused annual allowances from the previous three tax years and add them to this year’s allowance, provided:

This means you could potentially contribute more than £60,000 in the current tax year by “carrying forward” unused allowances from prior years — up to your relevant earnings limit.

If you have taken taxable income from any pension and triggered the MPAA, your allowance will be reduced from £60,000 to £10,000.

If you do not have any earnings in a tax year, you can still contribute a maximum of £3,600 (£2,880 in personal contributions and £720 tax relief).

For every personal payment you make into your SIPP from your net income, we’ll automatically claim basic rate (20%) tax relief for you. So if you contribute £80, this will be topped up to £100.

Once your tax relief has been sent to us by HMRC, we’ll pay it as cash into your SIPP account, so you can choose how to invest it.

If you’re a higher rate (40%) or additional rate (45%) taxpayer, you can claim back the rest of your tax relief through your annual Self Assessment.

The earliest you can access your SIPP is age 55, rising to 57 in 2028.

You can withdraw from your SIPP in various ways, including tax-free cash, income drawdown, lump sums, or a combination that best suits your needs.

You can also take up to 25% of your pension tax-free - subject to a maximum of £268,275 - while any remaining withdrawals will be added to your income and could be taxed.

Yes, you can have a SIPP and a workplace pension and can pay into both at the same time. Just make sure your total contributions don’t exceed you annual allowance.

Once you’ve maximised your employer pension contributions, paying into a SIPP can be a great way to complement your workplace savings.

Yes – there's no limit on how many pensions you can have. However, bringing your pension pots together into one SIPP can make your retirement planning much simpler.

We make it easy to transfer other pensions into the ii SIPP. You can transfer when opening your account, or you can come back and do it later.

Yes, it is possible for employers to contribute to a SIPP through one-off and/or regular payments. If you want to pay into your SIPP this way, you will first need to ask your employer if they are able to arrange this.

When you die, any remaining money within your SIPP can pass to whoever you wish to receive it. It’s important that you fill out an expression of wishes form to make sure your pension ends up in the right hands.

Your beneficiaries usually won’t pay inheritance tax on any money they receive but might pay income tax on any withdrawals if you die after age 75. If you die before age 75, they can inherit the pot without paying income tax.

From 6 April 2027 unused pension funds (as well as some death benefits) will become part of your estate for inheritance tax (IHT) purposes following an announcement in the Autumn 2024 Budget. Read more about the upcoming changes to pensions and inheritance tax.

Read our guide on what happens to your SIPP after death.

Yes, a Managed Portfolio is simply an investment option and will appear alongside your other investments within your SIPP account.

Call our award-winning UK-based support team on 0345 646 2390.

You can reach one of our friendly SIPP specialists between 8am-4:30pm, Monday to Friday.

If you’re thinking about retiring soon and want to understand your options, make sure you speak to someone at Pension Wise.

Pension Wise is part of the government’s Money Helper service, offering free and impartial pension guidance to the over-50s. They can also help you decide if transferring your pension is the right choice for you.