Move funds into flexi-access drawdown and take income

You can now move your pension into drawdown online.

At the same time, you can request to take up to 25% of the funds you move into drawdown as a tax free lump sum (up to a maximum of £268,275 unless you have a lifetime allowance protection), and/or set up a regular taxable income from your drawdown pot.

Click here for instructions on how to take or amend your income from an existing drawdown pot.

- The process should take around 30 minutes. It usually takes no more than 10 working days after this to set up your benefits.

Step-by-step

Important information on pension withdrawals

Once a request to make a withdrawal from a pension has been made it cannot be cancelled. This means Tax Treatment & Pension Allowances changes cannot be reversed. If you are unsure do not request a withdrawal. We recommend speaking to an authorised financial advisor or seeking guidance from the Government’s Pensionwise Service.

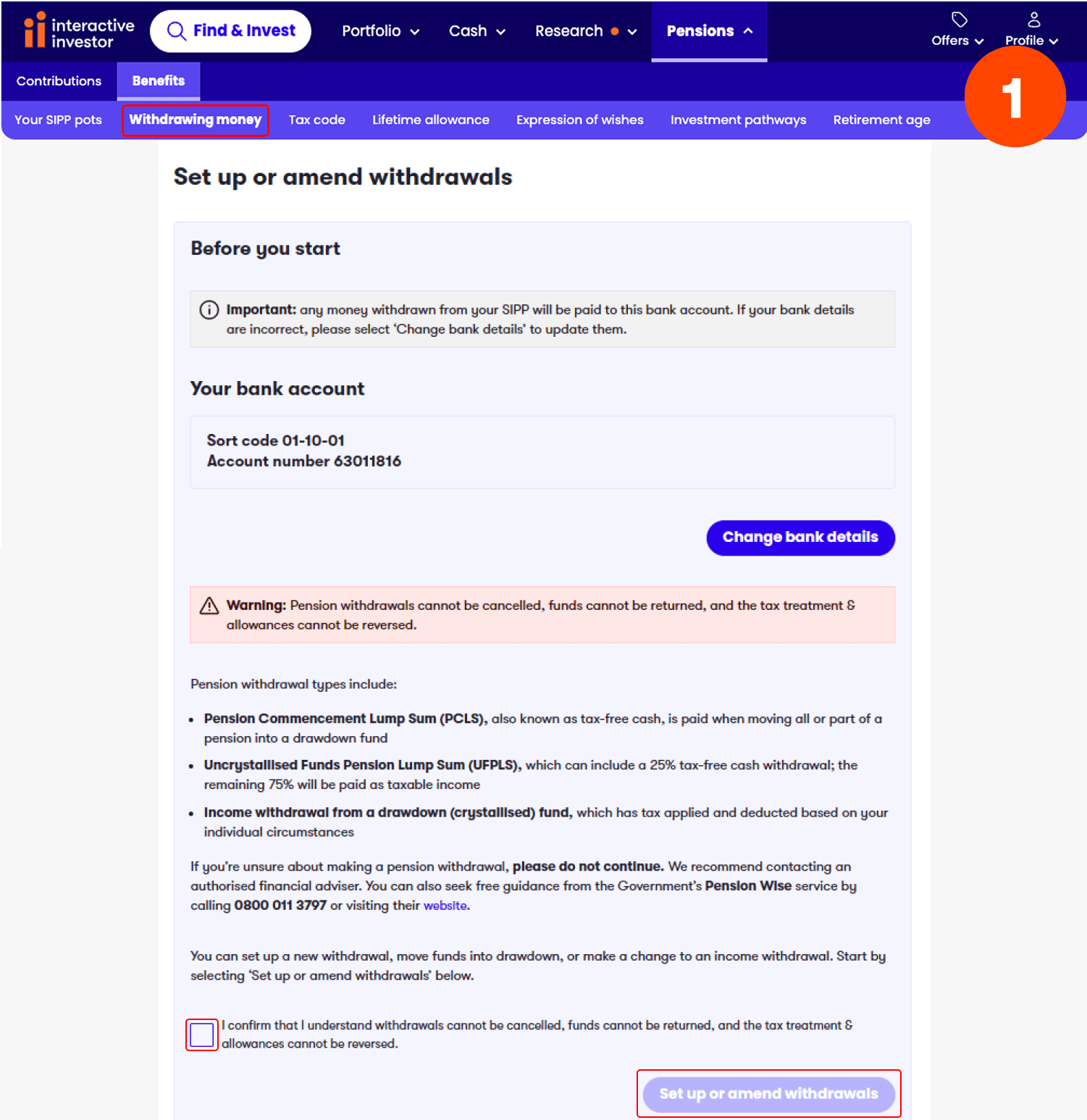

Step 1.

From the 'Pensions/Benefits' menu in your online account, select 'Withdrawing money'.

If you haven't done so already, you will need to add a bank account before you can continue.

Confirm that you understand that requests cannot be cancelled and the tax treatment cannot be reversed.

Then select 'Set up or amend withdrawals'.

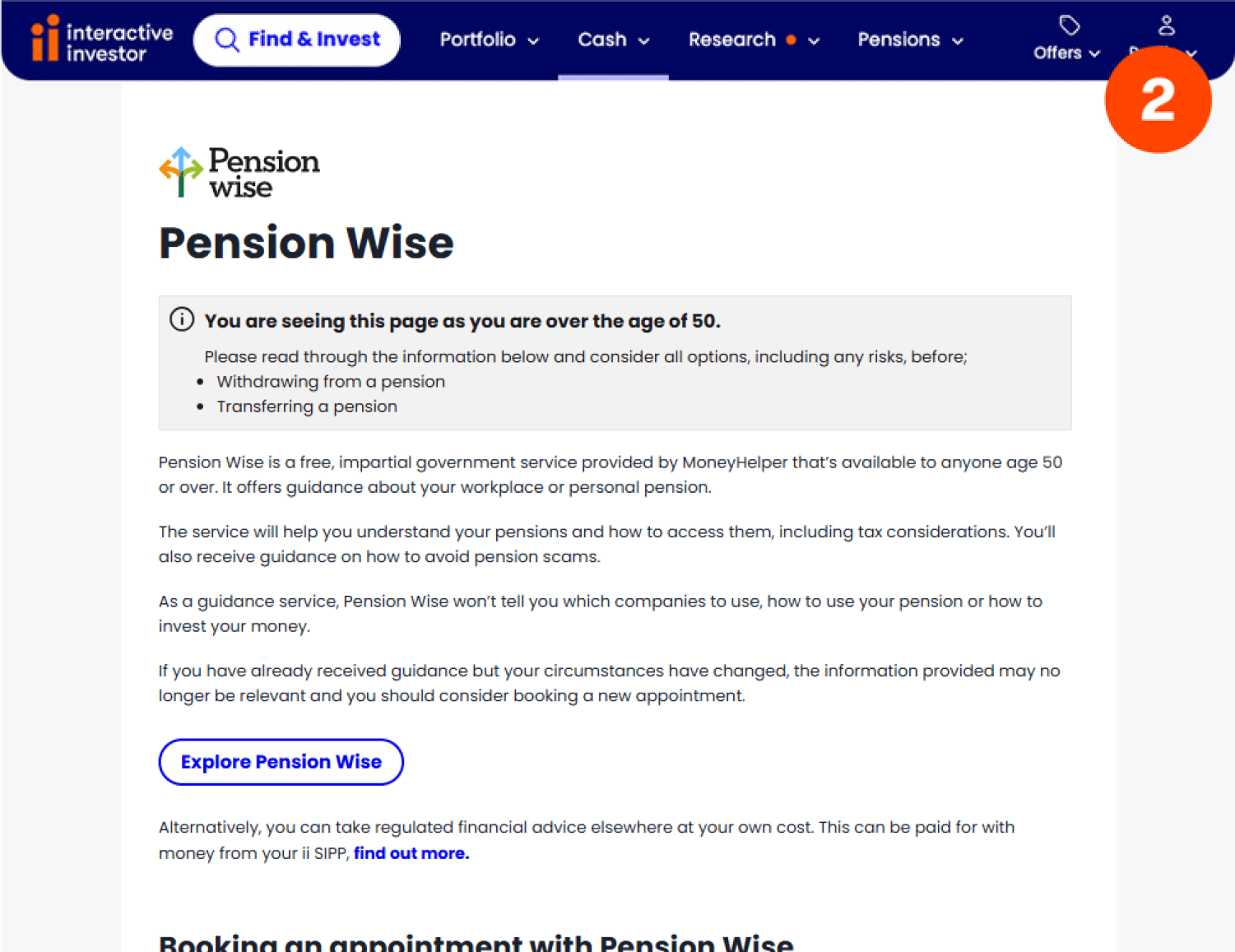

Step 2.

You will then see a page with information about taking guidance from Pension Wise before withdrawing from your pension. From here you can either choose to book an appointment with Pension Wise, let us know that you’ve already had an appointment or confirm that you wish to proceed without having an appointment.

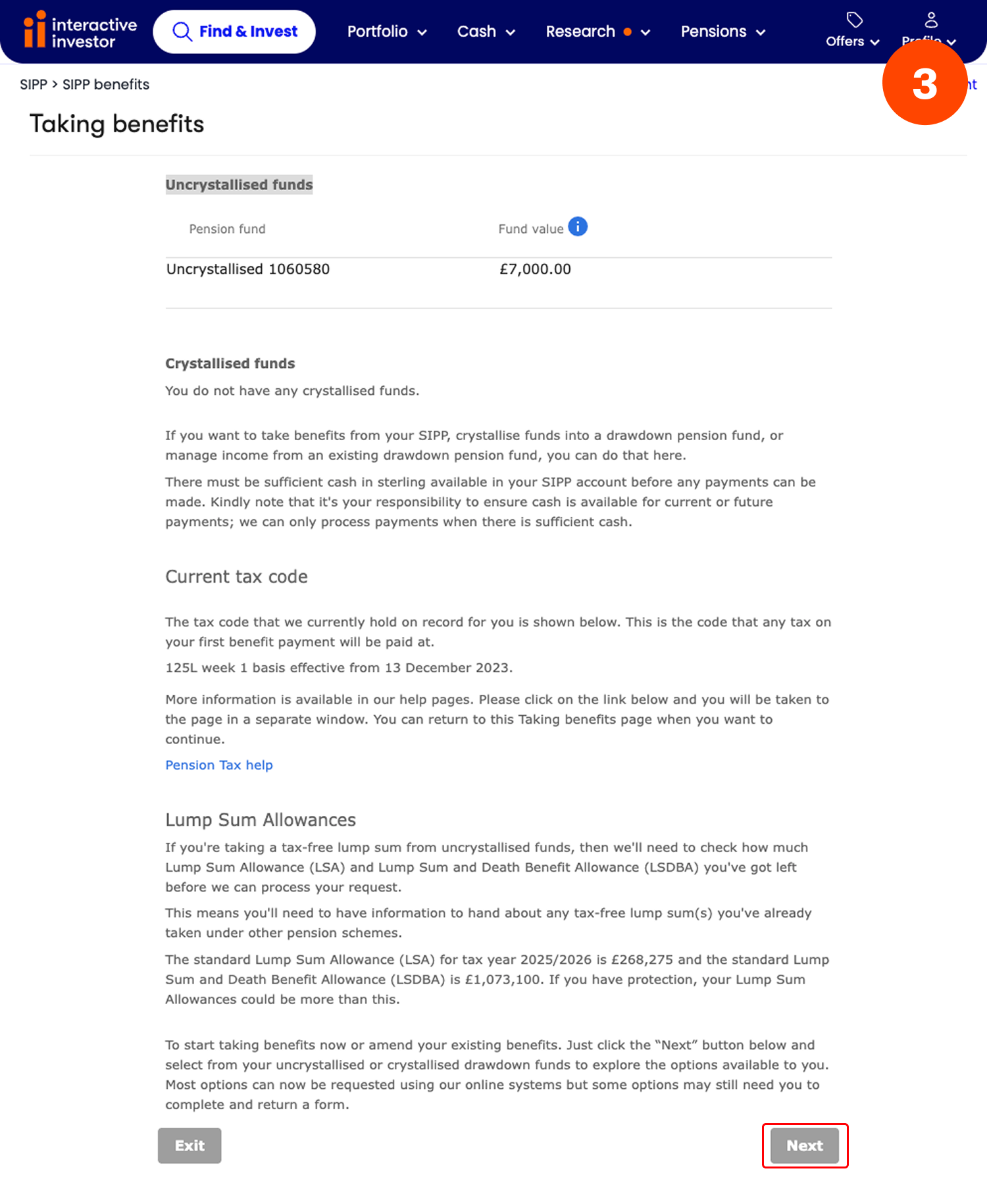

Step 3.

You will then see a summary of your available pension funds. Scroll to the bottom of the page and click ‘Next’.

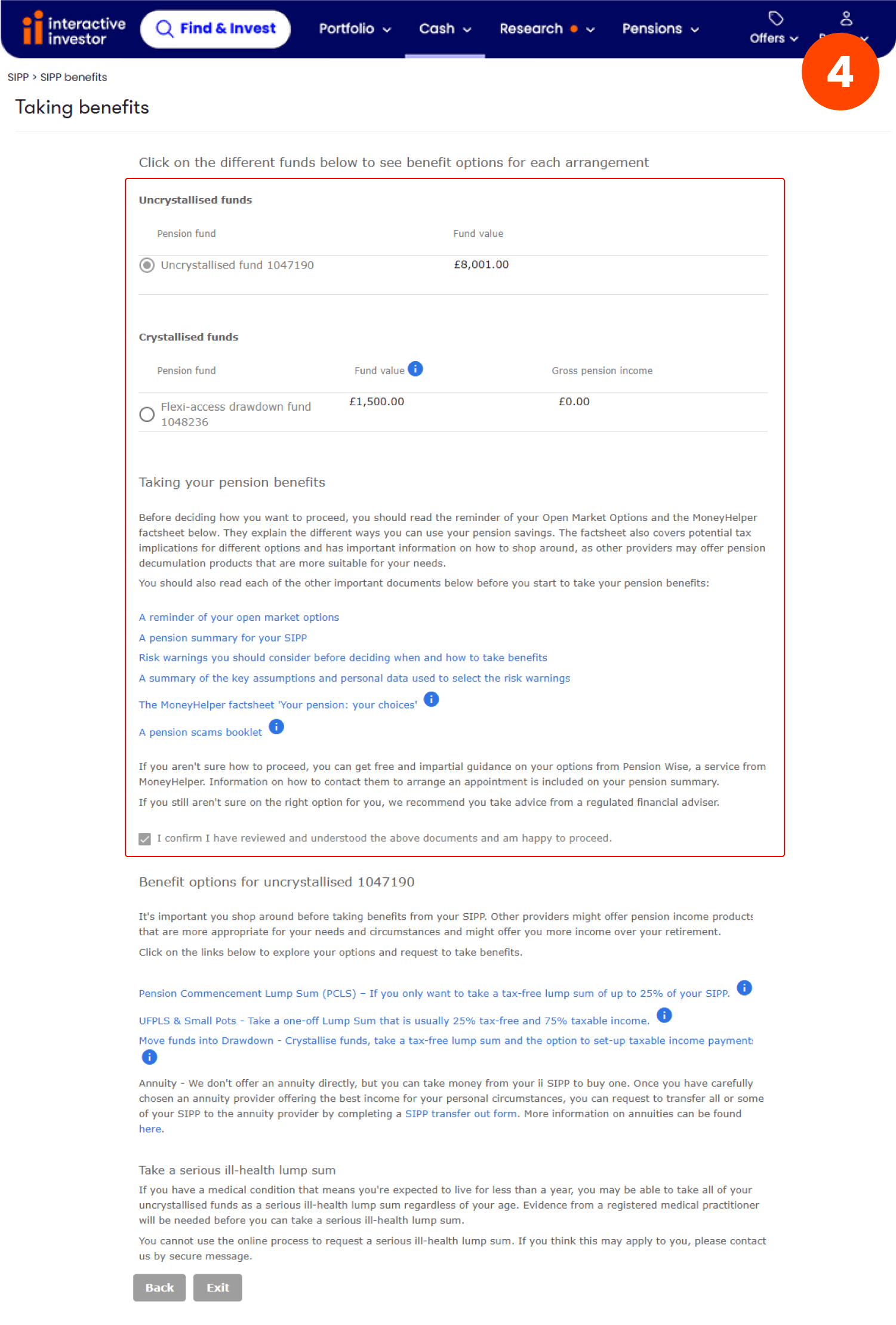

Step 4.

Here, select your uncrystallised fund (this simply means funds you haven't moved into drawdown yet).

Take time to read the six documents under ‘Taking your pension benefits’.

Doing this will allow you to proceed to the next step.

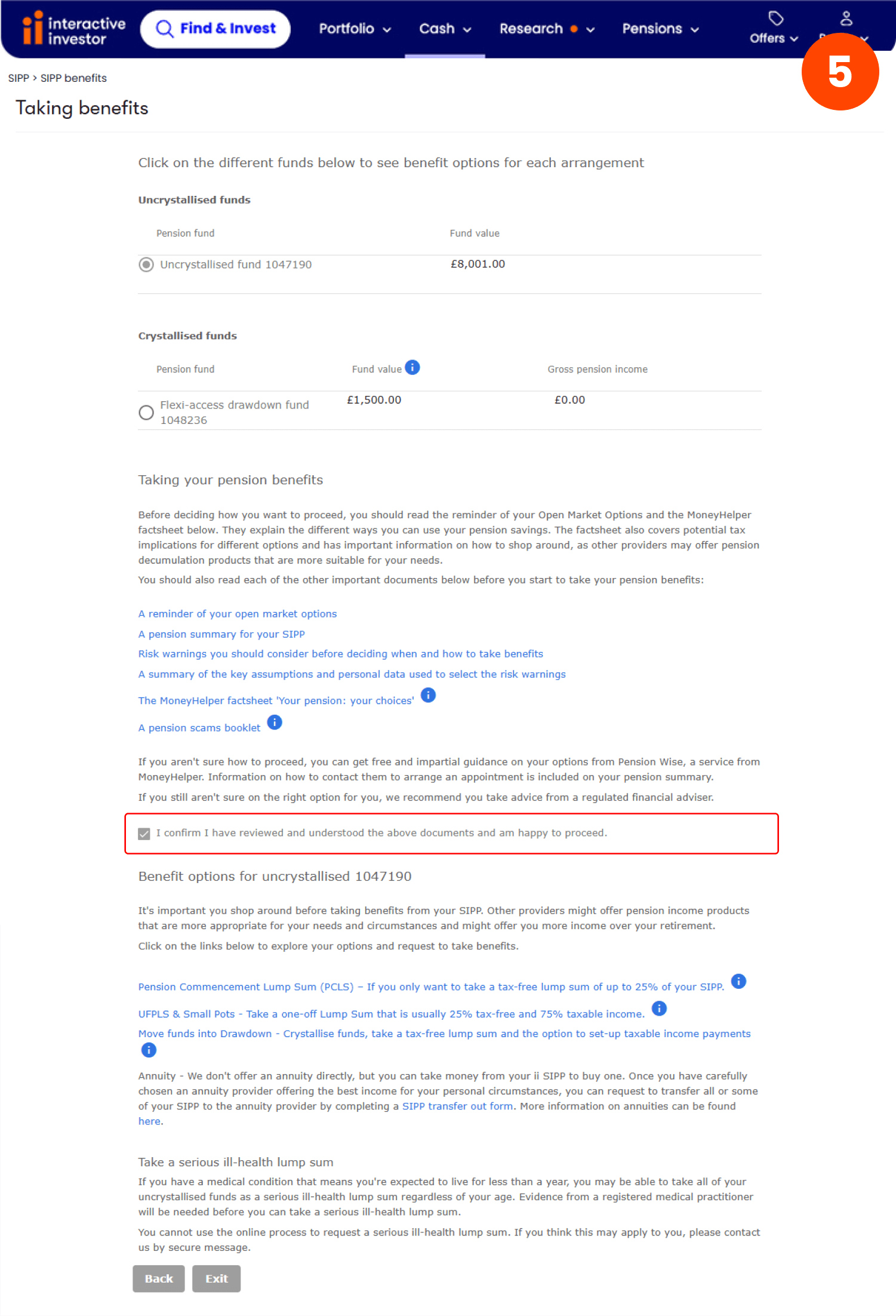

Step 5.

Tick to confirm you have read the documents, and select 'Move funds into Drawdown – Crystallise funds, take a tax-free lump sum and the option to set-up taxable income payments'.

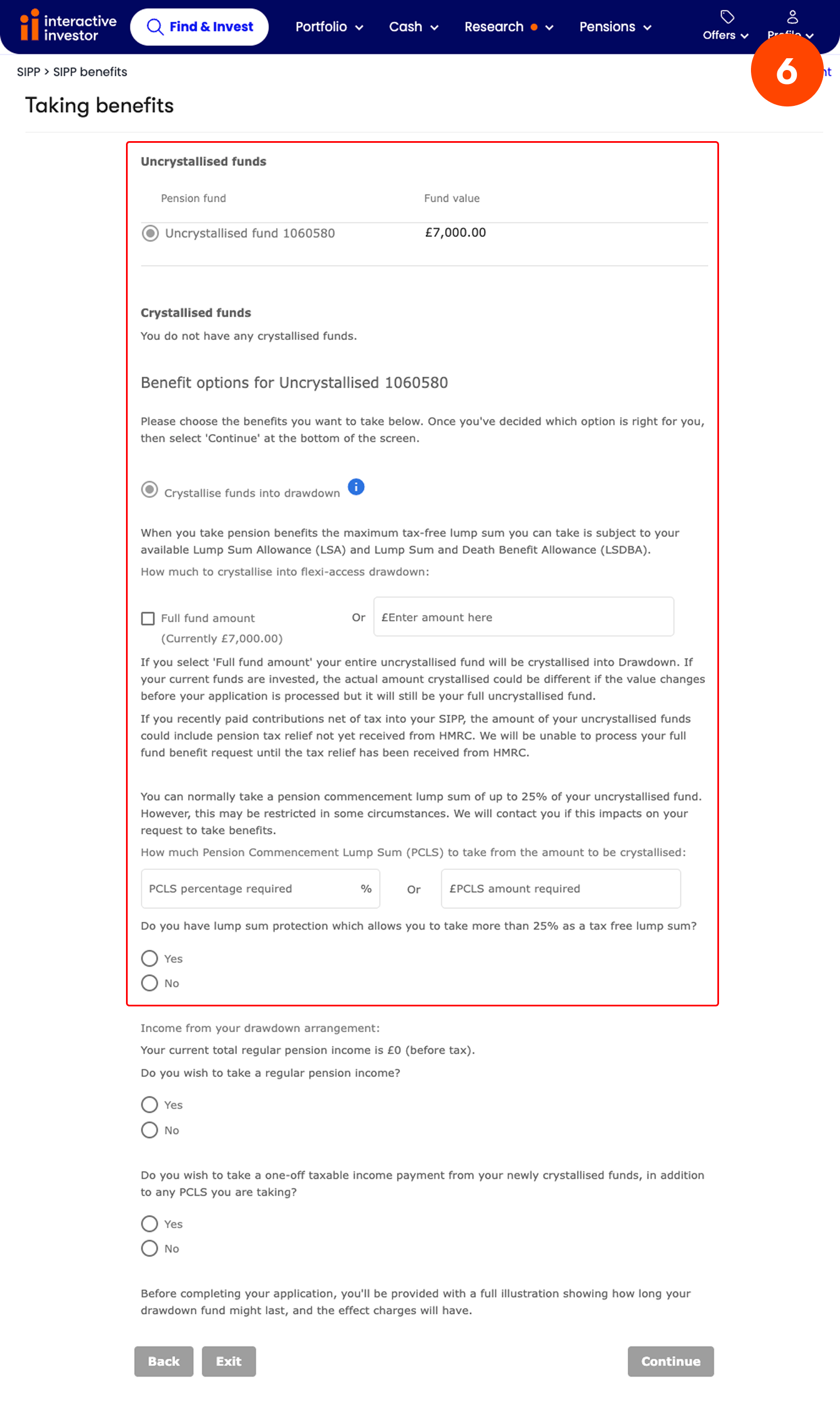

Step 6.

Here you can choose the amount you want to crystallise (move into drawdown), or select ‘full fund amount’.

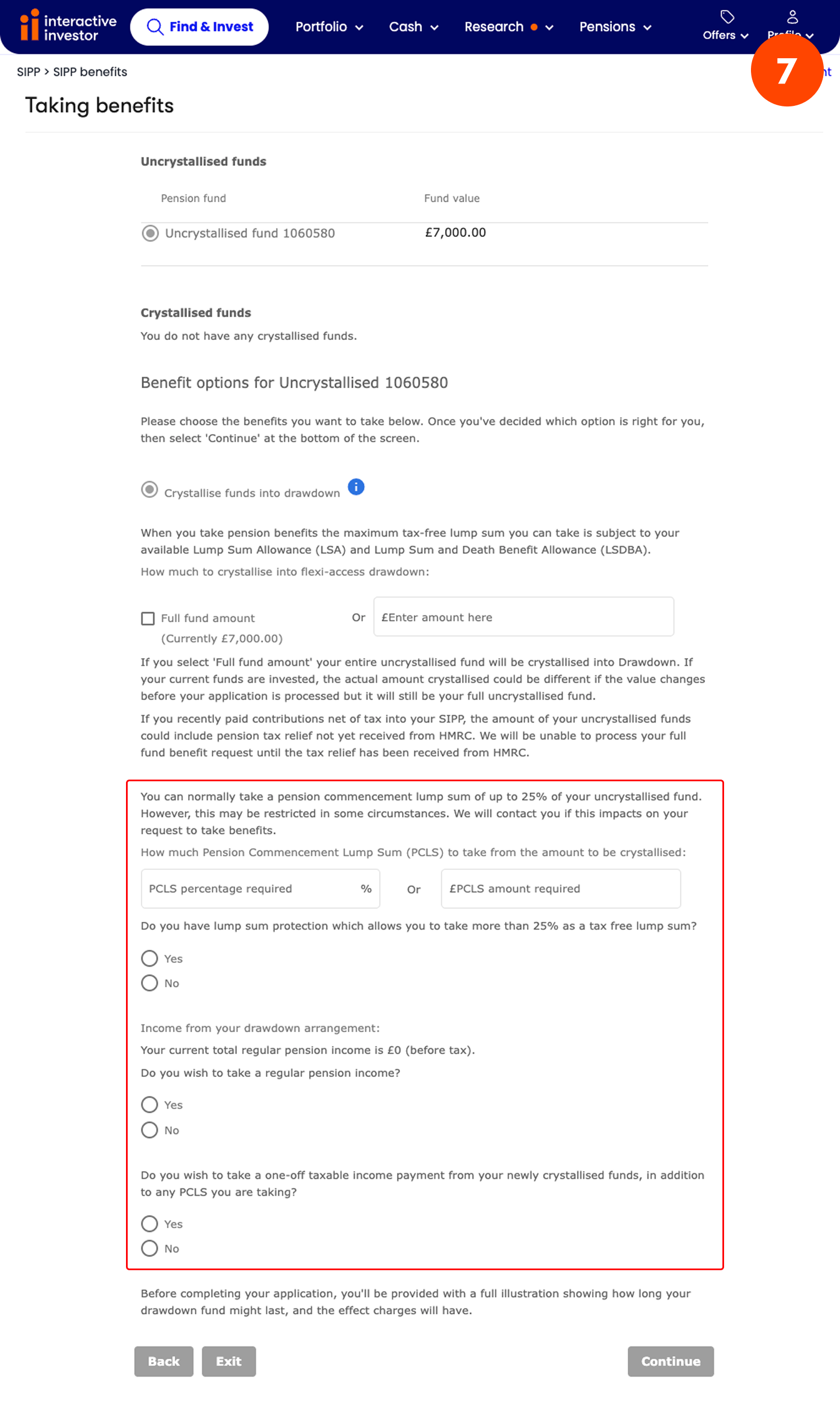

Step 7.

Next, enter how much of your pension you would like to take as a tax-free lump sum (up to 25% with an upper limit of £268,275 unless you have lifetime allowance protection). Enter ‘0’ if you don’t want to take a lump sum.

The minimum lump sum that you can request is £1,000.

Then select whether you’d like to take a regular income (which will be treated as taxable income).

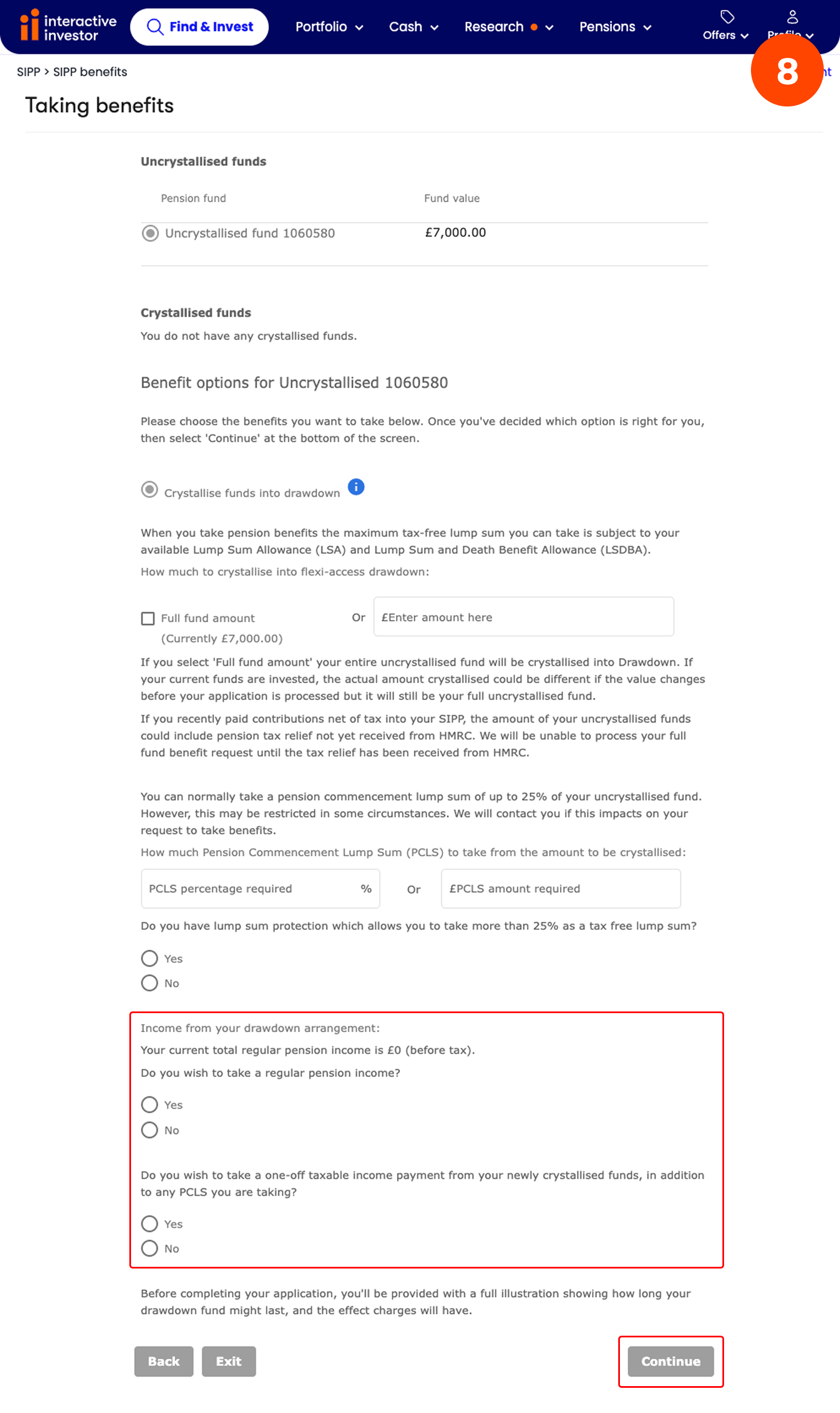

Step 8.

If you are taking a regular income, you can select the frequency and amount you would like to take.

You also have the option to take a one-off taxable amount.

Now click ‘Continue’.

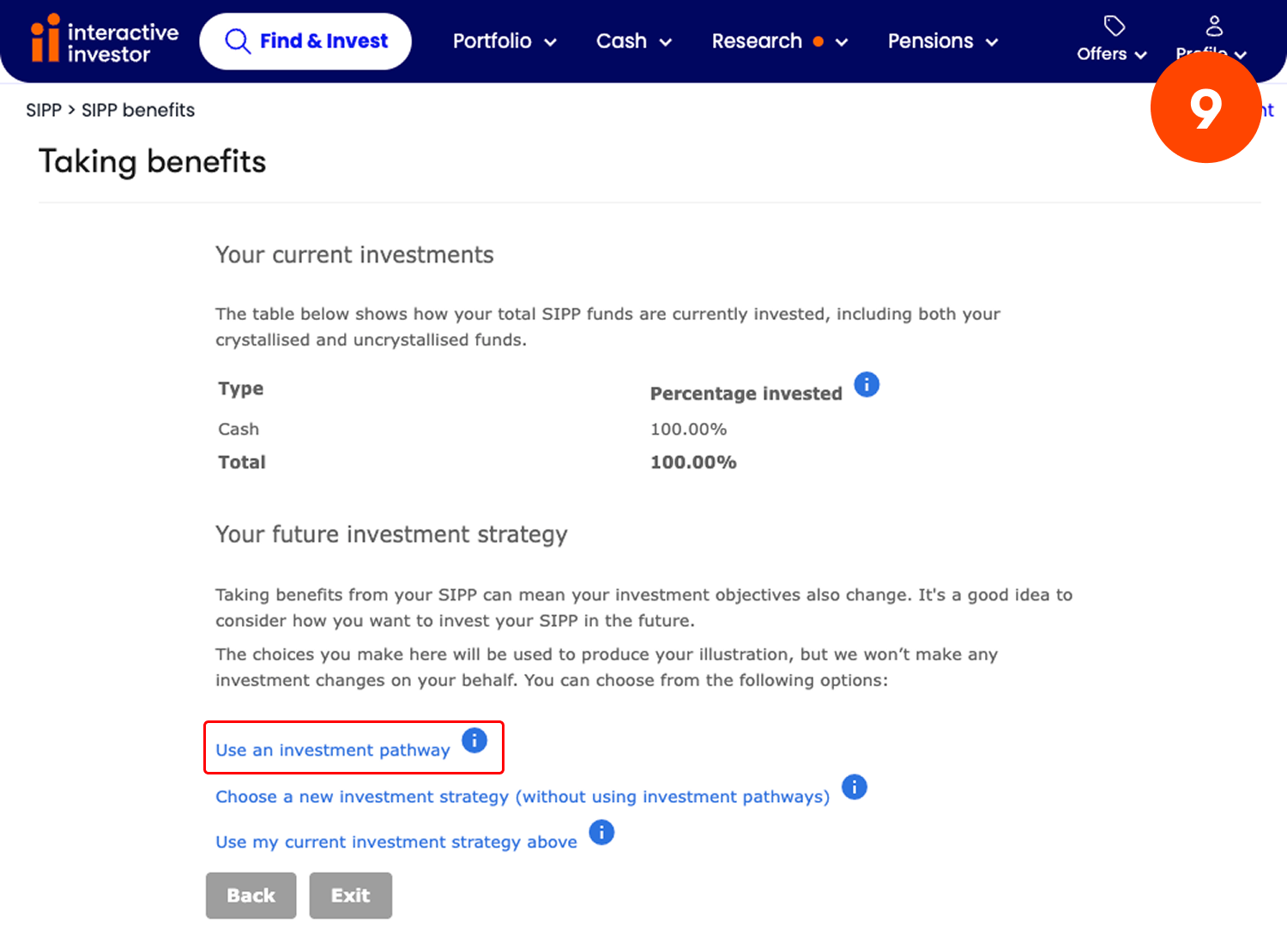

Step 9.

Here you will be asked how you want to invest your SIPP fund in future.

If you don't want to choose your own investment strategy, you can use an investment pathway.

These are investment funds selected by our experts to match four common goals that people have when moving funds into drawdown.

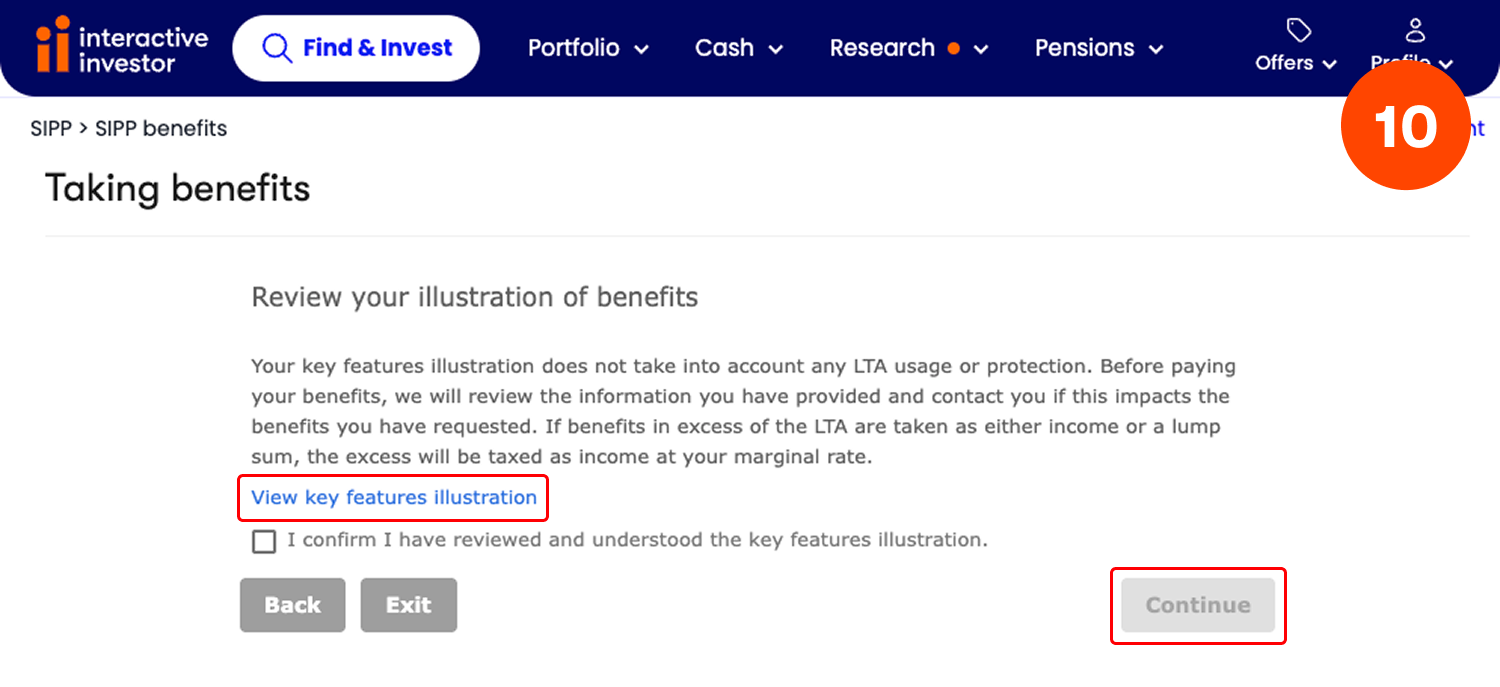

Step 10.

We will then ask you to review your illustration of benefits.

Click 'view key feature illustration' to see a breakdown of your drawdown arrangements.

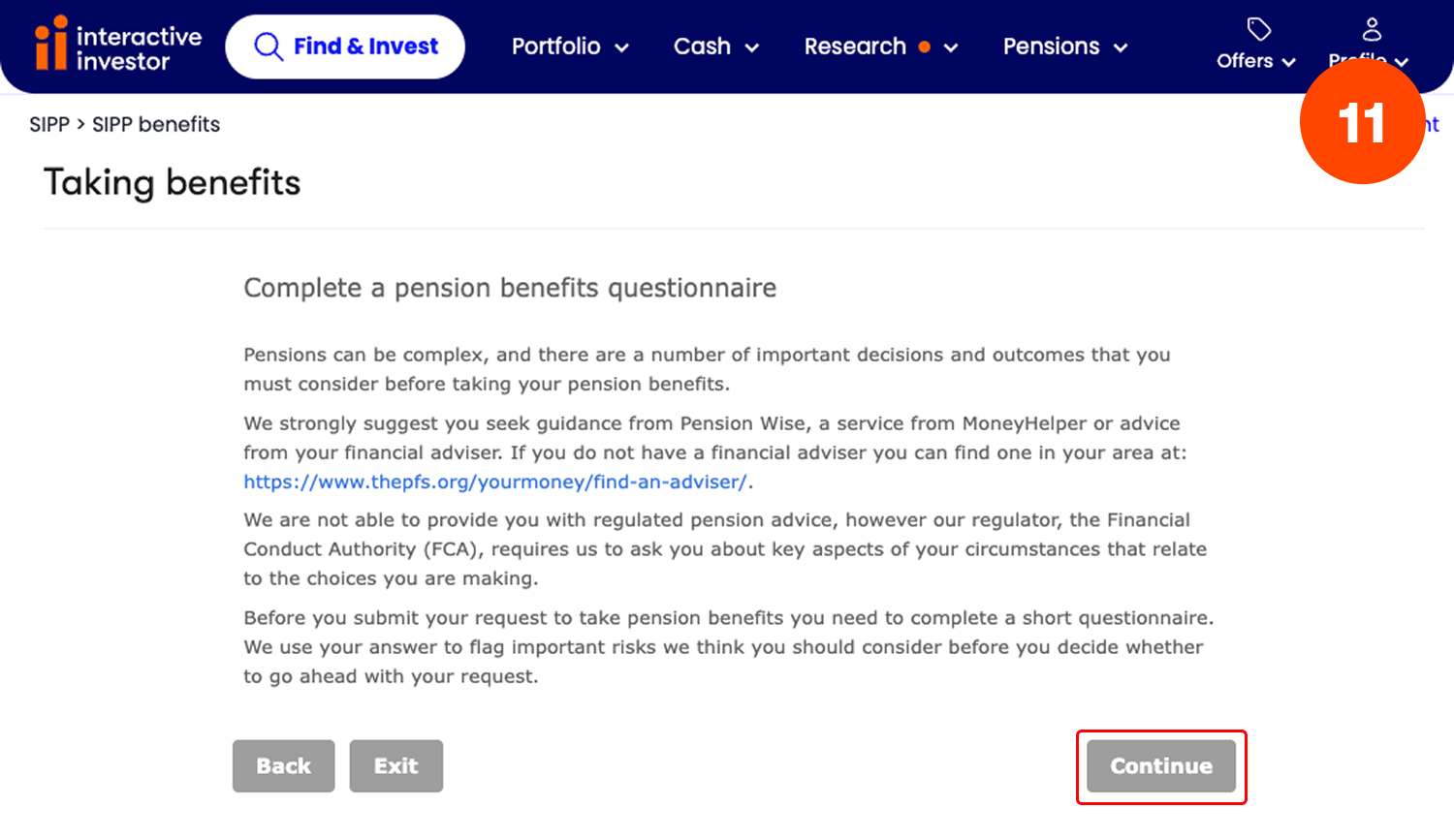

Step 11.

You will then be asked to complete a pension benefits questionnaire. Your answers will flag the important risks you should consider before taking benefits.

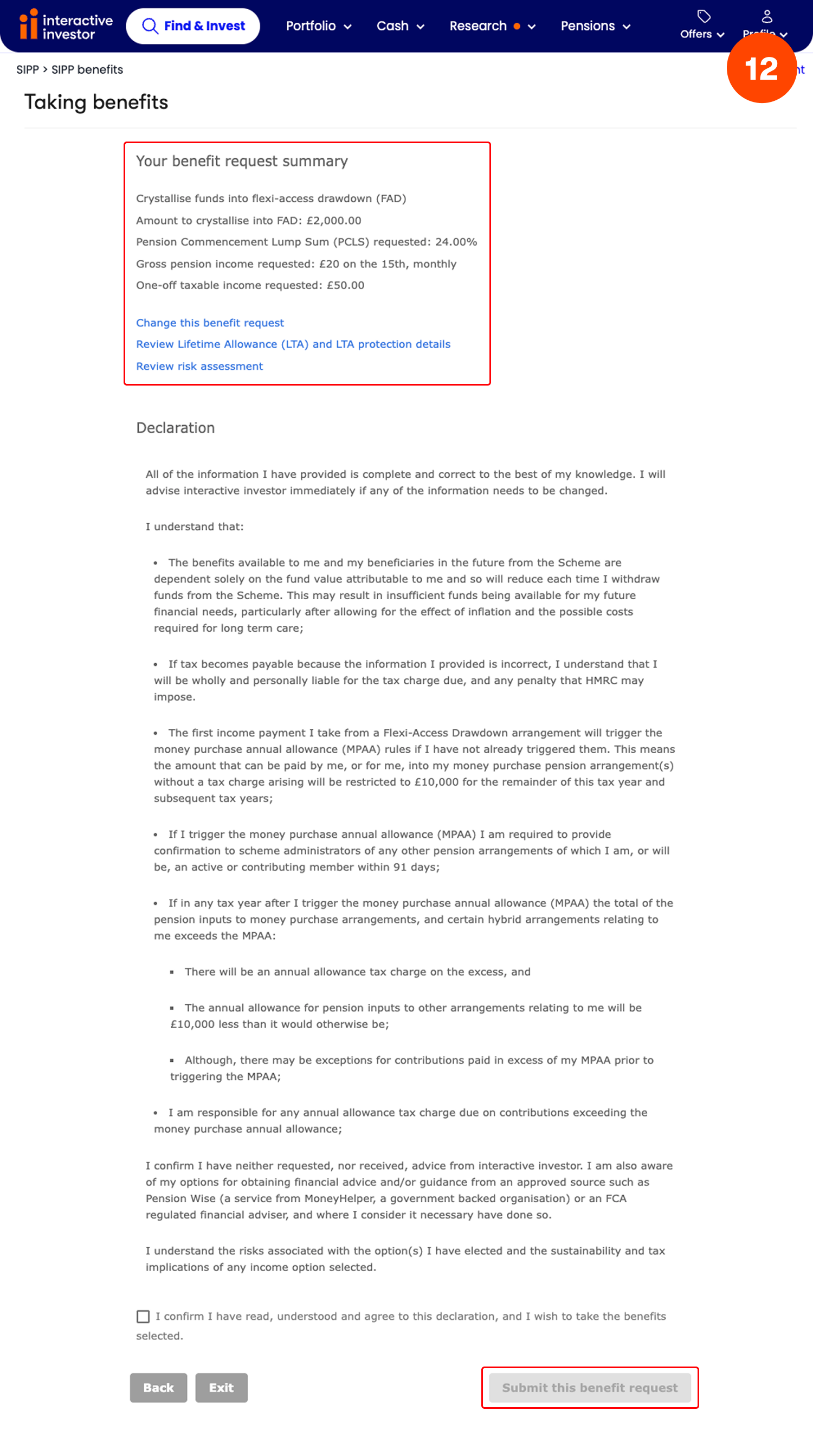

Step 12.

Check your benefit request summary and make sure it is accurate.

Once you have read through the declaration, click ‘Submit this benefit request’.

What’s next?

- It usually takes no more than 10 working days to set up your benefits.

- If you choose to take a taxable income payment as well as your tax free lump sum and if this is your first income withdrawal from your SIPP, you may be charged an emergency tax rate if we have not received confirmation of your tax code from HMRC. The emergency tax code assumes that you will carry on receiving the same amount each month even if the money you are taking is a one-off withdrawal. On an emergency tax code, you will also only receive 1/12th of your tax-free personal allowance. This may mean you pay more tax than is actually due. You can reclaim emergency tax on pensions by contacting HMRC directly.

How can Pension Wise help?

If you have a defined contribution pension scheme and are 50 or over, then you can access free, impartial guidance on your pension options by booking a face to face or telephone appointment with Pension Wise, a service from MoneyHelper.

If you are under 50, you can still access free, impartial help and information about your pensions from MoneyHelper.