Best mining shares to own right now

28th June 2018 14:13

by Graeme Evans from interactive investor

The trade war between China and the United States may still be raging, but mining analysts at UBS reckon that's no reason to think the commodity price gains supporting Rio Tinto and BHP Billiton will come to an end.

They've significantly hiked their price targets on the two mining giants, based in part on forecasts for continued rises in the 2018/19 prices for coal, aluminium and nickel. Iron ore and copper markets are also expected to hold firm.

That's a significant viewpoint given that mining stocks have sold off since mid-June, partly due to escalating concerns over the impact that a trade war could have on global growth and increase the safe haven attraction of the US dollar.

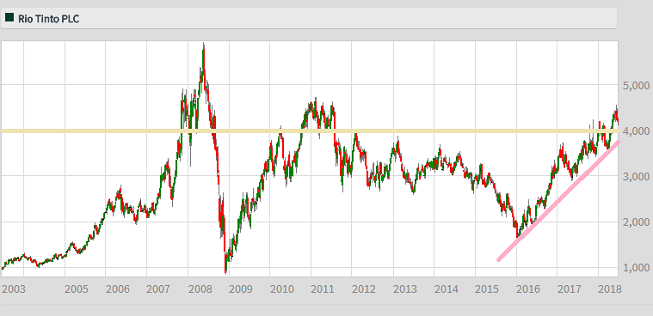

Source: interactive investor Past performance is not a guide to future performance

While still clearly a concern, today's note from UBS does not expect the trade war to have a bearing on property policy in China, where leaders have room to lift infrastructure spending should the economy slow.

The report said:

"We still expect key commodity prices at healthy mid-cycle levels in 2018/19."

However given the heightened geopolitical risk, UBS said BHP Billiton and Rio Tinto were its preferred stocks as the pair were less leveraged and poised to return cash equivalent to 15% of market cap over the next 18 months.

The note is neutral on Glencore, Anglo American and South32 Ltd due to a near-term downside risks in their key commodities, as well as various stock specific issues.

UBS's outright top pick in the sector continues to be BHP Billiton, with full-year results in August set to show that net debt has fallen to the lower end of the company's targeted range of between $10 billion and $15 billion.

This raises the potential that BHP could announce a $2-3 billion share buy-back.

UBS, which has raised its price target by 20%, added:

"We expect the stock to re-rate as BHP steps up returns to shareholders. We have preference for BHP over Rio due to its valuation, self-help potential and disposals."

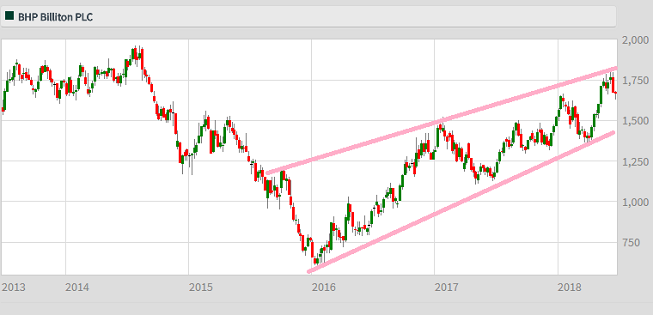

Source: interactive investor Past performance is not a guide to future performance

Strong cash flows also support the broker's buy recommendation for Rio Tinto, which has already committed to returning excess cash to shareholders.

They said:

"We also see the potential for aluminium prices to positively surprise over the next 12 months with China getting stricter on enforcing its environmental policy and supply side reform."

UBS's new price targets on BHP Billiton and Rio Tinto are based on net price valuation (NPV) multiples of 1x, with the latter stock increasing from £40 to £47 as a result.

Meanwhile, the broker sees the risk/reward on Anglo American as finely balanced, given concerns about the impact of the stronger South African rand on unit costs.

The note adds:

"In our opinion, further meaningful restructuring is unlikely and, while the political backdrop has clearly improved for South African mining, there is still uncertainty with a general election in 2019."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.