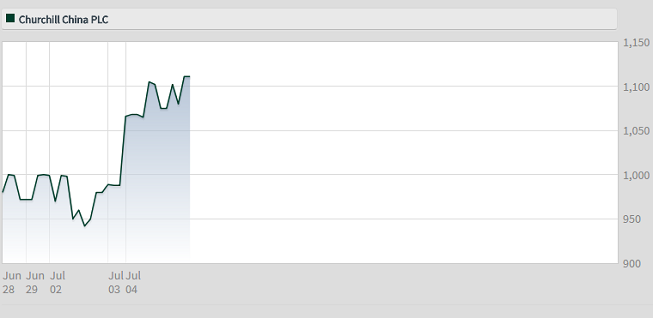

Why Churchill China just surged 13%

4th July 2018 12:54

by Graeme Evans from interactive investor

A high valuation multiple looks justified here after a cracking update from the restaurant tableware giant, writes Graeme Evans.

Just when it appeared that cracks were appearing in Churchill China's premium-rated valuation, the maker of restaurant tableware has popped up with another stunning update to re-energise the share price.

In a short half-year statement, the Potteries-based company said it was trading ahead of expectations as it continues to enjoy impressive levels of growth in European markets.

That’s a big relief for the AIM-listed stock’s sizeable fan club, some of whom must have begun to fear the worst after a big slowdown in the UK restaurant sector, including many closures.

• 16 conviction shares to consider

Those fears now look to be overdone as Churchill continues to report success marketing itself overseas. In 2017, exports grew to 55% of all business as sales outside the UK rose by 19% in the year.

Stiff comparatives and no meaningful FX benefit have clearly been no barrier this year, with growth in Europe likely to have been driven by high margin, value-added products.

Today's update prompted broker N+1 Singer to reiterate its view of Churchill as a "highly reliable small-cap growth stock with strong fundamentals".

Source: interactive investor Past performance is not a guide to future performance

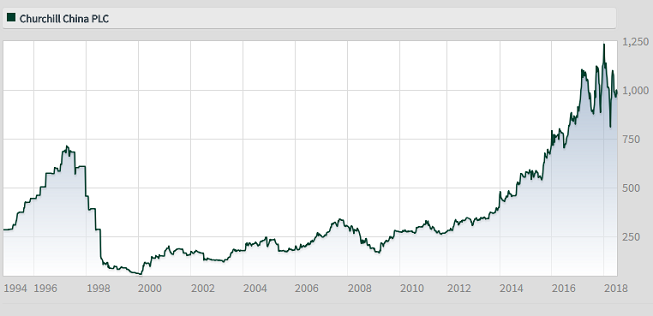

Shares have fallen 12% in the year-to-date, but even at a price earnings rating of 16 times N+1 analyst Sahill Shan thinks Churchill is good value. He lifted his earnings per share forecast for 2018-20 by 3%-4% and said there was potential for a rating of around 20 times and a price topping 1200p.

As many interactive investor readers will know, Churchill also features high up Richard Beddard's Decision Engine for good long-term investments. The stock scores seven out of 10 and is only kept off top spot by the drawback of the premium rating for shares. Richard's overall verdict is that it is one to consider for 'buy and hold' investors.

The ongoing appeal to investors was demonstrated again last year with total shareholder returns of 36%, up from 22% in 2016.

This reflected both a strong share price performance and a 16% rise in the total dividend to 24.6p, yielding around 2.5%. The dividend was supported by a £1 million rise in cash generated from operations to £7.7 million.

The company has been based in the Potteries since 1795, originally as Sampson Bridgwood. It listed on the London Stock Exchange in 1994, but the Roper family still hold a significant share of the business.

Churchill products are now found in hospitality sites in over 70 countries, achieved through a 500-strong global distributor network.

Source: interactive investor Past performance is not a guide to future performance

The company has changed dramatically in the past decade, having previously sold most of its tableware in the UK and a large proportion to retailers such as department stores. Cheap Chinese imports, however, made the retail market more difficult and hospitality sales now represent almost 90% of group revenue.

The big improvement in Churchill’s profitability since 2012 has been driven by innovation. This has included the introduction of coloured and textured ranges that are, due to technical advances relatively cheap to produce.

Anti-dumping duties on cheap Chinese ceramics have also helped to make its products more competitive, but exporters may lose this kind of perk once the UK leaves the European Union.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.