This AIM share's shock warning raises old fears

Its popular brands have staying power, but is that enough to keep our companies analyst onside?

21st June 2019 12:52

by Richard Beddard from interactive investor

Its popular brands have staying power, but is that enough to keep our companies analyst onside?

In May, Portmeirion (LSE:PMP), a manufacturer of British designed tableware and other homewares, revealed a shocking decline in sales to its South Korean distributor.

We know it was shocking even though we were not told its extent because the company revealed it grew in the UK and the USA, its biggest markets, 5% and 8% respectively in the first four months of 2019, yet overall revenue fell 10%. South Korea only accounted for 9% of revenue in the year to December 2018 yet the rout was enough to reverse growth in territories that together earned 65% of revenue.

Since sales in South Korea rose in 2018, it looks as though Portmeirion's sole distributor there stocked up in 2018, but sold so little it did not need to order much more in the first part of 2019.

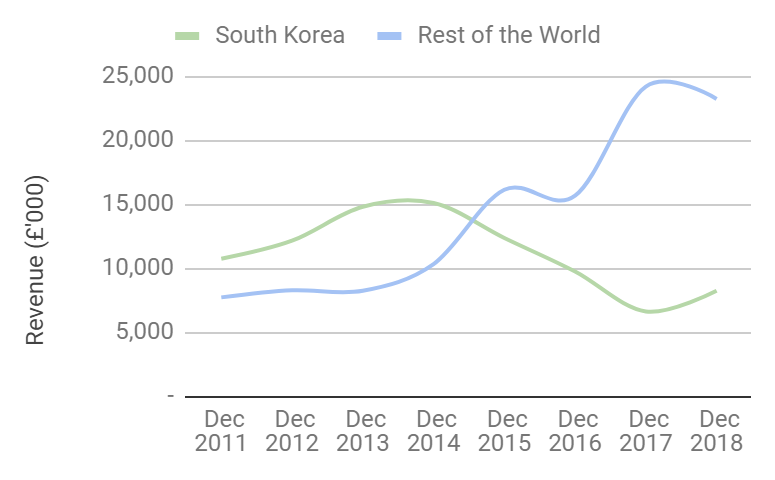

It all looked so different in 2014, when South Korea was poised to overtake the UK and become Portmeirion's second biggest market. That year revenue from South Korea was £15.1 million, revenue from the UK was £15.9 million, and revenue from the USA was £20 million. Then the rot set in and in three years South Korean revenues had more than halved to less than £7 million. In the brief period between March this year, when Portmeirion announced South Korean revenue had increased to nearly £9 million, and the profit warning in May, it looked as though the rot had stopped. Now it doesn't.

Developments in South Korea raise lots of questions. Portmeirion is developing new products, which it says should revive sales, although it will take time to bring them to market and we have no explanation why the existing product-line, which was refreshed last year too, is faltering.

In one sense, Portmeiron's failure to revive its popularity in South Korea is not such a big deal, because it is growing elsewhere. Since 2014, the year of peak South Korean sales, annual sales have increased from £61 million to just shy of £90 million in 2018. If we strip out about £14 million of sales growth Portmeirion acquired when it bought scented candle maker Wax Lyrical in 2016, Portmeirion has grown the tableware business by about 23% over the last four years.

In another sense, though, it is a big deal. The UK and the US are growing relatively slowly, which has put the emphasis on developing new markets. On that front, there is good news and bad news. The good news is that most of the growth in tableware, about £13 million, has come from the Rest of the World segment, which has more than compensated for the decline in South Korea:

The bad news... Well, there is no more bad news per se, just a bad feeling...

Much of the appeal of Portmeirion is its patterns. Portmeirion Botanic Garden, its principal pattern, has proved enduringly popular in the UK and the USA, and it routinely earns the company more than £30 million in revenue. Botanic Garden is very popular in South Korea as well, but the drip, drip, drip of sales interrupted only by what looks like a false dawn in 2018 may confirm a bubble has burst.

The truth is more complicated though. Portmeirion tells me some of the decline in sales in South Korea is because of 'leakage' of product from Rest of the World customers into the prosperous South Korean market. While it refuses to supply customers it knows sell outside their territories, it can never fully eradicate the grey market.

New product development for the South Korean market is not just a means of stimulating flagging demand. It is a way of differentiating the product for its South Korean distributor.

Scoring Portmeirion.

Does Portmeirion make good money?

Yes, by and large. After-tax return on capital has exceeded 15% every year since the financial crisis, except in its climactic year (2008) Then lower revenue and the high fixed costs of its factory in Stoke-on-Trent squeezed profit. The 12-year average is 17%.

The company expects to make good some of the lost revenue in 2019 during the remaining eight months of the year, but any decline in revenue will result in a greater decline in profit.

Score: 2

What could prevent it from growing?

Portmeirion owns established brands like Botanic Garden and Spode Christmas Tree. While their popularity is still growing in the USA, sales have been pretty flat in the UK, and growth is inconsistent elsewhere.

Newer brands, often licensed from UK designers like Sophie Conran and Sarah Miller, have yet to gain similar sized followings. Although another blockbuster like Botanic Garden is probably the dream, there is no formulaic way to make it happen.

Score: 1

How will it overcome these challenges?

Portmeirion's response is to develop or acquire more products, requiring it to be good at a lot of things. It refreshes existing rangers, licenses patterns to create new designs, and acquires new products to print them on. It sells direct to retailers and in its own stores, online, and through distributors.

The acquisition of Wax Lyrical, a scented candle maker, diversified the strategy to include other homewares, scented candles and reed diffusers, which the company has decked-out in its tableware patterns and is introducing to export markets.

Wax Lyrical sales increased in 2018. It is currently generating adequate returns which it needs to sustain if it is to prove its worth.

Score: 1

Will we all benefit?

I am torn. The company's policy is to pay more than the National Living Wage, and it has Investors In People's Gold accreditation so it is probably a good place to work. But the Annual Report skims over the challenges the company faces in export markets. Long standing chief executive Lawrence Bryan receives a handsome basic salary of nearly £500,000, with the potential for it to be multiplied by bonuses and incentives.

Score: 1

Are the shares cheap?

Quite. The shares trade on a debt adjusted pe of 14 times 2018 earnings.

Score: 1.2

A score of 6.2 means Portmeirion falls short of 7, the level required for a recommendation. Two weeks ago, I included it in a list of companies I may stop covering, but high levels of profitability confirm the brands have staying power and while Portmeirion could do more in its reports to explain volatile export markets and the challenges it faces, the overall trend has been and probably will be growth (albeit not in 2019).

Good news from Goodwin

Good news. Goodwin (LSE:GDWN), one of the case studies in my recent rant about perverse Long Term Incentive Plans (LTIP), has confirmed to me it has no plans to replace the scheme I criticised, which concluded at the end of April, with another LTIP.

We must wait for the annual report in August for the new remuneration policy but, for now, I am rescinding my decision to reduce the company's score for "fairness" from one to zero.

Richard owns shares in Portmeirion and Goodwin