A great alternative to 'perverse' company incentive plans

Opposed to 'perverse' corporate incentive schemes, our companies analyst has a much better idea.

31st May 2019 11:55

by Richard Beddard from interactive investor

Opposed to 'perverse' corporate incentive schemes, our companies analyst has a much better idea.

On 30 April, five directors in Goodwin bought 5,342 shares in the company. The amount might seem modest, but the share price was almost £32, so the purchases added up to a significant sum, about £170,000.

A vote of confidence...

Good news, we might conclude, a ringing endorsement of a recovering business from the people who know it best - the outgoing chief executive Richard Goodwin, who, with his brother John, has run Goodwin for nearly three prosperous decades, and their sons, also directors, one of whom has since replaced John as chairman, and the other two who are now joint managing directors.

The new arrangement makes sense, by the way, as the company has two distinct divisions: mechanical engineering, which casts and machines huge steel components, and refractory engineering, which quarries and processes casting powder for the jewellery industry. The sons were already running these businesses.

I would like to think the concerted buying was a vote of confidence, but the date of the share purchases is significant. 30 April was Goodwin's year-end, and also the date that would decide how many shares are awarded to members of the board under the company's Long-Term Incentive Plan (LTIP). As is so often the case, the potential award was large, shares worth up to 1% of the company per director, and dependent on the share price.

Or playing the market?

If the buying was intended to move the market and secure the directors a higher payout, it had little effect. On 30 April, nearly 30,000 Goodwin shares were traded, more than five times as many as the Goodwins bought, and the share price fell from £32.40 to £31.00. Their actions may have reduced the decline on the day somewhat, and the closing share price was not far below an estimate provided to me by Goodwin of £35, required for a full LTIP payout.

The announcement of the LTIP three years ago stripped away some of my trust in Goodwin and the suspicion that the directors may have acted together to boost their LTIP awards has stripped away some more. Whatever the actual motivations of boards, tying large chunks of remuneration to the performance of the share price gives executives the opportunity to play the market, not just by buying shares, but in framing a businesses’ prospects, and in motivating the decisions they take.

For example, Goodwin's LTIP was based on Total Shareholder Return, the change in the share price plus dividends paid in the period leading up to 30 April. Last year, Goodwin doubled the dividend because it was confident it had laid the foundations for a prosperous future after three difficult years in which orders from the troubled oil industry had seeped away.

The company probably is on the road to prosperity, but by doubling the dividend, Goodwin put out a powerful statement about the future returns shareholders might earn, a statement that would have on impact on investor's expectations, and help the share price higher. It had also added directly to the Total Shareholder Return measure upon which the directors pay would be based. Raising the dividend so dramatically may well have been the best thing to do for the business, but the intention may have been less noble.

Perverse incentives

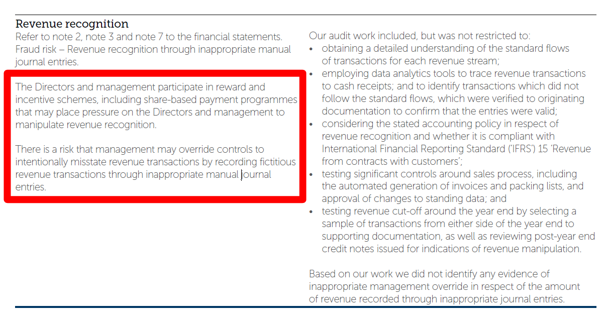

It is not just me that that thinks LTIPs create perverse incentives. Two weeks ago I investigatedStrix Group (LSE:KETL), and discovered the company’s auditor thinks its LTIP encourages fraud (though it found no evidence of it):

Tying executive's pay to the company's fortunes is a good idea in principle, but as the economist John Kay's government sponsored review of the UK stock market stated in 2012, this could easily be achieved by paying part of an executive's annual bonus in shares and preventing the executive from selling them for a long time.

Such a simple arrangement would allow shareholders, employees and other interested parties to see exactly how much executives are paid, and reward them should they grow the business. They would also suffer through the diminishment of their shareholding, should they destroy value.

It would remove the necessity for executives to hit arbitrary and malleable moving targets, like the share price on a particular day. It would reduce the money spent on remuneration consultants, and cut the printing costs of the annual report because, ridiculously, the longest section in a typical large company report is often the remuneration report. It would save diligent shareholders angst as we attempt to understand these schemes, increase trust in management, and focus them on running the business rather than watching the share price.

Sadly, few executives seem to want us to know exactly how much they are paid, or to lose part of their bonuses if they do not perform.

Go compare!

Failing an outbreak of modesty in corporate HQs, I have an alternative suggestion inspired by an article written by a member of The UK Individual Shareholders Society (Sharesoc) and published on its blog. He takes GoCompare (LSE:GOCO), the price comparison company, to task for the generosity of its LTIP.

What we need is a price comparison site for executives. My modest contribution to kick off this endeavour is a comparison of IntegraFin (LSE:IHP) and GoCompare.

Admittedly, the two companies are not in the same line of work, IntegraFin provides an investment platform for financial advisers. They are not similar sized businesses either. IntegraFin is much bigger. At £1.2 billion its enterprise value is three times GoCompare's £400 million, so you might expect it to pay its executives more. In fact both companies pay generous base salaries in excess of £400,000 to their chief executives. IntegraFin pays its chief executive slightly less though, and that is where the similarities end.

At IntegraFin the maximum total annual incentive opportunity for executives is 100% of base salary a year, a portion of which will be paid in shares. It does not have an LTIP, IntegraFin says (in so many words) that LTIPs create perverse incentives. IntegraFin's chief executive will earn a maximum of just over £800,000 in 2019.

At GoCompare, the chief executive will receive a bonus of up to 130% of base salary (up to 30% of which will be paid in shares), and "performance shares", essentially an LTIP tied to profit and share price performance, of up to 230% of base salary. The multiplier effect of the bonus and LTIP means his maximum pay is over £1.6 million.

The chief executive of IntegraFin does not do badly by any means, but this comparison has put the company on my list of firms to research. It has pretty much ruled out GoCompare.

Decisions, decisions

We cannot disregard all businesses with LTIPs though, there are just too many of them. In other respects, Goodwin appears to be a very good business. The company previously shunned complex remuneration arrangements and it is possible the current LTIP is a one-off designed to give the new leaders a stake in the business without diluting the old guard. It seems improbable to me they would take take decisions that would harm the business in the long-term, as the fathers own the majority of shares and sons appear to have been groomed to preserve Goodwin, quite possibly for the seventh generation.

My scoring system can mediate nuanced situations. One of the criteria I use to score companies is whether they treat other stakeholders equitably. I have twice reduced Goodwin's score on these grounds, from two to one when it introduced the LTIP, and from one to zero, in the process of writing this article.

These "downgrades" will have reduced the attraction of Goodwin shares relative to the others I follow. We publish the ranked list next week, so you will see how Goodwin sits then. In the update at the beginning of May it was still sitting pretty.

In time, I might regain some of the lost trust. A lot depends on the remuneration policy that will be put in place by the new board and put to the vote at Goodwin's AGM in October.

Richard owns shares in Goodwin.