Airbnb IPO generates massive excitement

After months of waiting, investors are chasing shares in the home rentals giant to dizzy heights.

10th December 2020 18:05

by Graeme Evans from interactive investor

After months of waiting, investors are chasing shares in the home rentals giant to dizzy heights.

Airbnb (NASDAQ:ABNB) shares surged ahead today as the most anticipated IPO of 2020 further highlighted the strength of investor appetite for fast-growing technology stocks.

A day after meal delivery company DoorDash (NYSE:DASH) soared on its first day of Wall Street dealings, the home rentals business followed suit by more than doubling in value as soon as the stock began trading early evening UK time.

The stellar start for the Nasdaq-listed stock, which trades under the symbol ABNB, is all the more remarkable because shares were being provisionally priced at between $44 and $50 when Airbnb started its pre-IPO investor roadshow last week.

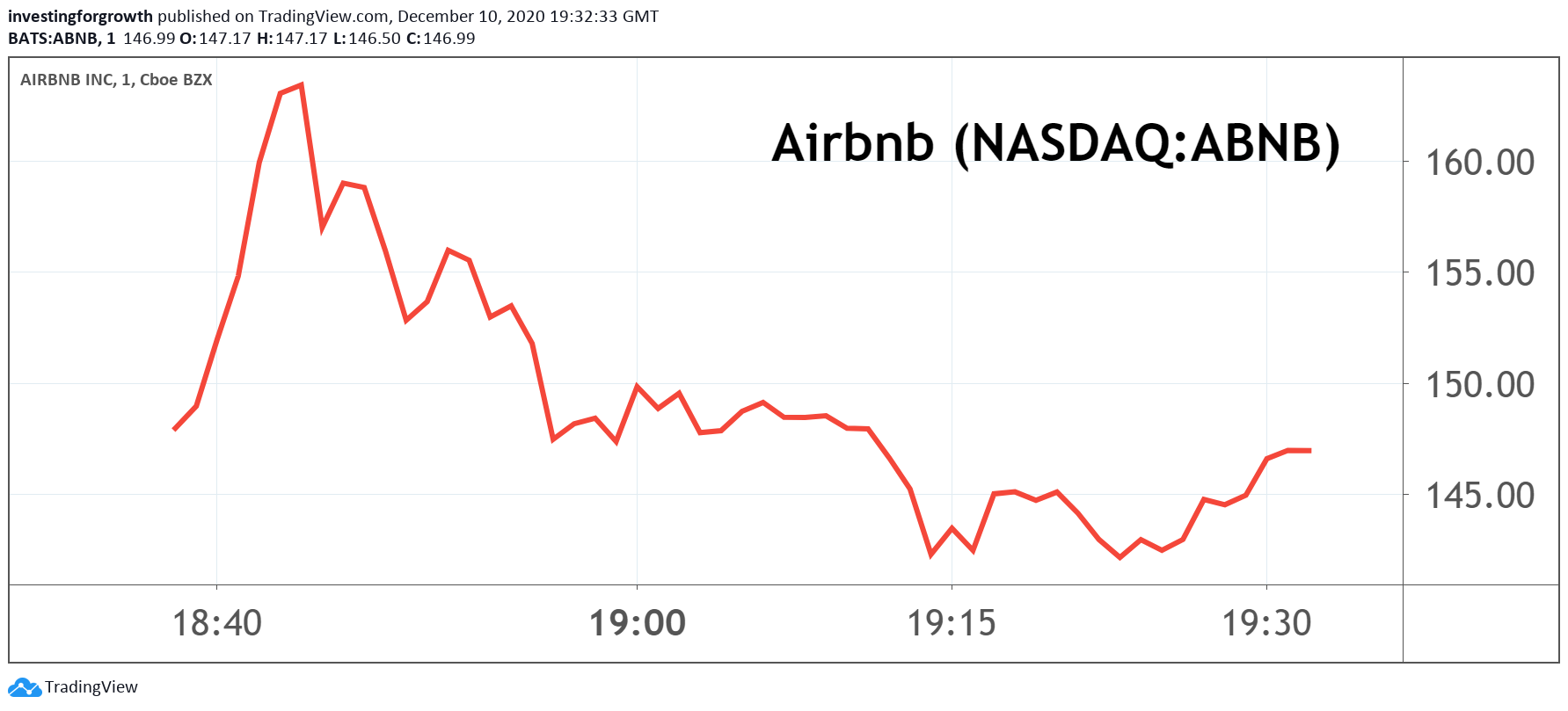

First hour of trading minute by minute

Source: TradingView Past performance is not a guide to future performance

Strong demand led to the range being increased to between $56 and $60 before the shares were finally set at $68 a piece ahead of today's debut. That gave the San Francisco company a valuation of $47 billion (£35.1 billion), including proceeds of about $3.7 billion (£2.7 billion).

- Airbnb prices its festive IPO at $30bn

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Investing in the US stock market: a beginner’s guide

The momentum for IPOs has been boosted by Joe Biden's election victory and the recent Covid-19 vaccine breakthroughs, with US markets setting new highs earlier this week.

The IPO marks a swift turnaround in fortunes for Airbnb, whose business declined by nearly 80% when borders closed and travel stopped due to Covid-19. The company was forced to reduce full-time headcount by 25% and suspend marketing spend, with the IPO put on hold.

Joint founder Brian Chesky wrote in the IPO prospectus: “I don’t think many people expected us to go public this year. I know some people questioned if we’d make it at all. What has transpired since then has been our most defining period since we started Airbnb.”

One factor helping the company during the pandemic has been the trend for travellers to favour staying in private homes rather than hotels. Revenues were 18% lower at $1.34 billion (£1.01 billion) in the three months to 30 September, but actions taken earlier in the year enabled the company to post a net profit of $219 million (£165.4 million).

- Will 2021 be a year of RECOVERY for global stock markets?

- Find out more about IPOs on interactive investor here

- What Bill Ackman thinks will happen to stocks in 2021

In contrast to London, where IPO activity has been tepid in the face of Covid-19 and Brexit, the US market is enjoying another bumper year as Dealogic reported last week that the $140 billion (£105 billion) raised by companies at that point of 2020 the biggest yet.

DoorDash surged 80% on its first day of trading for a market valuation of more than $60 billion (£45 billion), which compares with $16 billion (£11.9 billion) during a round of private fundraising in June.

Revenues for the September quarter rose sharply to $879 million (£656 million) but the company, which was only set up in 2013, still posted a loss of $43 million (£32 million) in the period. Like Airbnb, it priced its shares at a much higher level than originally targeted.

The resilience of stocks such as Apple and Amazon during the Covid-19 pandemic has provided a favourable backdrop for the latest batch of Wall Street newcomers.

In June, online car seller Vroom (NASDAQ:VRM) and business intelligence platform ZoomInfo Technologies (NASDAQ:ZI) made their debuts with a combined valuation of more than US$10 billion (£7.5 billion). Shares in the latter have more than doubled in the period since the IPO.

The new issues market gathered pace in September, with a run that included Warren Buffett-backed data warehouse company Snowflake (NYSE:SNOW). It more than doubled in value from $120 on its first day of trading, and is currently at US$371 a share for a market cap of more than $100 billion.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.