Analysis: Fastjet, Gulf Keystone and Motorpoint

29th June 2018 14:15

by Lee Wild from interactive investor

Long-term shareholders glued to their seats as airline FastJet headed south have been all but wiped out by a series of cash calls and boardroom disputes. But investors plucky enough to buy in after the latest calamity will be singing all the way to the departure lounge.

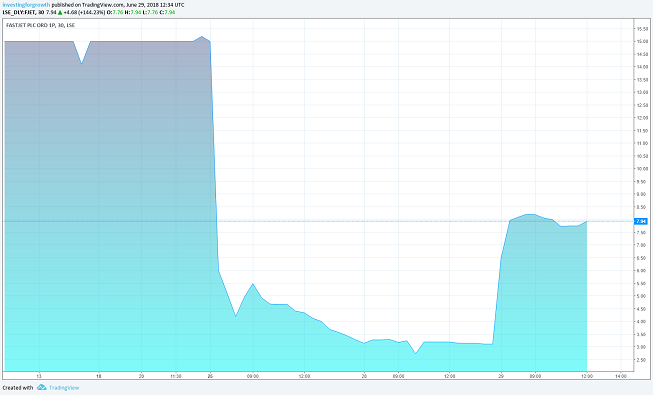

Fastjet, which was down to its last $3.3 million, said on Wednesday it could go bust if it wasn't able to raise cash quickly. Shares in the eastern and southern African carrier, once trading at around a tenner, could be had for less than 3p after plunging 74% in a single trading session.

Two days later and there's some good news.

Forget the final results included in a flurry of regulatory announcements – Fastjet lost $24.5 million in 2017 - it's the funding update that matters here.

Before the market opened, Fastjet announced a capital raising to bag at least $7 million at 8p a share, a premium of 146% to last night's closing price of 3.25p. Three hours later it was done, house broker Liberum placing all the shares and Fastjet's biggest backer Solenta Aviation subscribing for nearly 29 million shares worth $3 million.

The money, which will get the low-cost airline through to at least the end of 2018, has already been earmarked for the Zimbabwe and Mozambique operations and repaying loans (50%), with the other half winging its way to the Tanzania hub and for the launch of services in South Africa.

Source: Tradingview Past performance is not a guide to future performance

There’s also an open offer for existing shareholders – one open offer share for every 26 existing shares held - also at 8p. That means Fastjet could have as much as £9.2 million at its disposal.

Despite this short-term success, and that the placing at 8p puts a temporary floor under the share price, Fastjet shares remain high risk and a very speculative punt for the traders.

Spend the money well and get the South African operation away cleanly, and Fastjet has a future. However, those aware of its history, and that of the wider airline industry, might choose to rest easier at night and steer clear.

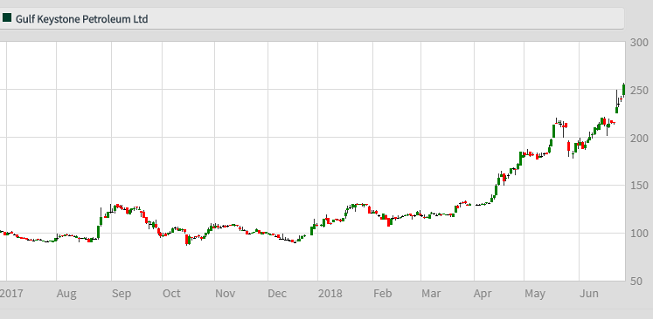

Gulf Keystone Petroleum Ltd was a company in trouble not so long ago, Now, it’s joined the 170% club, although it's taken substantially longer than Fastjet to achieve - since December last year – it's no less spectacular.

Long a favourite with small-cap investors, Gulf struggled to secure payments in the war-torn and highly volatile Kurdistan region of Iraq. Payments are now regular, and an agreement is in place to raise production at the Shaikan field to 55,000 barrels of oil per day (bopd) in the next 12 to 18 months.

Gulf has $222 million in the bank, enough to cover the $73 million needed to implement the 2018 approved capital expenditure. Getting to the longer-term target of 75,000-110,000 bopd will be more expensive. We’ll get more detail once the revised Field Development Plan is submitted to the Kurdistan Regional Government's Ministry of Natural Resources in the third-quarter of 2018.

The share price is up from 86p to a peak of 261p, a price not seen since 2016. It’ll be more if it gets to 110,000 barrels without any hiccups.

Source: interactive investor Past performance is not a guide to future performance

Elsewhere Friday, and another recent winner was having different problems.

Motorpoint Group was trading down more than 11% a day after the used car Supermarket announced that company founder David Shelton was selling 10 million shares, or 10% of the company, as part of divorce proceedings.

This morning, it was confirmed that the stake had been sold at 225p, raising £22.5 million. Shelton still owns 13.6% of the business, worth over £30 million at the placing price. He won’t be able to sell anymore for 90 days.

However, in a show of confidence, Motorpoint spent £2.9 million on 1.3 million of Shelton's shares as part of a £10 million buy-back programme. Even after this purchase it still has around £5.5 million to go which goes some way to underpinning the share price.

“At the sale price of 225p, Motorpoint’s stock is trading on a FY2019 PE ratio of 12.0x and an EV/EBITDA multiple of 7.7x, the stock is forecast to yield 3.3%,” writes Darren Shirley, an analyst at house broker Shore Capital.

Source: interactive investor Past performance is not a guide to future performance

This week's developments come just a fortnight after Motorpoint trumpeted better than expected full-year profits of £20.8 million.

"With a leading customer service proposition, strong cash generation, and a medium-term premium growth outlook underpinned by roll-out and maturity, the business continues to offer clear attractions to investors," said Andrew Wade, analyst at Motorpoint's other broker Numis. "The shares have had a strong run and now trade on 13x FY19 PE, but we see more to go for," he added, repeating his 290p price target.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.