The Analyst: how to become a private equity investor

There are several ways to put money into companies not listed on the stock market. Analyst Dzmitry Lipski runs through them here and explains the risk and benefits.

4th August 2025 10:40

by Dzmitry Lipski from interactive investor

Private equity, which involves investing in privately held companies not listed on stock exchanges, has grown significantly in recent decades, especially among institutional investors. Now, the industry is working to make it more accessible to retail investors.

One of private equity’s main attractions is access to unique investment opportunities unavailable in public markets. From early stage AI ventures to cutting-edge biotech start-ups, it offers a gateway to next-generation growth.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

In today’s elevated interest rate and inflation environment, retail investors may question whether private equity still belongs in a diversified portfolio. While suitability depends on individual goals and risk tolerance, its long-term return potential remains compelling.

How private equity works

Investing in companies not listed on the stock market supports business growth, facilitates management transitions, or prepares companies for future public listings or sales.

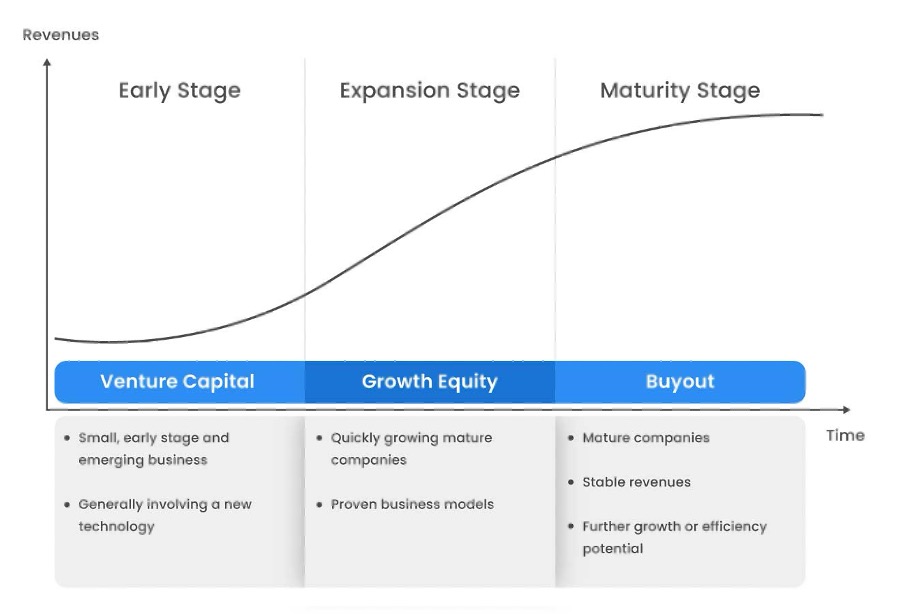

Depending on the size and stage of the business, there are different types of private equity strategies, and each one plays a role in a company’s development.

In a typical buyout, an investor purchases a majority share in a company to take control and guide its growth.

Growth capital is when investors put money into more established companies to help them expand or restructure operations.

Venture capital is money invested in start-ups or small companies that are expected to grow significantly over time.

Private equity fund managers, or general partners (GPs), operate like traditional fund managers but invest in private businesses instead of public companies. They typically hold these investments for several years, working closely with management to improve performance before selling, either to another firm or through an IPO for a profit.

Unlike public companies, which face constant pressure from shareholders to meet short-term financial targets, private equity-backed firms avoid short-term scrutiny. If public firms miss targets, stock prices may drop.

- Funds and trusts four pros are buying and selling: Q3 2025

- Where to invest in Q3 2025? Four experts have their say

In contrast, private equity fosters a collaborative environment focused on long-term growth. Fund managers and company leaders align closely, as both benefit from the company’s success. GPs are usually deeply involved in the company’s strategy and operations, helping to drive growth and value.

Private equity as an asset class

Private equity investing has unique features that set it apart from other asset classes.

One of the most important characteristics is its long-term nature. When fund managers acquire a company, they often spend several years improving and restructuring it before eventually selling it or taking it public. Because of this, investors need to be prepared for a longer time horizon, as profits are not realised quickly.

Unlike public equities, private equity investments are relatively illiquid. Investors usually commit their capital for extended periods, often with limited or no ability to withdraw funds early due to “lock-up” periods. While this lack of liquidity is often seen as a disadvantage, it can also encourage long-term discipline by reducing the temptation to react emotionally to short-term market fluctuations. In compensation for this illiquidity, investors may receive a liquidity premium, an additional return for holding less-accessible assets.

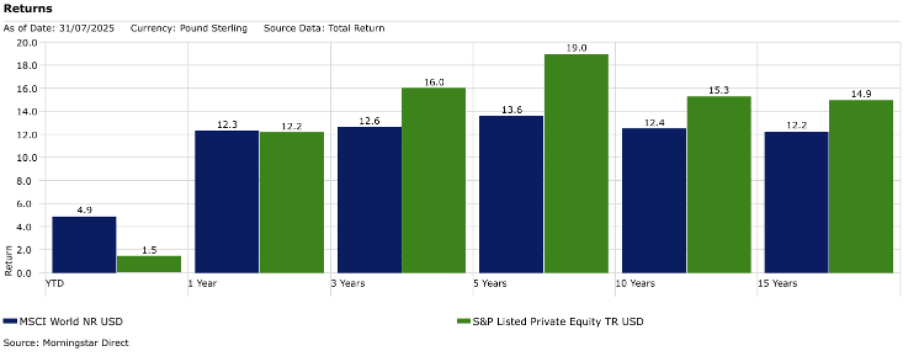

Historically, private equity has outperformed public equities and other major asset classes over the long term, offering a compelling risk-return profile, even through varying market conditions (see chart below). However, it's important to remember that past performance is not indicative of future results, particularly in private markets.

Past performance is not a guide to future performance.

Unlike publicly traded companies, private equity investments are not marked to market on a daily basis. Valuations are typically conducted by independent third parties on a quarterly or semi-annual basis. Because these assets are unlisted and less liquid, their valuations can be more subjective and less transparent.

Due to these characteristics, private equity is often best used as a satellite allocation within a broader, diversified portfolio, typically no more than 10%. While it may be more volatile on its own, private equity’s low correlation with public markets can help reduce overall portfolio volatility when combined with more traditional asset classes.

How to gain exposure

For retail investors, one of the most accessible ways to gain exposure to private equity is through diversified investment trusts or funds. However, it's important to recognise that not all funds perform the same, especially at times of economic and market uncertainty. As such, investors are tasked to identify funds managed by experienced investors with strong and consistent track records.

Because underlying holdings in such funds are unlisted and should take much longer to sell, closed-ended funds, which are publicly traded investment trusts, are the better choice as they offer greater liquidity via daily trading at stock exchanges. Also, such funds usually come with higher fees compared with traditional funds.

Cautious investors might consider global funds with flexible exposure to private assets. Scottish Mortgage Ord (LSE:SMT) is a key example, with about 25% of its portfolio in private companies such as SpaceX, ByteDance, and Revolut. These are typically well-established, cash-generative firms valued at over $1 billion.

- Why I voted against Scottish Mortgage’s dividend payment

- Most popular funds among professional investors

Many such companies delay or skip public listings due to ample private funding. Scottish Mortgage, for instance, invested in Alibaba Group Holding Ltd ADR (NYSE:BABA) before its IPO, when it was already worth $168 billion. The trust’s managers see private markets as essential for growth investors, offering access to early stage value creation often missed in public markets.

Among investment trusts focused more directly on private equity, the Patria Private Equity Trust (LSE:PPET) and NB Private Equity Partners Class A Ord (LSE:NBPE) stand out.

Patria Private Equity Trust invests in a diversified mix of private equity funds and co-investments, with a focus on Europe. Managed by Patria Capital Partners since 2001, it offers exposure to over 600 portfolio companies, emphasising less cyclical sectors. PPET has outperformed European small-cap indices and peers over time. It pays a quarterly dividend (3.2% yield, increasing annually since 2010), and charges a flat 0.95% management fee with no performance fee.

NB Private Equity Partners focuses exclusively on co-investments in profitable, resilient businesses, mostly in the US (70% exposure). With over 70 holdings, the portfolio emphasizes secular growth and vintage diversification. Backed by Neuberger Berman, NBPE has a long track record of outperformance and pays a 4.7% dividend yield. The board targets annual distributions of 3% of NAV or more.

- Top 10 most-popular investment trusts: July 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Both PPET and NBPE are trading at double-digit discounts, which could present an attractive entry point for long-term investors.

For those who want exposure to private equity but are put off by the fees or complexity of actively managed funds, there are also lower-cost options to consider. Several exchange-traded funds (ETFs) now offer access to the private equity space. One option is the iShares Listed Private Eq ETF USD Dist GBP (LSE:IPRV).

In summary, private equity investing is no longer out of reach for retail investors, but the landscape remains complex. Unlike public markets, private assets are less liquid, fees are higher, and it’s very difficult to get transparency into the value of assets. Whether through actively managed trusts or passive ETFs, investors should consider their risk tolerance and investment horizon before deciding how best to approach this growing segment of the market.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.