Where to invest in Q3 2025? Four experts have their say

Our panellists are wary of an autumn sell-off for equity markets, but have upgraded their scores for most equity markets.

25th July 2025 10:03

by Jim Levi from interactive investor

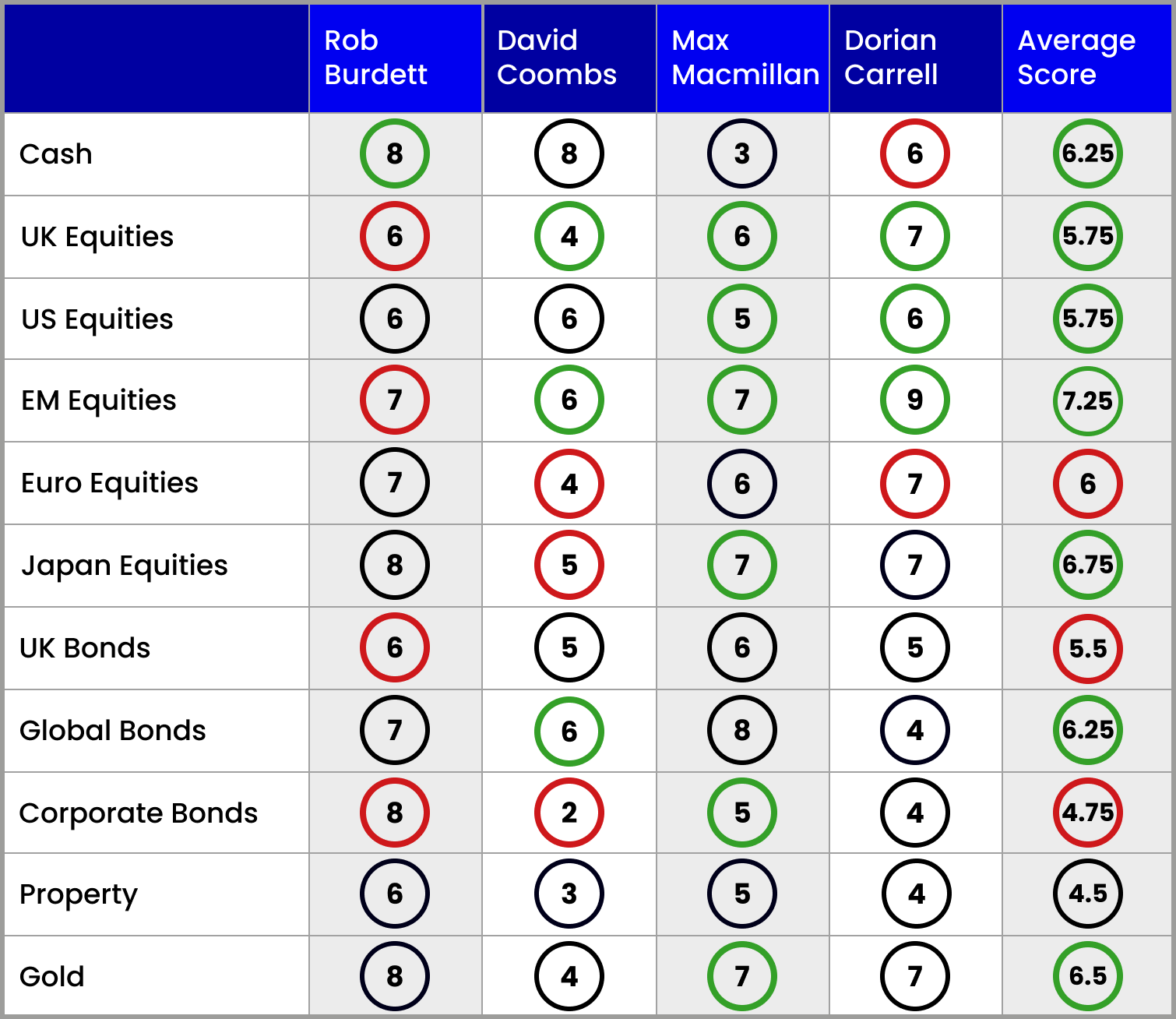

Our quarterly asset allocation article highlights the views of four professional multi-asset investors. We ask each investor to provide a score of one to nine for various assets, with five being a neutral score.

The stock market value of NVIDIA Corp (NASDAQ:NVDA) - now over $4 trillion (£2.9 trillion) - is equal in value to the entire German stock market.

This means either that Nvidia has exceptional growth prospects as the leading player in artificial intelligence (AI) development or that it is flagrantly overpriced. It may also, of course, mean that the German stock market is still undervalued even though it is hovering around all-time peaks. “It certainly makes you pause for thought,” says Dorian Carrell, head of multi-asset income at Schroders.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Markets have staged a strong recovery

Equity markets have defied gravity in the three months since I last touched base with our panel of four asset allocators. Wall Street’s leading indicators are all at around all-time peaks, as is the UK’s FTSE 100.

Meanwhile, other European as well as Japanese shares have recovered well from the sharp dip in April prompted by US President Donald Trump’s shock initial tariff manoeuvres.

- Should you invest when markets are at all-time highs?

- FTSE 100 breaks 9,000: which funds have led the rally?

In emerging markets, India’s leading index hit an all-time peak at the end of June, while even Chinese shares have recovered well from the April low.

“US equities are expensive,” Carrell admits, “but I agree it is possible that the S&P 500 index might continue to climb and fulfil the forecast of some commentators that it might break through the 7,000 barrier before the end of the year.” Earlier this week the index climbed back above 6,300 points.

He takes the view that “both the monetary and fiscal conditions are right for this to happen. Inflation in the US rather than recession is the prospect now”.

Panel not betting against the US

Carrell’s strategy is to increase exposure to equities across the board, except for Europe, while reducing his cash score from seven to six. At the same time, leaving his government bond and all other scores (corporate bonds, property and gold) unchanged.

Significantly, he’s raised his US equities score from four to six, but equally significantly Wall Street is now his lowest equity score.

It is rare to find a consensus among all four members of our asset allocation panel but they all seem to agree with Carrell that while they cannot risk being underweight in their US exposure, they recognise that at current high levels the potential for a sharp setback is considerable.

Coombs at Rathbones and Burdett at Nedgroup Investments both score a six for Wall Street, while the previously bearish Max Macmillan at Aberdeen has to concede that he was mistaken to be underweight in April, but only raises his score to a neutral five from three.

Emerging market opportunity?

While Carrell is cautious on Wall Street, he’s much more positive on equities elsewhere. In particular he’s hiked his score for emerging market equities from six to a super-bullish nine.

“We feel the continued weakness of the dollar gives emerging markets the most potential to perform,” he says. “In many cases too, valuations are attractive.”

- Funds and trusts four pros are buying and selling: Q3

- US interest cooling, but these shares are attracting the pros

Other equity markets - Japan, the UK and Europe - are all given scores of seven.

If he’s positive about the outlook for UK shares, Carrell is scathing about the long-term prospects for UK government bonds. “All the signs are that investors are becoming less and less willing to buy gilts because of our government’s apparent inability to control its spending,” he warns.

The TACO trade

At Aberdeen, Macmillan has turned much more positive on the outlook for equities because Trump’s “bark has turned out to be worse than his bite” on tariffs.

This has been coined the TACO trade – “Trump Always Chickens Out”.

“He seems to want to do deals rather than radically change the pattern of the global economy,” Macmillan says. He appears confident that a less aggressive Trump will somehow avoid pushing us into global recession.

Apart from US equities - up from three to five - underweight positions in UK and Japanese equities have now also ended. The UK score jumps from four to six and the score for Japan goes from four to seven, while the score for emerging markets rises from five to seven.

Fears of an autumn market setback

Just like Schroders’ Carrell, Macmillan has reserved his least positive score on equities for Wall Street, again reflecting what he calls “the late cycle environment”.

Fancy earnings multiples on many of the leading tech and fast-growing companies lead to fears of a market setback in the autumn, perhaps similar to the one that occurred in April. That, of course, proved to be a good buying opportunity for global equities.

Markets may be buoyant, but the overall mood is not particularly upbeat. In Macmillan’s case this caution is reflected in his score of eight for global bonds where yields are now approaching 5% on 30-year US Treasury bonds.

Coombs is holding a lot of cash in anticipation of another “air pocket” in the markets similar to the one that occurred in early April. His cash score remains at eight and, unlike other panel members, his highest equities scores are in the US and that is still only a six.

“Wall Street is hardly a screaming buy at the moment,” he admits. “But we still feel we have to be exposed to the wide choice of quality growth companies there.”

He also edges up his emerging markets score to six but goes underweight in Europe, while the score for Japanese shares is lowered to only a neutral stance. He’s managed to raise his UK score from a lowly three to four in a grudging response to the recent climb in home-grown shares.

Overall, Coombs is the least bullish on equities of the four panel members. On Trump’s tariff threats, he says: “The whole policy is proving complicated - it seems hardly catastrophic but it is inflationary.”

He remains particularly bearish on the corporate bond market where he’s now lowered his score further from three to two. “The spreads on these bonds are now so narrow it is almost unbelievable,” he says.

It’s intriguing to find Burdett taking an opposite line on corporate bonds, although even he’s decided to lower his score from a super-bullish nine to eight. “I'm still keen on this sector as an alternative to cash or equities because corporate earnings seem to be holding up well,” he argues.

Burdett remains the strongest supporters of equity markets among the panel. He’s overweight in every sector and is only slightly tweaking his scores from his position three months ago. Given the strength of major markets recently, his stance appears entirely justified. Even so, he keeps a high cash score against the rising risk of a correction before the year is out.

“You could argue that I should have had more exposure in the US, which is again proving to be the world’s best economy and the most flexible in adapting to the headwinds it faces,” he admits. “But valuations are high and in the case of artificial intelligence stocks probably too high.”

- Benstead on Bonds: gilts and the pension time bomb

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Japan remains his favourite sector, while UK equities are probably his least favourite, with him lowering his score here from seven to six. “Chancellor Rachel Reeves is in a bit of a bind,” he says. “Trying to find new sources of revenue without pushing the economy into recession. The UK economy is even more precarious now so that’s why I’m lowering my UK bonds score.”

Property has the booby prize with the lowest average score of 4.5 and here only Burdett remains overweight. “There are not too many signs of stress in the sector,” he claims. “Interest rate cuts not caused by a total collapse of the economy are going to help.”

With persistent central bank support ever since the Russian invasion of Ukraine, the gold price has remained strong. Among the panel only David Coombs remains underweight. The other three remain enthusiasts.

Note: the scorecard is a snapshot of views for the third quarter of 2025. How the panellists’ views have changed since the second quarter of 2025: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett is head of multi-manager with Nedgroup Investments.

Dorian Carrell is head of multi-asset income at Schroders.

David Coombs is head of multi-asset investments at Rathbones.

Max Macmillan is head of strategic asset allocation at Aberdeen.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.