The Analyst: two funds to exploit rotation out of US assets

There are many crowded trades in the States, and investors are switching into assets less exposed to Trump’s unpredictable trade policies. Analyst Dzmitry Lipski looks at an attractive allocation for your portfolio.

9th May 2025 11:22

by Dzmitry Lipski from interactive investor

Emerging markets continue outperforming their developed counterparts this year, even the “unbeatable” S&P 500. This trend is largely driven by attractive valuations, improving economic fundamentals, and a more stable political environment in many emerging economies.

These factors are prompting investors to rotate out of crowded US assets such as the “Magnificent Seven” tech stocks and seek diversification and growth elsewhere.

- Invest with ii: Open an ISA | ISA Investment Ideas | ISA Offers & Cashback

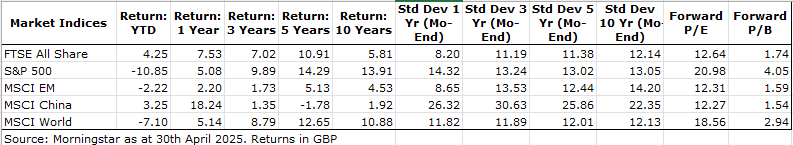

The table below shows the market returns, volatility and valuations.

Past performance is not a guide to future performance.

Concerns about President Trump’s unpredictable trade policies and his public criticisms of Federal Reserve chair Jerome Powell, have raised red flags for many investors. The uncertainty is weighing on sentiment around the US economy and dollar-denominated assets. So far this year, the US dollar has depreciated by nearly 10%. As confidence in Trump’s economic agenda fades, investors are turning towards strategies that benefit from a weakening greenback, such as gold and emerging markets.

Emerging markets, in particular, are being seen as an attractive allocation within global portfolios, offering potential growth opportunities amid concerns about US market direction.

While Trump’s trade agenda is mainly aimed at the Chinese, it’s a common misconception that emerging markets are all about China. While the country does make up roughly a quarter of the MSCI Emerging Markets Index, there are significant opportunities in other regions as well.

- China vs India, which market should investors pick?

- Investment outlook as US/China force world to pick sides

In Southeast Asia, countries such as Indonesia, Malaysia, the Philippines, Thailand and Vietnam, collectively known as the Tiger Cub Economies,are attracting increased attention, especially in light of the ongoing tensions between the US and China.

Meanwhile, in the Middle East, Saudi Arabia is gaining prominence, and in Latin America, Brazil stands to benefit from a potential recovery in commodity markets.

Equities remain the preferred asset class for many retail investors, but emerging market bonds are also gaining attention for their attractive yields and low correlation to other asset classes, which should offer good diversification benefits to investor portfolios.

Emerging market debt has been under pressure over the last several years due to elevated inflation and tight monetary policies. In addition, Trump’s trade war has further exacerbated the sell-off in these markets, driving outflows and underperformance against other fixed-income markets. With spreads widening and yields rising, valuations started to look attractive, making it a good buying opportunity for long-term investors.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Ian Cowie: signs this one’s a winner from Trump’s tariffs

Investors remain hopeful that Trump will scale back his trade war and bring greater clarity to policy direction, which could help stabilise the markets.

Today, the combination of a weakening US dollar, anticipated Federal Reserve monetary easing and improving fundamentals is making both equities and bonds in emerging markets increasingly appealing.

However, investors should be very cautious and selective as the asset class consists of a diverse collection of countries and companies.

As there are likely to be clear winners and losers in this market, active managers employing a more flexible approach and accurately managing risk, should be a better choice for investors.

ii Super 60 emerging market fund ideas

JPMorgan Emerging Markets Ord (LSE:JMG) has been managed by Austin Forey since the mid-1990s, and more recently alongside John Citron, and seeks to maximise total returns from emerging markets over the long term.

With a focus on quality and growth, the managers look from the bottom up for consistent earnings, competitive advantages and high returns on equity. The trust historically held a modest overweight to India (21% of portfolio - circa 3% overweight) and an underweight to China (19.7% - near 9% underweight) where perceived political and economic risk weighs on conviction. Tech, financials and consumer staples combined represent over two-thirds of the portfolio and are overweight positions.

Mid-term returns have been hampered by, among other factors, a persistent discount, which at 11.7% is notably deeper than five to 10-year averages, but the team and process have proven able to outperform over the long term. The trust benefits from Forey’s long tenure and his and Citron’s substantial experience in addition to JPM’s immense analyst resource. Given the trust’s substantial scale and tiered charge, the fee of circa 0.79% is one of the cheapest among actively managed emerging market peers.

M&G Emerging Markets Bond GBP I Acc fund seeks to deliver both income and capital growth by investing in a diversified portfolio of bonds across emerging and frontier markets. The fund has the flexibility to invest in government and corporate bonds, denominated in either local currencies or US dollars (also known as “hard currency”).

The portfolio includes approximately 140 bond issuers, offering broad diversification across geographies, credit ratings, and durations. Top country exposures include Malaysia, Mexico, South Africa, Indonesia and Brazil. The average credit rating of the portfolio is BB+. Currently, around 70% of the fund is allocated to government bonds, with the remaining 30% invested in corporate debt.

The fund has been managed by Claudia Calich since December 2013. With more than 20 years of experience in emerging markets, she brings deep expertise to this complex asset class. Claudia is supported by a well-resourced team of credit analysts at M&G, enhancing the fund’s research capabilities. Through careful bond selection and broad diversification, the fund has consistently outperformed its benchmark. In addition, it offers an attractive yield of over 6%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.