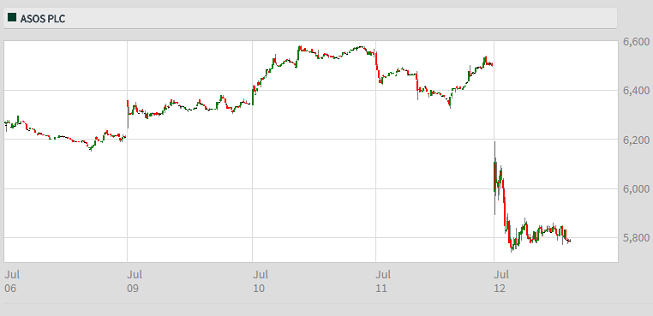

ASOS dives to 2018 low

12th July 2018 13:35

by Graeme Evans from interactive investor

ASOS has had plenty of ups and downs over the years, and this is one of the down days. Graeme Evans gives the reason for this latest capitulation.

After the shock of an ASOS update that didn't quite meet expectations, comes the inevitable question for investors: Is now the perfect opportunity to buy shares?

That's because the AIM-listed stock is at its lowest level in 20 months, having disappointed some market watchers with its trading update for the first 10 months of the financial year. Shares fell 10% as ASOS said its full-year sales are likely to be towards the lower end of its targeted 25% to 30% range.

Retail sales growth for the four months to June 30 of 21% was lighter than the 25% forecast, reflecting some pressure on international trade.

The growth figures quoted should be the envy of most retailers, but when your name is ASOS the bar is set very high. Shares have been duly punished, but is it an over-reaction?

Judging by a number of comments from analysts today, there’s little in the update to change the current positive sentiment towards ASOS.

The team at RBC Capital Markets said: "ASOS is a best-in-class operator delivering sustainably high levels of growth owing to a large market opportunity and a competitive, ever-improving proposition.

"Nothing in the trading update this morning has undermined this view."

They note that shares are trading at a 1.6 times valuation/sales multiple, which is 20% below its historical average. Fundamentals are unchanged, with an expected 25% annual growth rate in earnings per share over three years.

RBC dded: "We reiterate ASOS as our top pick, which offers a potential 32% upside (to 7700p)."

Liberum sits t 8,000p after making no change to its guidance today, while Andrew Wade of Numis Securities is at 8,500p based on the company’s “vast long-term profitable growth opportunity”.

ASOS trades on a projected 2018 price/earnings (PE) multiple of just below 70x.

While disappointed to be edging back his 2018 revenues forecast, Wade said the downgrade was the result of ASOS prioritising full-price sales and had meant a favourable impact on his margin projections.

He said: "Moreover, we are encouraged by the strong UK performance — ASOS’s most mature market — where it is still growing at over 20%."

ASOS chief executive Nick Beighton also sounded relaxed about the current performance, particularly as the final quarter of the financial year has started well. The group is still on track to meet full-year forecasts for profits in 2018.

He added: "We remain confident of delivering another year of strong growth."

As we highlighted in April, ASOS believes it can achieve £4 billion of net sales and become the world's "number one destination for fashion loving 20-somethings".

If that happens then there’s no doubt that investors will be handsomely rewarded. But to get there, ASOS has warned that capital expenditure will have to increase to between £230 million and £250 million in order to support the "considerable opportunity" it sees.

This will mean the company records cash outflows this year and next, before a return to inflows in FY 2020.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.