Is AstraZeneca share price slump a buying opportunity?

Vaccine euphoria quickly disappeared, but there’s lots happening at this popular drug giant.

16th March 2021 13:42

by Graeme Evans from interactive investor

Vaccine euphoria quickly disappeared, but there’s lots happening at this popular drug giant.

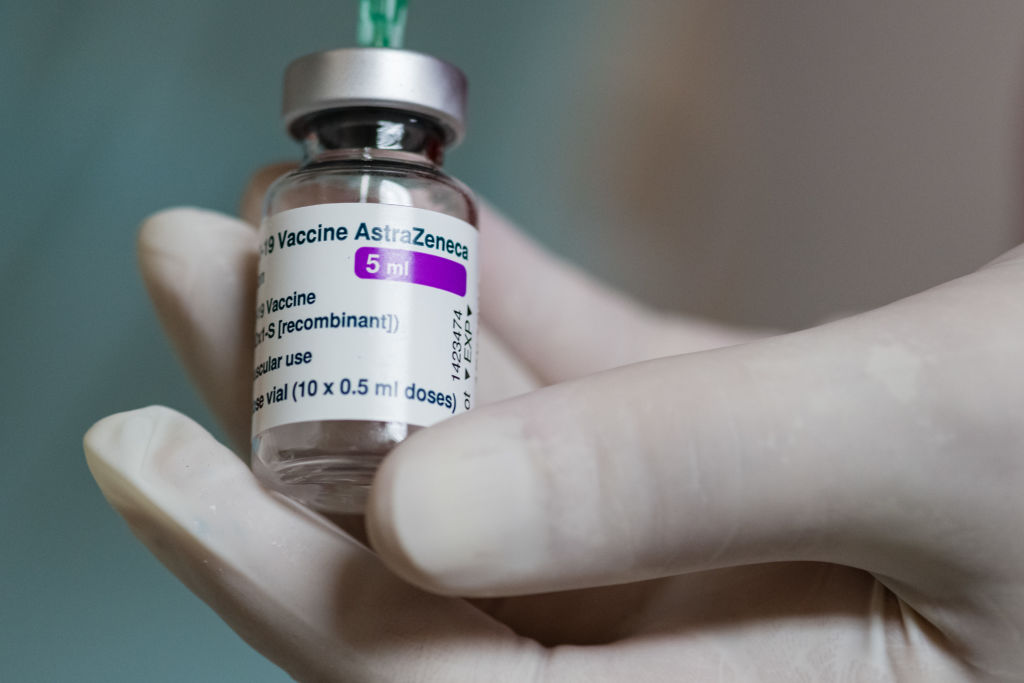

Europe's vaccine safety fears failed to put faltering AstraZeneca (LSE:AZN) shares under more pressure today as investors instead focused on another of its products for fighting Covid-19.

The blue-chip shares rallied by 3% today after Astra revealed that the US government will take an additional half a million doses of its potential AZD7442 long-acting antibody Covid-19 therapy, which is aimed at people who may not be able to have a vaccination.

Astra said the latest order took the total value of current agreements with the US government for AZD7442 to about $726 million in 2021. Analysts at Morgan Stanley have previously speculated that the therapy could deliver a revenue boost of $3 billion this year.

Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

That's in contrast to the Oxford vaccine, which is being sold at cost and is this week the subject of huge regulatory focus after a number of European countries paused its use due to an unconfirmed link to blood clots.

- Michael Lindsell: The Richard Hunter Interview podcast

- How I find winners and three top stock picks

- Shares for the future: a dozen good businesses

Rather than helping to keep AstraZeneca shares close to the 9,000p level seen in the summer, the Oxford vaccine breakthrough in November has been accompanied by a sharp loss of market value. Shares were today trading at 7,210p, having started the month at 6,794p.

The retrenchment reflects more than just Covid-19 forces, however, with the impact of December's massive deal for US biotech Alexion Pharmaceuticals (NASDAQ:ALXN) likely to be the biggest factor. At $39 billion, the price tag represents Astra's biggest ever corporate deal.

The cash-and-shares acquisition, which is due to complete by the third quarter of this year, will broaden Astra's portfolio in rare diseases. It also expands its presence in immunology drugs on the back of CEO Pascal Soriot's successful push into cancer treatments. The combined company is expected to deliver double-digit average annual revenue growth through 2025.

Analysts at Jefferies expect the strategic merits of the combination to become more widely appreciated by investors once completion of the deal comes into view. They have upgraded Astra to a ‘buy’ recommendation and lifted their price target by 7% to 8,850p.

In a note published today, Jefferies said: “A multitude of pipeline catalysts and new launches should aid a recovery of the shares.”

On the addition of Massachusetts-based Alexion, they said the resulting strengthening of cash flow generation not only provided additional flexibility to reinvest in R&D but raised mid-term dividend prospects. This could be crucial for income investors at a time when rival GlaxoSmithKline (LSE:GSK) is expected to rebase its dividend payout.

- What is ISA season?

- Golden rules for ISA investors: Before you invest, pass these tests

- Biggest tech trends I am backing for next five years

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The entry into the rare diseases segment is particularly attractive, given that this is a high-growth therapy area with significant unmet medical need. Over 7,000 rare diseases are known today, but only about 5% have US Food and Drug Administration-approved treatments.

Jefferies notes that Astra trades at a 5% sector premium on 15 times 2022 earnings, reducing to 12.5 times 2023 earnings for a level similar to peers despite its leading growth profile.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.