Shares for the future: a dozen good businesses

Richard Beddard picks 12 shares that should perform well over the next decade.

26th February 2021 14:57

by Richard Beddard from interactive investor

Richard Beddard picks 12 shares that should perform well over the next decade.

The Decision Engine is a collection of good businesses ranked by long-term value.

Before revealing this month’s ranked list of shares, let us consider what makes a good business. These thoughts are inspired by an article published in Forbes in 2019 that occasionally does the rounds on social media.

It is headlined “The Greatest Investor You’ve Never Heard Of”. This is apparently Herbert Wertheim, a former optometrist and self-made billionaire whose fortune, the article says, “comes not from some flash of entrepreneurial brilliance or dogged devotion to career, but from a lifetime of prudent do-it-yourself buy-and-hold investing”.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

In fact, there was a flash of entrepreneurial brilliance in Wertheim’s mix, because Wertheim reinvested income from the business he founded.

As described, his portfolio is invested in many of the most successful businesses of today, but he is no Johnny Come Lately. In his broker statements, are hundreds of millions of dollars in stocks such as Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT), purchased decades ago during their IPOs.

- Richard Beddard: scoring a music stock with Beatles connections

- Richard Beddard: the challenge of scoring two top-flight companies

- Richard Beddard: scoring two good long-term investments

His strategy was to focus on patents:“Instead of concentrating on the metrics in financial statements, Wertheim is devoted to reading patents and spends two six-hour blocks each week poring over technical tomes. “What’s more important to me is, what is your intellectual capital to be able to grow?”

The mother of all competitive advantages

Patents are evidence of invention and a licence to profit exclusively from it for a limited period of time.

Perhaps the king of patents in the Share Sleuth portfolio is Renishaw (LSE:RSW), an engineering company that makes machine tools, 3D printers, and surgical robots. It has thousands of patents.

Renishaw’s annual report in 2020 counted 17 new patent applications, 89 patent grants, 1,896 active patents and six in-house patent attorneys. It invests an incredible 13% to 18% of revenue each year in research and development.

I give patents only a little attention when I score a share, though. Knowing a company has lots of patents might help me nudge the score up, but if a company does not mention patents it is not a deal-breaker.

There are problems with using patents as a proxy for the strength of a company’s intellectual property.

A former chief executive of Anpario (LSE:ANP) told me the company did not patent its animal feed formulations because it would give rivals more information they could use to reverse engineer them.

Appraising patents requires specialist legal and technical knowledge. Not all valuable intellectual property can be patented, and the fact that something is patented does not stop somebody else from inventing a competing product that works slightly differently and even better.

Although it is tempting to think of patents as the mother of all competitive advantages, they do not spring from nothing. Behind every patent is an inventor, so the mother of all competitive advantages for a business is the people that make the intellectual property.

I find myself in the unaccustomed position of quoting Elon Musk (pictured below), the chief executive of Tesla (NASDAQ:TSLA). In 2014, he wrote on the company’s corporate blog: “Technology leadership is not defined by patents, which history has repeatedly shown to be small protection indeed against a determined competitor, but rather by the ability of a company to attract and motivate the world’s most talented engineers. We believe that applying the open source philosophy to our patents will strengthen rather than diminish Tesla’s position in this regard.”

Tesla still files patents, and the small print restricts Tesla’s technology to companies that are as open as Tesla or companies that are not, but are prepared to license its intellectual property. Tesla seems to think patents are valuable, but the people and business culture that invent the intellectual property are more valuable.

People power is one of the reasons I have added Focusrite (LSE:TUNE) to the Decision Engine. It is the music technology business I investigated last week.

People power

Focusrite holds design patents that prevent rivals from copying the look of some products and a recent acquisition, Martin Audio, has been a more active patenter. But the company is no Renishaw or Tesla.

Focusrite impressed me because of its employment practices. The company has training programmes at all levels, it is identifying and plugging pay gaps, and is introducing a new framework to identify how people can build their careers. The company has a free canteen at its headquarters in High Wycombe, subsidises music lessons and has an employee share option scheme.

Practices like these and their impact are hard to verify but Focusrite has won various awards, and employee reviews on recruitment site Glassdoor give the company a score of 4.6 out of 5, with 92% saying they approve of chief executive Tim Carroll and 90% saying they would recommend working there to a friend. The written reviews are quite inspiring, and point to a high level of employee involvement in strategy, a strong common love of music and an appreciation of the perks.

The figures tally with the company’s internal measures. It says its e-NPS (Employee Net Promoter Score), a measure of how likely employees are to recommend the firm to a friend, is +43 (anything above 0 is positive, -100 is the minimum and +100 is the maximum). Focusrite says it is working to improve its score from “good” to “great”.

Not all companies disclose the results of employee engagement scores or statistics relating to employee retention, but I think it stands to reason that those that do think they are important. Motivated staff mean inventive products and happy customers. This is reflected in another statistic, Focusrite’s NPS (Net Promoter Score), which asks customers whether they would recommend the company’s products to a friend. It is a titanic +74.

We have strayed quite far from patents, because I am seeking a broader definition of what makes a company good rather than documentary evidence of tangible inventions. Many of the things that make companies good are intangible, rooted in how they are organised, and how they recruit, train and retain employees.

If there is a common theme connecting all the shares in the Decision Engine, I want it to be that they all empower their people.

12 shares for the future

As well as adding Focusrite to the Decision Engine, this month I have re-scored three companies: lift component supplier Dewhurst (LSE:DWHT), Victrex (LSE:VCT) and language services provider RWS (LSE:RWS).

Much to our collective relief, I imagine, the government has published a credible-looking roadmap to a new normal. No doubt we will take some detours, but this has given me the confidence to return Churchill China (LSE:CHH), a supplier of tableware to the hospitality industry, leisure airline Jet2 (LSE:JET2), tenpin bowling alley operator Hollywood Bowl (LSE:BOWL)and school supplier RM (LSE:RM.) to the ranked list of shares.

I had previously removed them to a separate ‘speculative’ table because of the extreme risks posed by the pandemic, risks that appear to be receding.

A word of warning about RM. It is the highest ranked of the four and published its full year results on Tuesday, so I will be re-scoring it as soon as it has published its annual report.

As always, the shares are scored according to four fairly persistent criteria: profitability, risks, strategy and fairness, plus one that changes every day the stockmarket is open - price.

I believe it is a collection of shares that should perform well over the next decade, ranked so the best value shares are near the top.

While all the shares are probably good long-term investments, I consider those scoring seven or more to be particularly good value. Hence, there are 12 shares for the future this month:

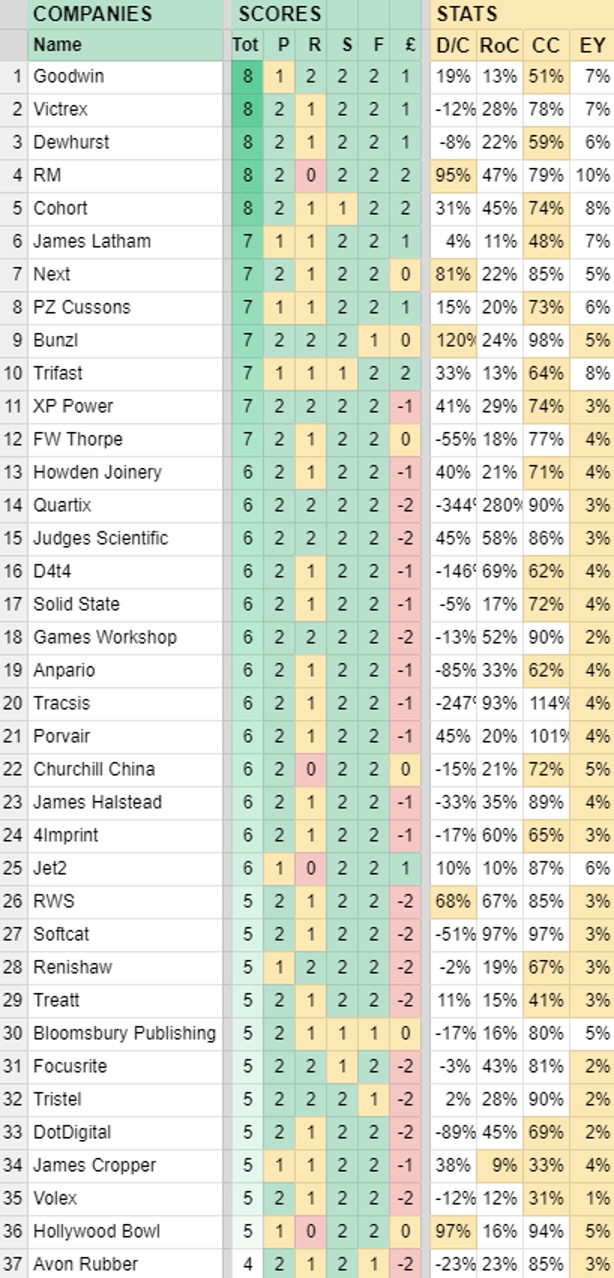

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Tot: Total score, P: Profitability, R: Risk, S: Strategy, F: Fairness, £: Price

D/C: Debt as a % of capital, RoC: Ave return on capital, CC: Ave cash conversion, EY: Ave earnings yld

Due to share price movements and updates scores may differ from scores in the linked profiles.

To see how I scored these shares, please click on the links in the table below:

| Name | Description | Find out how Richard scored these shares |

| 4imprint (LSE:FOUR) | Sells promotional materials like branded mugs and tee shirts direct | 4mprint |

| Anpario (LSE:ANP) | Manufactures natural animal feed additives | Anpario |

| Avon Rubber (LSE:AVON) | Manufactures respiratory protection equipment and body armour | Avon Rubber |

| Bloomsbury Publishing (LSE:BMY) | Publishes books and online resources for academics and professionals | Bloomsbury Publishing |

| Bunzl (LSE:BNZL) | Distributes essential everyday items consumed by organisations | Bunzl |

| Churchill China (LSE:CHH) | Manufactures tableware for restaurants and eateries | Churchill China |

| Cohort (LSE:CHRT) | Manufactures military tech. Does research and consultancy | Cohort |

| D4t4 (LSE:D4T4) | Develops and integrates of Customer Data Platforms | D4t4 |

| Dewhurst (LSE:DWHT) | Manufactures pushbuttons and other components for lifts and ATMs | Dewhurst |

| dotDigital (LSE:DOTD) | Develops marketing automation software | DotDigital |

| Focusrite (LSE:TUNE) | Designs and manufactures recording equipment, loudspeakers, and instruments for musicians | Focusrite |

| FW Thorpe (LSE:TFW) | Makes light fittings for commercial and public buildings, roads, and tunnels | FW Thorpe |

| Games Workshop (LSE:GAW) | Manufactures/retails Warhammer models, licenses stories/characters | Games Workshop |

| Goodwin (LSE:GDWN) | Casts and machines steel. Processes minerals for casting jewellery, tyres | Goodwin |

| Hollywood Bowl (LSE:BOWL) | Operates tenpin bowling centres | Hollywood Bowl |

| Howden Joinery (LSE:HWDN) | Supplies kitchens to small builders | Howden Joinery |

| James Cropper (LSE:CRPR) | Manufactures specialist paper, packaging and high-tech materials | James Cropper |

| James Halstead (LSE:JHD) | Manufactures vinyl flooring for commercial and public spaces | James Halstead |

| James Latham (LSE:LTHM) | Imports and distributes timber and timber products | James Latham |

| Jet2 (LSE:JET2) | Flies holidaymakers to Europe, sells package holidays | Jet2 |

| Judges Scientific (LSE:JDG) | Acquires and operates small scientific instrument manufacturers | Judges Scientific |

| Next (LSE:NXT) | Retails clothes and homewares | Next |

| Porvair (LSE:PRV) | Manufactures filters and filtration systems for fluids and molten metals | Porvair |

| PZ Cussons (LSE:PZC) | Manufactures personal care and beauty brands | PZ Cussons |

| Quartix (LSE:QTX) | Supplies vehicle tracking systems to small fleets and insurers | Quartix |

| Renishaw (LSE:RSW) | Whiz bang manufacturer of automated machine tools and robots | Renishaw |

| RM (LSE:RM.) | Supplies schools with equipment and IT, and exam boards with e-marking | RM |

| RWS (LSE:RWS) | Translates documents and localises software and content for businesses | RWS |

| Softcat (LSE:SCT) | Sells hardware and software to businesses and the public sector | Softcat |

| Solid State (LSE:SOLI) | Manufactures rugged computers, battery packs, radios. Distributes electronics | Solid State |

| Tracsis (LSE:TRCS) | Supplies software and services to the transport industry | Tracsis |

| Treatt (LSE:TET) | Sources, processes and develops flavours esp. for soft drinks | Treatt |

| Trifast (LSE:TRI) | Manufactures and distributes nuts and bolts, screws, and rivets | Trifast |

| Tristel (LSE:TSTL) | Manufactures disinfectants for simple medical instruments and surfaces | Tristel |

| Victrex (LSE:VCT) | Manufactures PEEK, a tough, light and easy to manipulate polymer | Victrex |

| Volex (LSE:VLX) | Manufactures connectivity components and power cord | Volex |

| XP Power (LSE:XPP) | Manufactures power adapters for industrial and healthcare equipment | XP Power |

Richard owns many of the shares listed in the Decision Engine.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.