Autumn Budget 2021 preview: the key issues for Chancellor Rishi Sunak

30th September 2021 10:01

by Alex Sebastian from interactive investor

We discuss some of the main issues Rishi Sunak will be wrestling with, not least the massive bill for pandemic support, as he fine-tunes his upcoming Budget.

The Budget on 27 October is fast-approaching and Chancellor Rishi Sunak will be working hard on nailing down the details.

In his address to Parliament, Sunak is expected to set out the government’s tax and spending plans for the next three years.

This comes as the country is still in the process of getting back on its feet economically after repeated lockdowns over the past 18 months knocked everything for six.

As well as the ongoing recovery from the pandemic, the recently arrived petrol and energy crunch will be giving the Chancellor plenty of food for thought.

- Five things investors must know about Britain’s energy crisis

- Spectre of inflation is trigger for investors to tweak portfolios

- Supply chain troubles are hidden threat to your finances

- Social care tax hike: how to plan for later life costs

While the petrol crisis is likely to be solved quickly as it has resulted entirely from a lack of licenced truck drivers, the gas supply crunch could be a bigger and much longer lasting issue.

It stems from a global shortage underpinned by deep structural factors, and the government may feel compelled to act to mitigate its impact on households over the winter.

National insurance rise

In one respect, Sunak has stolen his own thunder with this Budget. In early September, the government announced new tax hikes to fund increased NHS and social care spending.

Personal taxation rises, or cuts, are the centrepiece of any Budget, so going early with the 1.25% national insurance (NI) rise announcement could take some of the sting out of his speech.

That’s not to say we can rule out further big changes to personal tax rates. The Treasury will be keen to rebalance the nation’s books following the huge cost of the furlough scheme and other pandemic measures.

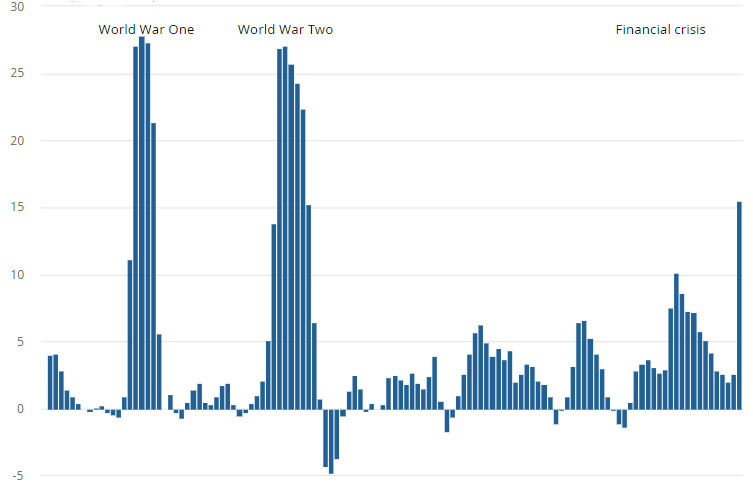

Low tax receipts and high expenditure meant the government borrowed £325.1 billion in the financial year ending March 2021. That’s equivalent to 15.5% of the UK’s gross domestic product (GDP), the highest such ratio since the end of World War Two.

Public sector net borrowing excluding public sector banks, UK, financial year ending March 1901 to financial year ending March 2021 (% of GDP)

Source: Office for Budget Responsibility and Office for National Statistics

With the money from the national insurance rise being funnelled into the NHS and spent, Sunak may be eyeing other revenue raising ploys.

Such moves would be very risky for the government given it has already broken its manifesto pledge not to raise people’s taxes once. Twice in the space of a couple of months could be a step too far.

Who will the Chancellor target?

Rather than raising personal taxes again we could see tax rises for big business. This is much easier for the government to get away with politically.

An area expected to see some significant announcements is student finance. Briefings have been given to media that this is a near-term priority for the government.

- UK economy springs post-Covid surprise

- Furlough finale further squeezes households: what you can do

- Check out our award-winning stocks and shares ISA

Reports claim one policy change on the table is cutting the minimum salary at which repayments of student loans kicks in from £27,000 to £23,000. Former universities minister Lord David Willetts urges Ministers to go further, arguing that a cut in the earnings threshold to £21,000 would save £3 billion of public spending a year.

It is a difficult balancing act for the government because the opposition from those who fall into this category will be fierce. It doesn’t have any easy options though when it comes to steadying the ship of creaking higher education funding.

What about pensions and the environment?

Turning to pensions, it is unlikely we will see any big changes. This is because Sunak has already risked the wrath of pensioners by temporarily ditching the ‘triple lock’ for a double lock, in response to a sharp spike in wages.

Pensioners are a key voting demographic, so it’s hard to see any further squeeze on them being announced this time around.

- Pensions jargon buster

- Are you saving enough for retirement? Our pension calculator can help you find out

- ii Top Ten: things to keep in mind when managing your own SIPP

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

We should expect to see Sunak go to great lengths to polish up his and the government’s ‘green’ credentials.

There’s a political arms race to see which parties can be the most proactive in tackling climate change, and the Conservatives appear determined not to let the opposition outflank them on these matters.

The key for the government is to bring carbon emissions down towards the net zero target without tanking the economy or destroying many households’ finances.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.