Best and worst stock markets in January 2020

Saltydog analyst looks back over a volatile start to the year, and names the tech fund he likes now.

3rd February 2020 13:29

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog analyst looks back over a volatile start to the year, and names the tech fund he likes now.

A hesitant start to the year but NASDAQ bucks the trend

After a positive end to 2019, January has been disappointing for stock markets around the world.

The year got off to a bumpy start when, on the 3rd January, Iran’s top military commander, General Qasem Soleimani, was killed in a US airstrike in Iraq. The Americans were responding to attacks by Iran-backed militias on their American Embassy in Baghdad.

After the general’s death, the Iranians retaliated by firing 16 short-range ballistic missiles at two Iraqi bases that host US troops. At one stage ‘World War III’ was trending on social media and US teenagers feared that they would be drafted into service. Fortunately, the military action didn’t escalate any further, but tensions remain between the US and Iran.

Just when it looked like one catastrophe had been averted, another potential global crisis emerged. Health authorities in China reported the country’s first death from a new type of coronavirus. The Wuhan Municipal Health Commission said seven other people were in a critical condition. By the end of January, the number of cases around the world had risen above 10,000 and the World Health Organization had declared the coronavirus an international public health emergency. The total number of fatalities is now 361.

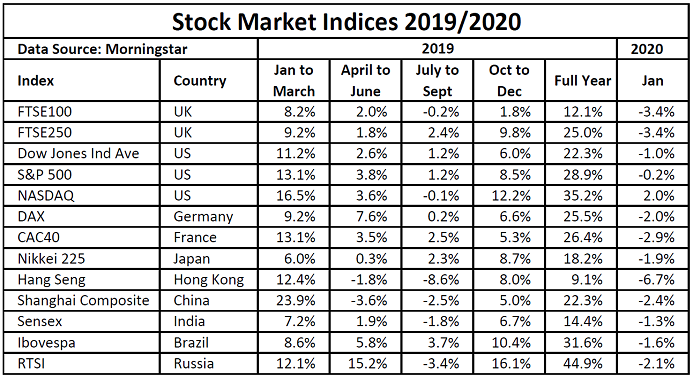

All the uncertainty has weighed heavily on global equity markets. The table above shows most stock market indices going down in January. The worst, the Hong Kong Hang Seng, dropped by 6.7%. The Shanghai Composite looks as though it got away relatively unscathed, down 2.4%, but that’s not the whole story. The Chinese stock markets were closed for Chinese New Year, which was extended by three days. They’ve only just re-opened and, after its first day’s trading, the Shanghai Composite is down nearly 8%.

The best-performing market has been the tech-focused NASDAQ, which went up 2% in January.

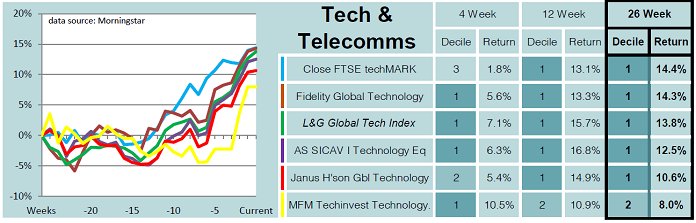

The ‘Technology & Telecommunications’ sector also features in our latest Saltydog analysis. Last week it was showing the best four-week return, up 5.7%, and it had been making gains for seven weeks in a row. The only other sectors that have been making such consistent gains are £ Strategic Bonds and £ Corporate Bonds, but their overall returns are significantly lower.

The leading funds, based on their performance over the last 26 weeks, are shown in the table below.

From the graph it is fairly clear that most of these funds didn’t make much progress until about 15 weeks ago. In fact, they were all trending down. However, in the last 12 weeks they’ve made gains ranging from 10.9% to 16.8%.

Last year, Technology and Telecommunications was the best performing Investment Association sector, gaining 31% in 12 months, and it’s had a pretty good start to this year.

For most of last year we were holding the Fidelity Global Technology fund and the Polar Capital Global Technology fund in our demonstration portfolios. We’re currently invested in the Janus Henderson Global Technology fund.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.