Beware the eerie calm in sterling assets

Our companies analyst considers how investors might deal with Brexit issues coming to a head this week.

9th April 2019 11:32

by Edmond Jackson from interactive investor

Our companies analyst considers how investors might deal with Brexit issues coming to a head this week.

A relative calm for sterling and stocks through recent Brexit chaos can create a false sense of security. It may part-reflect a globalist mindset in financial markets, about how authorities will wrest some form of compromise or kicking any can of acute risk down the road; quite like central bankers have done since the 2008 crisis, with their stimulus measures.

Another influence could be that financial traders having wracked wits over Brexit scenarios to the point of mental exhaustion, currently lacking firm views whether bull or bear.

This week, however, a series of deadlines bring matters to a head, with an emergency EU summit on Wednesday and a no-deal Brexit happening at 11pm Friday if the EU27 fail to achieve unanimity on an extension.

Assumption is EU27 (eventual) unanimity for Brexit extension

The Irish prime minister has affirmed what appears to be the consensus view in financial markets, that when it comes to the crunch, neither the governing/business elite in Britain nor the EU27, will go down a hard Brexit route, especially with Germany now teetering on recession. Disruption and a demand shock must be avoided at all cost.

Donald Tusk's proposal of a one-year extension enabling Britain to leave as soon as there's a solution to current deadlock, has appeared just such a compromise that financial markets have come to expect.

A chief risk to this assumption – most prominently from France, also Lithuania and Malta - is suspicion that a long extension will do serious harm to the EU parliament if frustrated Brexiteers vote in rebellious MEPs should Britain be required to hold European elections next month.

Jacob Rees-Mogg has already suggested making life as difficult as possible for the EU by vetoing budget proposals. Moreover, this would encourage other nationalists, with far-right politicians in Italy, Germany, France, Poland and Austria meeting early this week to create a unified group. As if the EU hasn't enough problems without adding Britain.

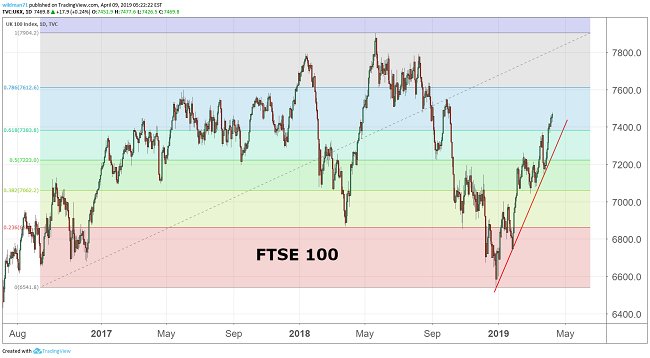

Source: FTSE 100 chart by TradingView Past performance is not a guide to future performance

So, the EU27 faces a very difficult week, to weigh mitigating effects economically of a Brexit extension versus its liability to stoke political trouble. In truth we can't tell if the much-flaunted "EU unity" will hold amid exceptional times.

Quite whether the Conservative government and Labour opposition will coalesce around a customs union is unclear, although first the chancellor and now foreign secretary have said "red lines no longer apply", which also partially removes the prime minister as a punch-bag for the Tory Right.

Does any form of late-stage portfolio hedging make sense?

For the majority of individuals, it is hard to do much else than maintain a diversified portfolio including overseas earners to mitigate sterling-based investments. One hedging option for domestic UK equities is "short ETFs" - exchange traded funds offering a spread of synthetic instruments able to profit from asset price falls.

For example, Boost FTSE 250 (LSE:1MCS) tracks the FTSE 250 index, which you would think is most appropriate to hedge against a plunge in sterling/domestic equities. However, short ETFs (or exchange traded products, ETPs) are really for sophisticated day traders, given the maths of compounding tends to undermine "holding" returns.

In the past I've been intrigued by short ETFs, but hesitate to recommend them as practical - you can easily end up losing money in a volatile sideways market. ETF's are best understood as delivering the inverse of the daily market index return, if that works for you.

Shorting the FTSE 100 is unlikely to work either, given this index's composition of overseas earnings – especially miners – and its relative strength versus the FTSE 250, Small-cap and AIM indices post the 2016 referendum.

- What Brexit clarity could do to the FTSE 100

- We pick six investment managers to beat Brexit blues

- 16 funds to cover all possible Brexit outcomes

- 2019 outlook Brexit and beyond

But if a hard Brexit was to conflate with the growing evidence of international economic slowdown, to prompt a shift to “risk-off” - out of equities as an asset class – then yes, short ETFs such as X FTSE 100 Short Daily Swap (LSE:XUKS) are potentially of interest to sophisticated day traders.

Smaller companies are most at risk, where, as I've frequently cited in stock comment pieces, there's been scant reassurance when reporting results, and where managers have prepared for a hard Brexit especially – as if investors should assume establishing trading subsidiaries in the EU will resolve, or at least mitigate any market access issues.

Despite a risk of profit warnings, be ready to turn bullish

From a company analyst perspective I’m mindful about how stock-piling inventory for fear of disruptions is likely to have absorbed working capital – possibly requiring increases in short-term debt, even compromising dividend growth where there hasn't been ample cover.

Not to over-dramatise this, but it wouldn't be surprising to see a few warnings creep into company updates where trading is already challenged and market expectations only just hold.

If parliament does end up supporting a customs union to deliver Brexit, and despite protests from the Right, this should at least provide an element of certainty relative to the chaos of recent months. And, while offensive to those private investors who are Conservatives, this is likely to be welcomed by the international financial community which, above all, wants to see a compromise struck than delivery on any particular vision of Brexit.

So, if the assumption does hold this week, Brexit is being diluted or deferred so as to avert a hard Brexit, despairing Leavers should not sulk lest sterling and equities promptly twig to "risk back on" – otherwise you could be too jaundiced to seize a buying opportunity.

Domestic UK stocks such as financials and housebuilders could enjoy a lift simply in the belief that a key element of short-term risk has been averted. Personally, I don't see much end to the overall Brexit uncertainties though, as confusion and rancour have served to poison the atmosphere for the next and more crucial negotiation – of what Britain's long-term relationship with the EU should be.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.