Big or small funds? The surprising answer when it comes to size

31st August 2022 09:38

by Sam Benstead from interactive investor

The data is in, fund size really does have an impact on performance, writes Sam Benstead.

It is generally accepted that small investment funds perform better than larger ones because fund managers can be “nimble” and easily jump in and out of stocks.

This is because managers have to build up only small positions in companies to hit their required portfolio allocation. Therefore, small stocks can be accessed without taking a significant stake in a business. This potentially creates issues if they need to quickly sell them.

On the other hand, large funds are considered cumbersome, forced to move slowly when buying and selling stocks, and too big to own exciting and under-researched smaller companies.

- Read about: Free regular investing | Opening a Stocks & Shares ISA | Cashback Offers

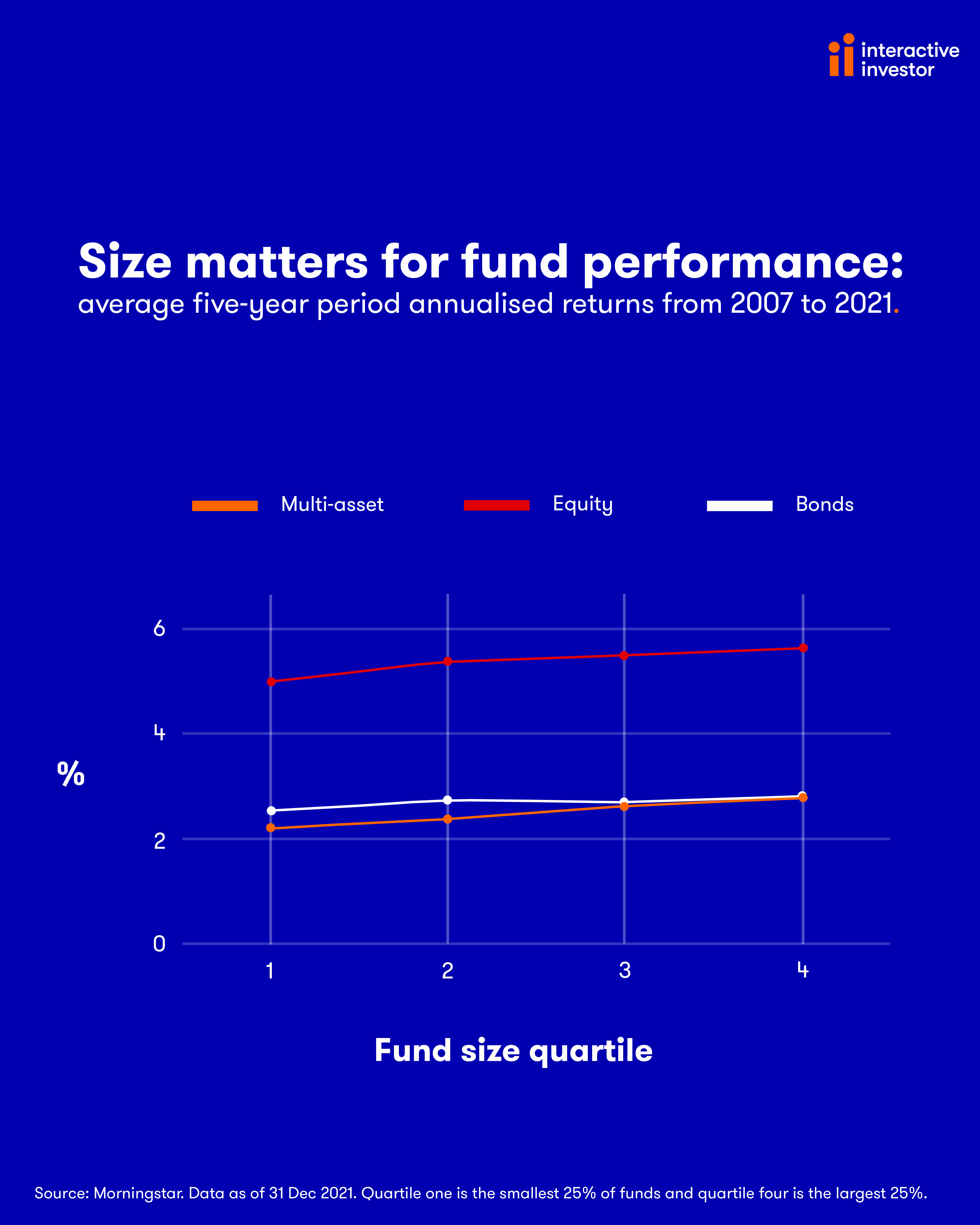

However, new data tells a different story, according to a study from fund researcher Morningstar. It found a clear link between the performance (on a risk-adjusted basis) of Europe-domiciled funds and fund size, particularly among equity funds, but also for bond and multi-asset funds.

Its study included 23,326 unique active funds in Europe with a full performance record over at least one of three five-year calculation periods between 1 January 2007 and 31 December 2021.

In all three asset classes and in all five-year periods, the largest funds beat the smallest before accounting for fees. For bond funds, it found the picture was slightly more mixed than for the others, but still strongly correlated, with a positive trend overall between the amount of assets and returns.

- 11 investment trusts aiming to take advantage of stock market falls

- A tactic to ride out the inflation storm using these funds and trusts

- The most-popular dividend shares among fund managers

Looking into performance after fees, the picture was similar, especially between the smallest 25% of funds and the largest 25% of funds.

This is because small funds tend to be more expensive than larger funds as they do not have the economies of scale required to cut costs for investors.

The median of the smallest quartile of equity funds was 24 percentage points more expensive than funds in the largest quartile of the category.

The differences are directionally similar but smaller in magnitude for multi-asset and fixed-income funds, evidenced in the chart below.

Resources matter

One reason small funds perform worse than large funds, according to Morningstar, is that they fall behind in terms of portfolio management and support resources compared with larger rivals.

Morningstar data showed that the median fund size was only €76 million (£65 million) and the average was €350 million (£300 million) at the end of December 2021.

A quarter of funds had less than €20 million (£17 million) in assets, meaning a typical management fee of 1% would create an annual revenue of €200,000 for such a fund.

Morningstar said: “This is clearly not sufficient to cover the cost of hiring a strong cast of portfolio managers, analysts, client representatives, back-office personnel, and the like, and paying for data and other third-party services on top.

“Granted, this is a simplistic view as individual funds typically feed into a broader business and their resources are not linked one-to-one to the cash flow they generate for the asset manager. However, it is typical for asset managers to add resources to strategies as they grow, and vice versa.”

- Five reasons why investment trusts are different from funds

- The income funds and trusts investors are turning to

Liquidity issues for large funds

But being big also creates challenges. For example, Morningstar said that small and mid-cap funds could grow too big for their investment universe, leading to difficulty buying and selling stocks.

It said: “Managers may struggle to sell or buy securities without having a material impact on market prices or needing to delay or spread their trades through time because of a lack of market depth.”

The issue isn’t only seen with small-cap funds. Big large-cap funds may also become more diversified to manage liquidity and therefore dilute their active bets against the benchmark, according to Morningstar.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.