Biggest fallers during the crash and the shares to buy

As the market crash rages on, we reveal stocks down 50% during the rout and strategies to cope.

12th March 2020 12:06

by Graeme Evans from interactive investor

As the market crash rages on, we reveal the stocks that have slumped by 50% during the rout and some trading strategies to cope.

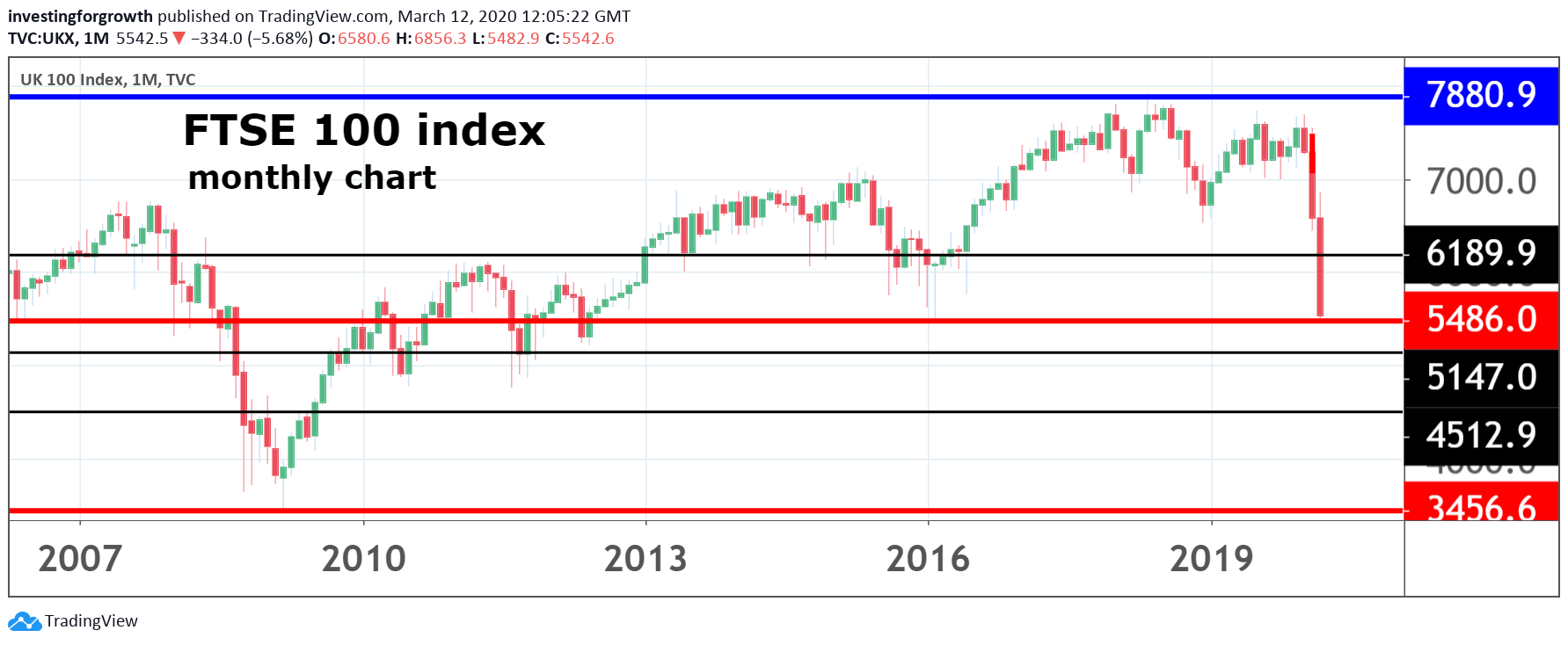

Investors had nowhere to hide today as coronavirus panic wiped 6% from the FTSE 100 index and extended losses for some of London's biggest stocks to 50% since the sell-off began.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

With few signs that Europe and the United States are able to bring the outbreak under control, the top-flight index is now at its lowest level since the height of the European debt crisis in 2012. The longest bull run in US stock market history has also been ended in emphatic fashion, with the Dow Jones Industrial Average entering bear market territory last night.

Source: TradingView Past performance is not a guide to future performance

The losses endured by individual stocks since the start of the turmoil on 21 February are simply stunning, particularly given the time frame. They are led by travel companies Carnival (LSE:CCL) and TUI (LSE:TUI) with falls of more than 50%, with airlines easyJet (LSE:EZJ) and International Airlines Group (LSE:IAG) off 44%.

Weaker economic output and a slump in oil prices means BP (LSE:BP.) and Royal Dutch Shell (LSE:RDSB) are a third lower, with British Gas owner Centrica (LSE:CNA) down 38% despite already being at a record low. The sell-off also shows no respect for reputations, with previously high-flying JD Sports Fashion (LSE:JD.) among the top flight's biggest fallers after falling 36%.

Even at today's historically low levels, and with stocks such as Barclays (LSE:BARC) on forward price/earnings (PE) multiples as low as 5.2x, it's a brave investor that “buys the dip”. There's no indication the outbreak has yet to peak, with measures announced so far by various central banks or by Chancellor Rishi Sunak in the UK having no impact on market sentiment.

What's really spooked investors today is President Trump's ban on travel between most of Europe and the United States, highlighting to investors not only the severity of the situation but the potential for much weaker global economic activity. Meanwhile, most of Italy is currently closed for business and the World Health Organisation has admitted defeat in the battle to contain the virus after declaring the outbreak a pandemic.

Analysts at Jefferies said today: “The West has been totally unprepared to control the virus and the best it can do now is to prevent the healthcare services from being overwhelmed. Financial conditions are still tightening and the policy makers are behind the curve.”

Today's latest slump means the FTSE 100 index is now 26% lower than the start of the year, with a decline of similar magnitude for the more UK-focused FTSE 250 index.

Source: TradingView Past performance is not a guide to future performance

In the midst of what UBS neatly describes as “outsize volatility” for most asset classes, emerging markets equities have shown relative strength after a fall of just 15% since mid-February. This may be a reflection of the rapid containment efforts of Asian governments, notably in China, at a time when the infection is spreading fast across Europe and the US.

UBS expects markets to remain volatile until there's a combination of three things — evidence of virus containment, clarity on the economic impact and a concerted global policy response.

The bank told clients in a note this morning: “Although we have seen some stimulus measures from policymakers, it is unclear if it will prove comprehensive enough to mitigate the economic damage arising from the coronavirus containment measures.”

What should investors do?

UBS's recommendations in the current climate include favouring strategies that enhance portfolio yield, such as dividend stocks, and preparing for further US dollar weakness over the medium term as the Federal Reserve continues to cut interest rates.

Alongside more risk-averse investors increasing exposure to gold and longer-duration US Treasuries, the bank suggests that now might be a good time to buy into long-term themes.

UBS said: “Even after the current crisis passes, an ageing global population, developments in healthtech, and recent strides in genetic therapies all offer long-term opportunities for investors seeking long-term portfolio growth.

“The crisis may also accelerate longer-term trends in connectivity and localization, benefiting companies exposed to the fourth industrial revolution and digital transformation.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.