Can Mag 7 tech rally continue after best month in two years?

Big gains for American tech stocks are threatened by a prolonged stand-off on tariffs and damaged US credibility. Graeme Evans reports on one analyst’s outlook for US tech.

3rd June 2025 13:24

by Graeme Evans from interactive investor

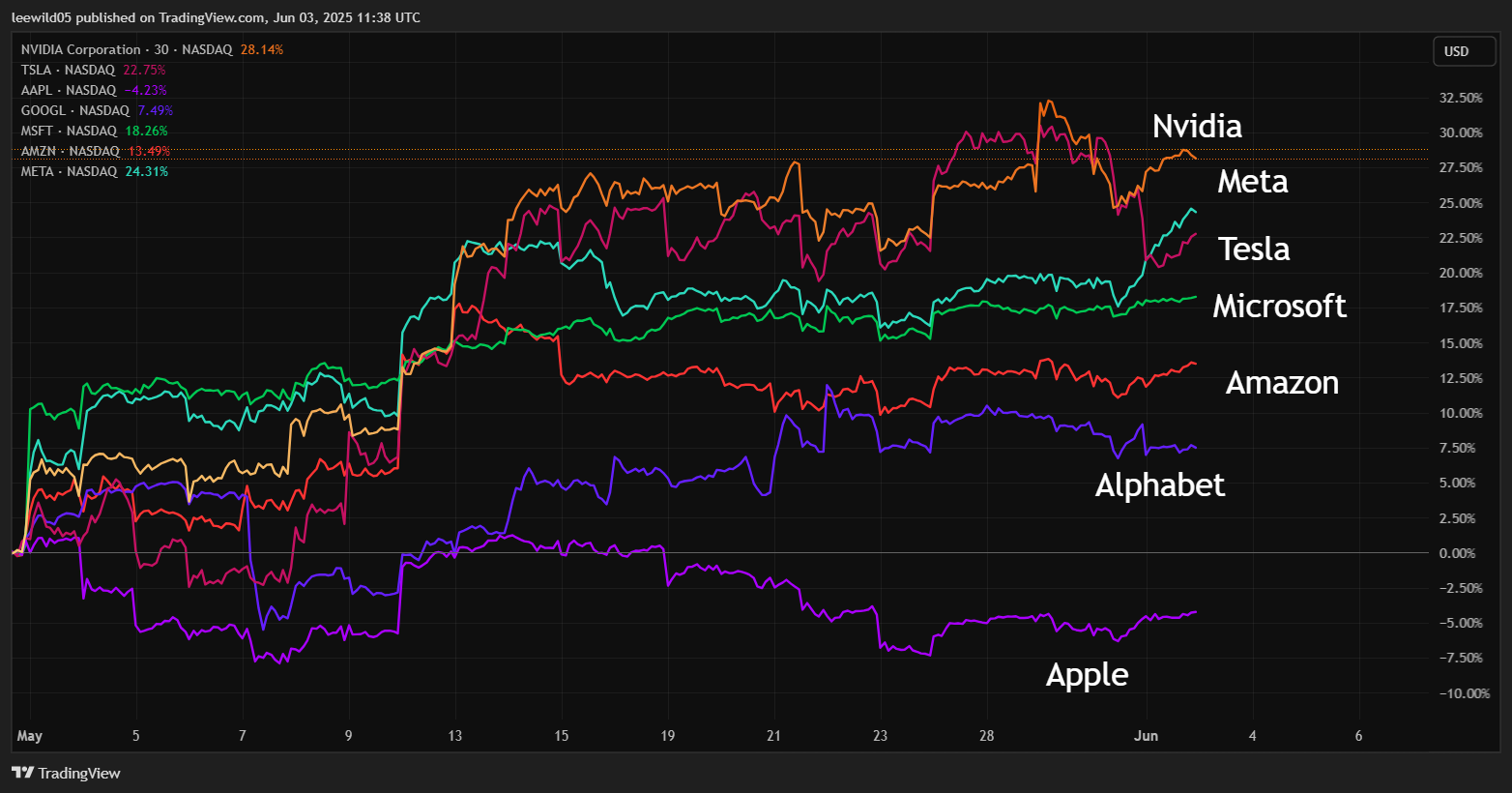

Tesla and NVIDIA Corp (NASDAQ:NVDA) more than made up for the performance of Apple Inc (NASDAQ:AAPL) in May as the Magnificent Seven group of mega-cap stocks roared back to form with its best month in two years.

The 13.4% advance was driven by the easing of US-China trade tensions and the potential benefits attached to President Trump’s $2 trillion (1.5 tillion) worth of US-Middle East economic deals.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Nvidia rose 24.1% and Tesla Inc (NASDAQ:TSLA) extended its recovery since its quarterly results on 22 April to 46%, supported by Elon Musk’s renewed focus and hopes of an imminent robotaxis launch.

Apple remains the group’s laggard, reflecting its perceived relative weakness in AI-related initiatives, and the threat of 25% tariffs unless it shifts production to the US.

Its shares were the only faller among the seven in May, leaving them below Tesla as this year’s worst-performing Magnificent Seven investment following a decline of 20%.

Google owner Alphabet Inc Class A (NASDAQ:GOOGL) rose 8.2% but is still down slightly for the year, a position shared by Amazon.com Inc (NASDAQ:AMZN).

Source: TradingView. Past performance is not a guide to future performance.

Facebook owner Meta Platforms Inc Class A (NASDAQ:META) and Microsoft Corp (NASDAQ:MSFT) are both higher in 2025, while Nvidia shares have returned to where they were at the start of the year.

The chip giant boosted confidence at the end of the month by reporting first-quarter results ahead of Wall Street expectations, with its strong guidance for $45 billion of revenues in the current quarter despite a $8 billion hit from China export curbs.

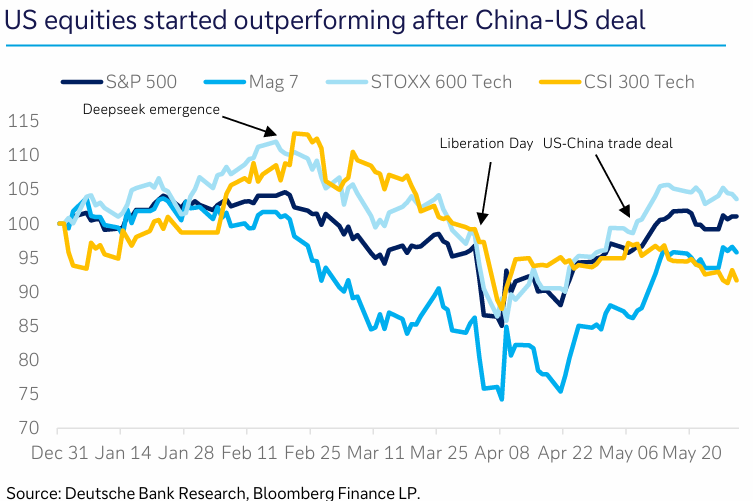

According to today’s Deutsche Bank tech performance review for May, the US sector outperformed European counterparts for the first time this year after the Nasdaq 100 rose 8.8% against the STOXX 600 tech at 7.8%.

- Tech funds top the performance charts once again

- Buffett, Wall Street and heroic retail investors: who’s right?

Europe remains well ahead year-to-date after posting growth of 17.5%, reflecting the fact that tariffs pose a much larger burden for US corporations.

Chinese tech underperformed in May, weighed down by ongoing US export controls on semiconductors and hardware as the CSI 300 Tech fell 3.4% in May.

Past performance is not a guide to future performance.

Deutsche Bank said that the rebound for US tech may be a temporary reprieve, warning that a prolonged stand-off on tariffs has the potential to undermine global trade momentum and fuel macroeconomic volatility.

US credibility is seen as another key downside risk, given that investor confidence may weaken on erratic policy signals and in light of Moody’s downgrade of the US credit rating.

It adds: “May was a strong month for tech, but the durability of the rally remains in question. As before, Magnificent Seven performance will likely serve as a barometer for broader risk sentiment.”

- ii view: Nvidia sales boom as datacentre demand soars

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The turnaround in US tech fortunes during May was in contrast to the mood of professional investors just a month earlier.

April’s survey of fund managers by Bank of America reported that the Magnificent Seven was no longer the most crowded trade and that allocation to US equities had dropped to a net 36% underweight for a record two-month decline.

Three-quarters of investors agreed that the theme of US exceptionalism had peaked.

Long gold positions became the most crowded trade, ending a 24-month streak for the Magnificent Seven as the allocation to tech pulled back in April to the lowest figure since November 2022 at net 17% underweight.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.