Buffett, Wall Street and heroic retail investors: who’s right?

Analyst John Ficenec studies recent investing behaviour of Wall Street legend Warren Buffett and looks at the conflict between professional investors and the rest of us. There are lessons to be learned.

28th May 2025 10:14

by John Ficenec from interactive investor

A war has broken out on the stock market between professional and retail investors. At first glance this may look like the investment industry cashing in at the top by dumping overvalued equities on to inexperienced investors before disappearing on to their yachts, trotters up for the summer. However, it’s never quite that simple, and understanding the drivers of these seismic capital flows can give us a clearer picture of why buying now is a good time to deliver long-term returns.

- Invest with ii: Most-traded US Stocks | Buying US Shares in UK ISA | Cashback Offers

Wall Street vs Main Street

A conflict between professional investors and retail punters is unusual as both sides have been united since the 2020 Covid pandemic, steadily buying shares and driving America’s S&P 500 to a record high of 6,147 in mid-February of this year, and the FTSE 100 to a peak of 8,908 a couple of weeks later in early March.

Since then, the relationship has fractured as markets plunged then seesawed. Investment professionals spooked by Trump’s tariffs dumped shares and bet against the market in late March and early April, while retail investors did the opposite and heavily bought shares after the sell-off. It’s easy to think that one side knows something the other doesn’t, but looking at one famous investor gives us a clearer picture of what’s really going on.

The Sage sells out

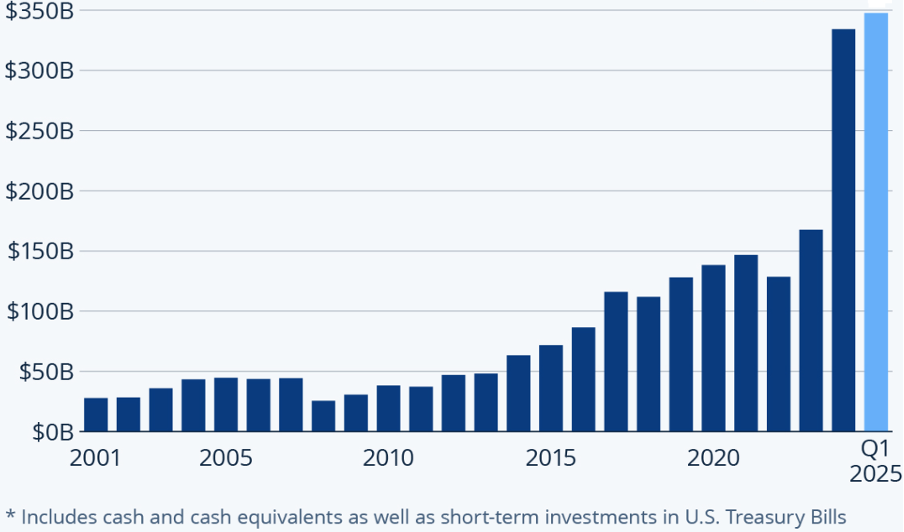

Warren Buffett, the 94-year-old Sage of Omaha, has been dumping shares and is holding the largest amount of cash ever in his Berkshire Hathaway Inc Class B (NYSE:BRK.B) investment company. The Smaug-like $347.7 billion (£257.5 billion) held at the end of March this year, should be reason enough for investors to take fright and run for the hills - if the best investor ever is selling, then it’s a brave person who thinks they know better. But a closer analysis of that cash balance shows why there is nothing wrong with owning shares right now.

Source: Statisa, company filings.

The devil is always in the detail. The total amount is not cash held in a current account like you or me, it is a made up of $42.2 billion in cash and US Treasury bills under three months in duration, and $305.5 billion in Treasury bills with a duration of three months to one year, according to the latest 10Q regulatory filing. Buffett is buying fixed-income securities in US Treasuries. What that means is Mr Buffett is happy to make a loan to the US government for a duration of up to a year and get paid for doing so.

Never bet against Uncle Sam

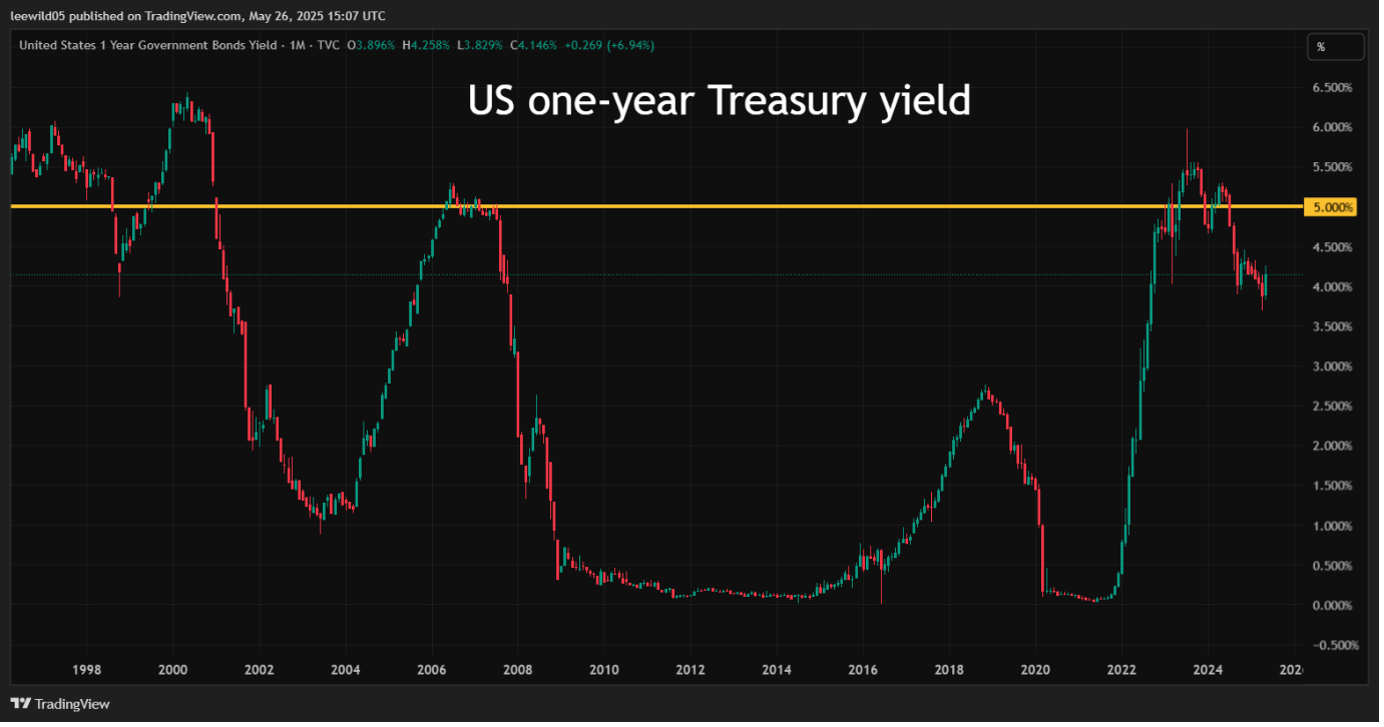

In the world of investment, a short-dated US Treasury bill is called the “risk-free rate” of return because if you hold it to maturity, as I’m sure Buffett intends to do, then the only way you could lose money is if the entire United States government collapsed and defaulted on its debt, something it has never done. And if the yield on those Treasuries is close to a 25-year high, then there is never a better time to take some money off the table and park it in government bonds for a while.

If the funds are left in Apple Inc (NASDAQ:AAPL) shares, yes they offer returns, but they also expose Buffett to losses, or what is called the equity risk premium. If we take the one-year US Treasury as a proxy, then at the time he was most heavily buying in early 2024 the yield was over 5%, and forecasts for the returns on the S&P 500 for the following year were 10%. Very simply, by selling Apple shares and buying Treasuries he guarantees a return of 5% for the cost of missing out on the potential 5% additional return in equities, or however much Apple shares rise. It is this ability to walk away from making more money from holding Apple shares to ensure safer returns for his investment company, that makes Buffett great.

- Three hot stocks in a booming sector

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The level of cash and short-term Treasuries has been relatively stable at Berkshire Hathaway since early 2020 through to the end of 2023, before suddenly jumping higher last year. So, it’s last year that we want to look at in more detail to see what happened.

The quarterly 10Q regulatory filings give us the opportunity to lift the lid on how those Treasury purchases developed across the 12-month period. In the first three months of the year, the answer is not much, rising by just $21.3 billion to end March 2024 at $188.9 billion, but then it takes off with $88 billion of purchases in the three months to the end of June 2024 to $276.9 billion, and another $48.3 billion of purchases in the three months to end September 2024 at $325.2 billion, before falling again to just $9 billion of purchases in the three months to December, ending the year at $334.2 billion. So, it’s just that six-month period from March to the end of September 2024 where it jumps $136.3 billion higher.

Date | Dec 2020 | Dec 2021 | Dec 2022 | Dec 2023 | Dec 2024 | Mar 2025 |

Total cash and short-term Treasury | $138bn | $144bn | $129bn | $168bn | $334bn | $348bn |

If we look at the Treasury yield around that period, it gives us an idea of why Buffett was buying short-dated US Treasuries. Only three times in the past quarter of a century has the yield on short-term US Treasuries gone above 5% - in early 2000, in early 2006, and more recently in early 2023 to mid-2024.

US one-year Treasury yield since late-1990s

Source: TradingView. Past performance is not a guide to future performance.

US one-year Treasury yield since end of 2023

Source: TradingView. Past performance is not a guide to future performance.

Selling shares and buying Treasuries is a slightly chicken and egg argument. Did he sell shares to buy Treasuries or buy Treasuries because he had sold shares? But, as with anything in investment, the answer is more nuanced and linked to two of Buffett’s guiding principles, first not to lose money and only then to go looking for excess returns.

Coca-Cola leaves a bitter taste

Buffett has long been a fan of Coca-Cola Co (NYSE:KO), no more so than his favourite Cherry Coke, having first invested all the way back in 1988. But a painful experience in the late 90s taught him a valuable lesson. Coca-Cola had been on a fantastic run and was sitting pretty at $41 per share in mid-1998, but the shares were expensive, with a valuation of around 50 times earnings and 11 times sales, Buffett decided not to sell and has since admitted it was an expensive mistake.

The shares almost halved in value during the next five years, falling to around $20 in 2003 after the dotcom crash, and didn’t recover their 1998 highs until 2013, some 15 years later. It’s this reminder of what happens to share prices when valuations reach extremes that would have been in Buffett’s mind when looking at Apple.

Apple was ripe

Buffett took his first bite of Apple in 2016, and since then it has generated returns of almost 700% for Berkshire Hathaway. That runaway success caused something of a problem for his portfolio as it made up half the fund by the end of 2023. Now Buffett likes to make a smaller number of concentrated positions, but from a portfolio management perspective, the fortunes of Berkshire Hathaway were becoming reliant on one company. The whole point of portfolio strategy is to diversify across different companies, so you aren’t too exposed to losses in one area.

By the end of 2023, Apple shares at $192 were also getting very expensive on a number of valuation measures, trading on a price/earnings (PE) ratio of 30 times, well above the 10 times Buffett first started buying in 2016, and they were trading on 8 times sales at the close of 2023 compared to around 2 times back in 2016.

An Apple store in Chongqing, China, with an advert for the iPhone 16 and Apple Watch. Photo: Cheng Xin/Getty Images.

To warrant those heady valuations Apple had been delivering annualised revenue growth of 15% for the decade 2010 to 2020, soaring to over 20% in 2021 as people spent their Covid cash. However, that growth slowed, with revenue falling by 2.8% in 2023, and when you throw in concerns about the US economy, the impact of the US election and a trade war would have on Apple’s Chinese manufacturing base it’s easy to see why Buffett was looking to reduce his stake.

Now we can see it’s less a picture of Buffett selling shares because a crash is coming, and more Buffett sticking to the investment discipline by reducing outsized positions in shares that look overvalued and are exposed to specific risks. Buffett still holds $66.6 billion in Apple shares, his largest single position, or some 26% of the equity portfolio, so he still very much believes in the company.

Selling, selling everywhere, but it’s not what you think

It wasn’t just Buffett selling in early April, it was professional investors dumping shares. According to analysis from Goldman Sachs, one of the main culprits was hedge funds. Again, this has less to do with fears of an impending crash and more to do with the fundamentals of fund financing.

- DIY Investor Diary: how I apply Warren Buffett tips to fund investing

- What 100 days of Trump 2.0 has meant for investors

Hedge funds don’t invest like you or I, with £10 saved used to buy £10 of shares; they use leverage, or borrowing, to increase returns. Quick back-of-the-envelope calculations show how it works. Let’s say they raise £10 million from investors and want to buy shares in a company. First, they contact their prime broker at the bank and ask them to buy £10 million in shares, but only have to place £1 million deposit on margin with the bank as security, and the bank will charge them 5% a year for the £9 million borrowed.

If the fund does that 10 times, they benefit from exposure to £100 million worth of shares, while only having £10 million in funds. At the end of the year, if the market has risen 10% they make £10 million on the £100 million of shares. They pay the bank £4.5 million for the 5% margin loan, return £1 million to investors for the 10% gain, and split £4.5 million between the managers - easy money. The problem is when shares start falling.

If stock market volatility increases, the bank will ask for more money on margin to cover potential losses, so the hedge fund has to act very quickly to raise funds, often by selling its best positions. The losses as well as the returns are amplified through the leverage.

Hedge funds have had a good few years, with the wider S&P 500 rising 24% in 2023 and another 23% in 2024, well above the 11% annual return for the past 20 years. Those returns have been driven by tech stocks and amplified by leverage. So, it’s no surprise the heaviest selling has been in the tech sector as it looks more like taking profits.

What of the hedge funds shorting, or betting against share prices? Well again, that’s not the whole picture as the clue is in the name. These funds hedge their bets, so if they hold shares in Apple, for example, instead of selling they could take a short position in a Nasdaq tracker exchange-traded fund (ETF). As Apple falls they make money on the Nasdaq short position, effectively staying neutral. So, a sharp rise in short activity isn’t a vote against shares, it’s protecting gains during a period of uncertainty.

Pity the greater fool

What of our poor retail punters buying overpriced shares from the wily professionals? Well, that’s not entirely true because retail only started buying after the sell-off, and this was entirely rational because by early April they were now getting shares in companies like Apple, NVIDIA Corp (NASDAQ:NVDA) and Amazon.com Inc (NASDAQ:AMZN) some 20% cheaper than the start of the year.

- Nvidia results preview: how much bad news is in the price?

- Trading Strategies: why stock market gains could be ahead

Given the UK household savings ratio has been increasing since mid-2022, according to latest Office for National Statistics (ONS) figures, and interest rates are forecast to fall in the UK and US, it makes sense to put savings to work in the market if there is a sale on.

A quick glance at the markets show that retail buyers have been proved resoundingly right so far, making gains of around 20% since buying at the lows.

Time to back up the truck?

Does that mean I would rush out to buy tech shares right now? No, I probably wouldn’t because Apple is back to $195 and looks expensive again on 30 times earnings given the risk and growth outlook.

What does look attractive are shares in smaller companies in the UK, with the FTSE 250’s PE ratio at a bargain 10.2, a discount to the blue-chip FTSE 100 on 12.2, the S&P 500’s PE of 28 and Nasdaq 100 on 39.

Buffett set to buy British

Given Buffett’s investment discipline there is every chance his next big purchase could be in Britain as well. It has everything he likes, low valuation, high-quality companies and a stable political background. What’s more he’s sitting on a near $350 billion held in securities which mature in the coming months, and he will retire at the end of the year.

The UK hasn’t been a happy hunting ground for Buffett after losing money on Tesco (LSE:TSCO) and Diageo (LSE:DGE). However, as he’s shown time and again in his more than 70-year career, if you stick to the fundamentals of value, you will always gain in the long run.

John Ficenec is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.