Tech funds top the performance charts once again

Saltydog Investor considers how various fund sectors fared in May, with technology funds back on top with a one-month gain of 8.9%.

3rd June 2025 09:16

by Douglas Chadwick from ii contributor

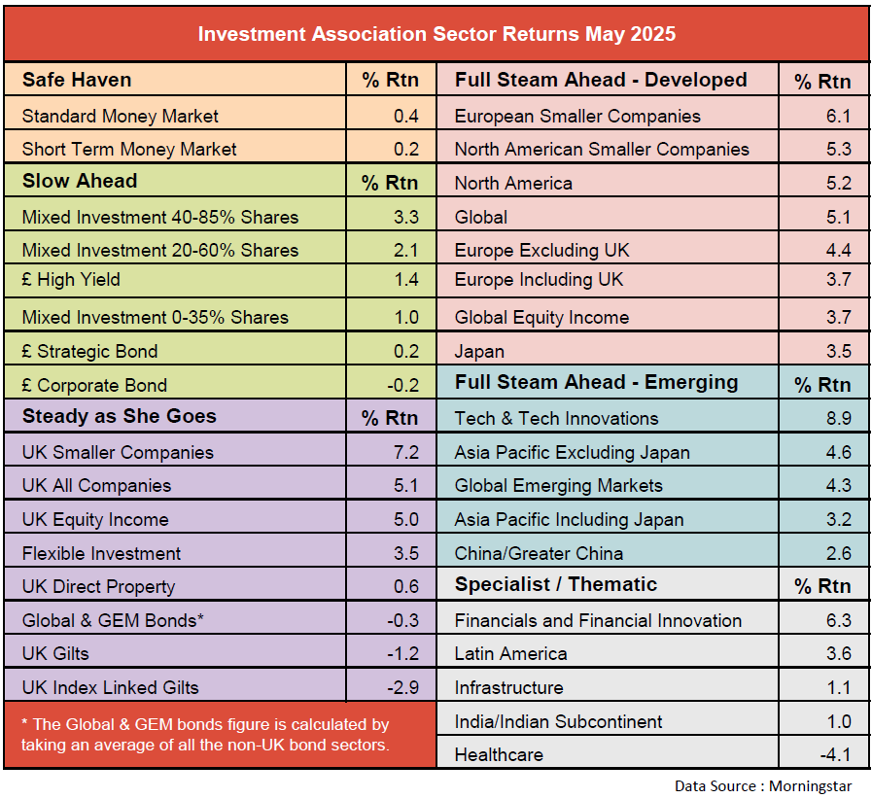

Each month we review the latest Investment Association (IA) sector performance. Although there are now more than 50 sectors, we typically focus on 34. There are a couple of reasons why:

- the IA does not publish average sector returns for some sectors due to the widely varying investment strategies, risk profiles, and objectives of the fund managers. Examples include the Specialist, Targeted Absolute Return, and Commodities & Natural Resources sectors

- The number of bond sectors has increased dramatically over the years. There are now distinct sectors for various types of bonds denominated in different currencies, such as Euro High Yield or USD Government Bond. However, since there are only a handful of funds in some of these sectors, we combine all the non-UK bond sectors into our ‘Global & Global Emerging Market Bond’ sector.

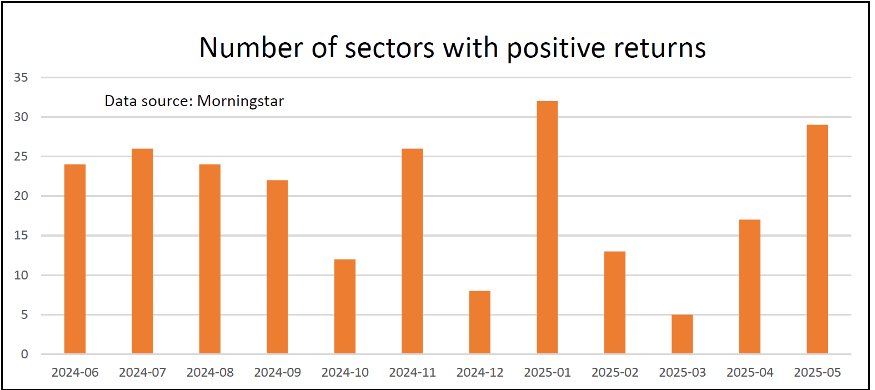

In March, only five of the 34 sectors went up – the fewest in over a year.

Despite a poor start to April, half the sectors ended the month with positive returns. That momentum continued into May, with 29 sectors making further gains.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Past performance is not a guide to future performance.

The sectors that suffer the largest falls in times of market uncertainty often recover the most when sentiment shifts. That has definitely been the case over the last few months. The Technology & Technology Innovation sector was the worst-performing sector in March, falling by 10.4%, and it lost a further 0.8% in April. However, last month it was the leading sector, with a one-month gain of 8.9%.

Past performance is not a guide to future performance.

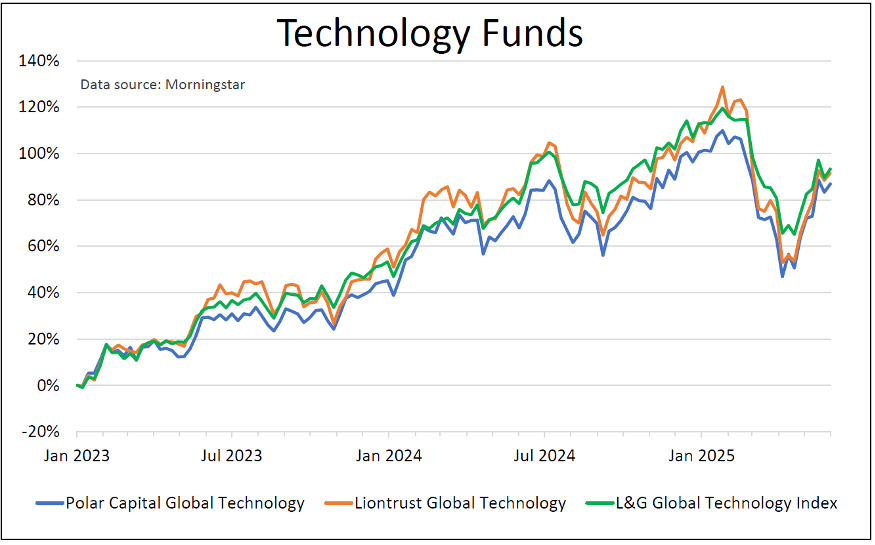

The best-performing fund last month was Polar Capital Global Technology, with a one-month return of 14.3%. Next was Liontrust Global Technology fund, up 13.3%, followed by the L&G Global Technology Index, which rose by 12.4%.

Since the financial crisis of 2008-09, the technology sector has enjoyed a prolonged period of strong growth and outperformance relative to most other sectors. While the broader economy suffered heavy losses during the crisis, technology companies were relatively insulated and recovered quickly.

This sustained growth has been driven by ongoing investment in technology infrastructure and innovation, including developments in software, cloud computing, mobile devices, and, more recently, artificial intelligence (AI).

The sector received a further boost following Donald Trump’s election victory last year. Investors were optimistic about its prospects under the new administration, anticipating business-friendly policies, reduced regulatory pressure, and increased support for innovation and capital investment.

However, soon after he was inaugurated, technology stocks started to fall sharply. This was mainly caused by the rapid escalation of trade tensions and the imposition of new tariffs. These tariffs targeted key trading partners such as China, Canada and Mexico, directly impacting technology companies that rely on global supply chains for manufacturing and components. Major firms such as Apple Inc (NASDAQ:AAPL) and NVIDIA Corp (NASDAQ:NVDA) faced the prospect of higher costs, which weighed heavily on investor sentiment.

- Is US stock market exceptionalism over?

- Time to be bullish or bearish? Five pros give their take

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

There were also concerns that an all-out trade war could force the US, and potentially the rest of the world, into recession. In the first quarter of this year, US GDP fell for the first time since the beginning of 2022.

The leading technology funds lost the gains that they had made over the previous 12 months.

Past performance is not a guide to future performance.

Since then, some of the tariffs have been reduced to allow time for trade talks to take place. Negotiations are under way, and markets have rebounded. The UK is the only country to have finalised a deal, but the EU and China have agreed to further delays while discussions continue. There have also been some positive developments in the Middle East.

It is encouraging to see that the technology funds have bounced back, although they still have not reached the highs that we saw earlier in the year. For them to continue to grow, we will need to see further progress in the trade negotiations – especially between the US and China.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.