A chance to own this compelling longer-term growth story cheaply

7th September 2022 10:04

by Rodney Hobson from interactive investor

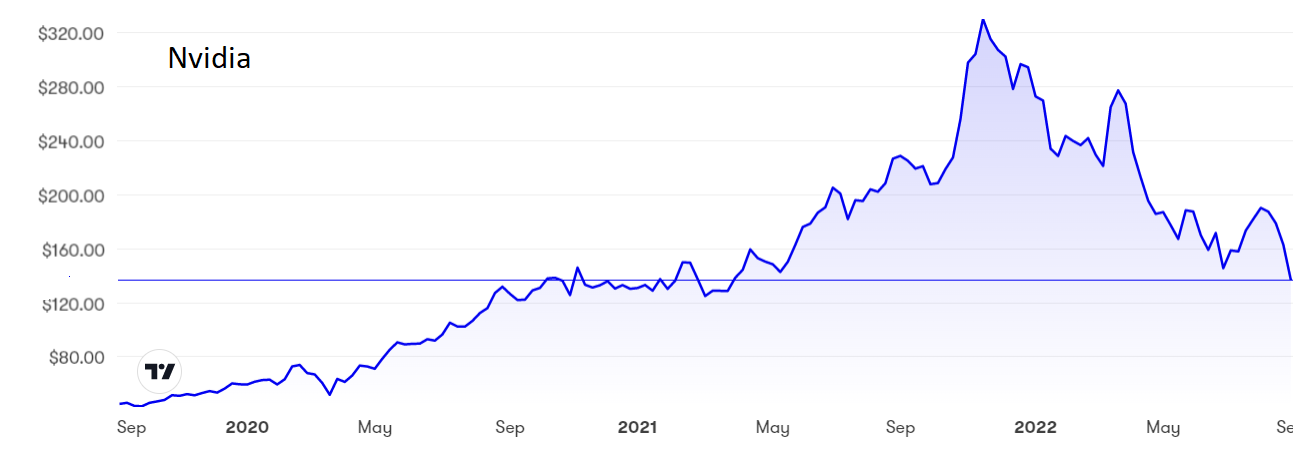

Persistent rises in interest rates and rising energy bills could take a toll on discretionary spending, but a lot of bad news is already factored into this giant’s share price. Time to buy?

Events have taken another turn for the worse at chipmaker NVIDIA Corp (NASDAQ:NVDA). Yet while extra caution is called for, the future should produce a gradual improvement that could turn out spectacularly well for those willing to hold on for the long term.

Second-quarter figures to 31 July showed revenue up 3% year on year at $6.7 billion, quite satisfactory on that basis but not when compared with the previous quarter, which showed an alarming drop of 19%. Worse still, net income slumped 72% on the same quarter of 2021 to $656 million as operating costs rose relentlessly.

- Discover more: Buy international shares | Interactive investor Offers | Most-traded US stocks

Unsurprisingly, analysts had been expecting rather better, and when a further cautious update on third-quarter prospects emerged, the shares shed about 9% before stabilising.

Past performance is not a guide to future performance.

Nvidia designs graphics computer chips that are used mainly in expensive personal computers for gaming. Despite diversification into supplying processing units for data centres and vehicle entertainment systems, the original gaming chips side is still dominant and therefore susceptible to any downturn in demand for this line of products.

Although the employment situation in the key market of the US is holding up far better than expected, it seems likely that persistent rises in interest rates there will take a toll on discretionary spending, as will soaring inflation on this side of the Atlantic.

Much has been written about the difficulties that chip-makers have been having in keeping supply chains moving, but Nvidia has identified a new threat: some of the manufacturers that are its customers are reducing their inventory levels to soak up a glut of graphics chips and to prepare for lower demand from end users in the next few months. The macro environment is described as “challenging”, a term that covers a multitude of meanings but none of them good.

The company now expects revenue to slide in the current quarter to the end of October, suggesting a total of $5.9 billion, about $1 billion less than previous expectations and 17% lower than a year ago.

Nvidia remains optimistic for the longer-term future, though, and with good reason. It points out that vehicle manufacturing is turning into a tech industry that is on track to become as equally big an earner as gaming, while advances in artificial intelligence are having a similar impact on data centres and robotics, while making a major contribution in pharmaceuticals.

This spread of uses for the company’s world-leading computer chips means that it will be better equipped to withstand any downturn in one part of the business, while opening up the route to firing on several cylinders. This is important because the demand for gaming technology soared during the pandemic shutdowns and will continue to tail off as life returns to normal, and people are not stuck in their homes looking for ways to keep themselves amused.

On the negative side, Nvidia faces real and serious problems in the geopolitical sphere. It will have to apply for licences to export to China, including Hong Kong, under new regulations set by the US government to prevent products being diverted to military use. This could involve moving some operations out of China at some expense, while $400 million worth of sales in China are at risk.

Hobson’s choice: I cautiously rated Nvidia a buy in June at around $160 but did suggest that investors might prefer to wait until the shares had settled. That caution proved justified, but at the current price of $135 there is now more reason to buy. This remains a solid, profitable company with market-leading positions and an eye for new markets. The floor is still around $124.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.