Chart of the week: should you buy or sell Apple shares?

19th April 2022 12:29

by John Burford from interactive investor

After getting it right on Apple shares last time, here’s what technical analyst John Burford believes will happen to the world’s biggest company now.

Is Apple about to report disappointing earnings?

Apple (NASDAQ:AAPL) is one of the most important tech companies globally and is a member of the famous 'FAANG gang' that has been a major focus of investor attention for some time. These US companies have defined the global growth sector for many years, but the question must be asked: can Apple maintain its dominance in its field, given that the mobile-phone market is very mature with competition rife.

In recent years, it has ventured into services with its Apple Pay, iCloud and several other services. And the growth here has been nothing short of stunning, with Q4 services revenue up 24%.

And that has kept Apple shares aloft just when it appeared that it had run out of steam in Q1. With visions of a rumoured self-driving electric vehicle in the works and a new computer headset said to be announced soon, the shares have recovered from the $150 low on 14 March.

- Chart of the week: is it heresy to short Apple shares here?

- Why reading charts can help you become a better investor

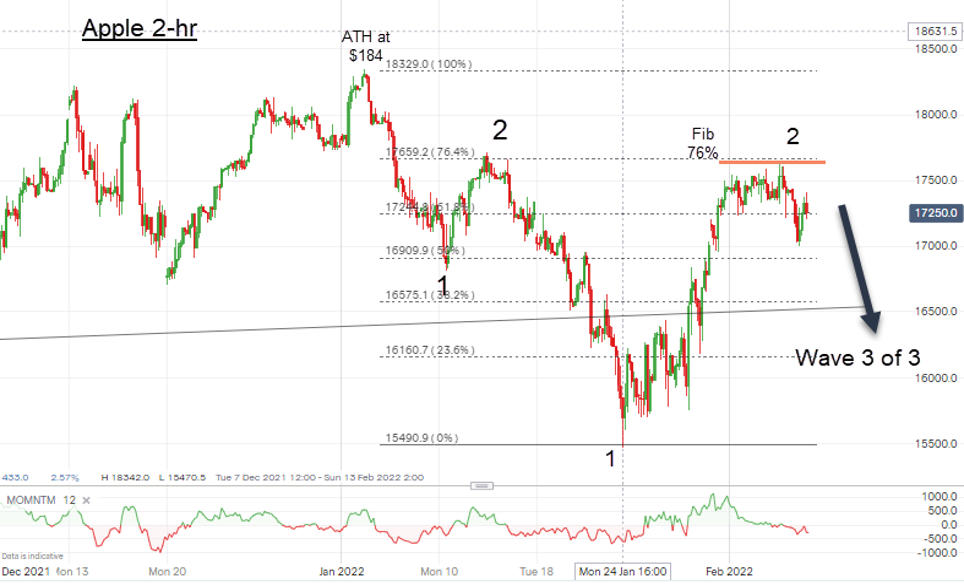

In fact, this decline to the low was suggested in my COTW of 7 February. This is the chart I posted then:

Past performance is not a guide to future performance.

My forecast was for a wave down to take the shares below the wave 1 low at $155. And if/when that occurred, the big test would be to observe a move sharply lower or to find support and advance.

This is the updated chart:

Past performance is not a guide to future performance.

As forecast, the shares moved lower and broke below my first target at the wave 1 low at $155. But they found major support at the $150 low and began a strong advance, taking them to the $180 high in late March.

This month, investors have been looking forward to the 28 April earnings report for Apple’s second fiscal quarter (first calendar quarter) of 2022, with the shares selling off to the current $165 area.

Note that $165 is at the Fibonacci 50% retrace of the prior wave off the $150 low. This is a major area of support. It also touches the downtrend line in a potential kiss and sharp bounce up. It should support a move higher from around here.

But if that support gives way, the path is clear for a test of the major line of support around the $152 level.

John Burford is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.