Chart of the week: This is where the smart money's going

12th November 2018 11:20

by John Burford from interactive investor

These traders have a strong track record of accurately predicting a turn in the trend. Technical analyst John Burford explains what they are doing now.

In trading, sentiment rules

In conjunction with my Tramline methods of analysis, I monitor the prevailing mood or sentiment surrounding the market I am watching. By sentiment I mean the degree of bullishness or bearishness in the market. Sometimes, this can reach extreme levels – and at these times it is a warning to expect a turn in the trend. I believe we are now at such a juncture with many shares.

I consider sentiment measures a vital part of my analysis, particularly when it does reach extreme levels. That is because throughout history, when sentiment gets too bullish, market tops tend to form. And for a trader, being able to forecast market tops is a most valuable skill.

Ignore the amateurs that tell you 'picking tops and bottoms is fruitless and can't be done'. That lazy approach may appeal to the dabblers, but not the pros and I hope all of my readers want to have a professional approach to trading/investing.

Sadly, the UK markets are ill-served by the financial authorities regarding internal data, especially sentiment, but in the USA we are much better provided for. The Commodities Trading Commission monitors the futures positions every week of the three types of participant – the Managed Money (hedge funds), the Commercials (those who genuinely hedge their cash positions) and the Small Retail Trader (the Moms and Pops). Together they make up the entire futures market.

This is the Commitments of Traders (COT) report issued every Friday as of the previous Tuesday. Note that it is not a survey, an opinion poll, nor a guesstimate, but it counts the actual money-on-the-line futures positions of the three sectors.

Of course, these positions change over time and the changes can provide us with valuable insight that is difficult to accurately gauge elsewhere. And that is precisely the situation today.

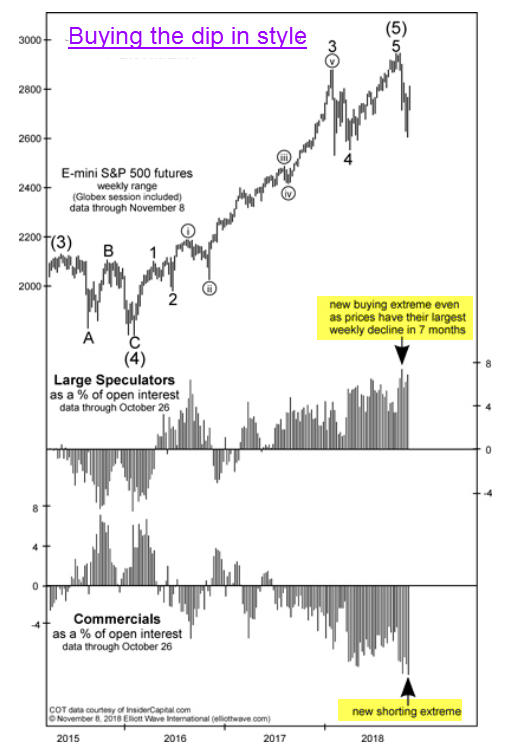

The S&P e-mini contract on the CME is the biggest share index market in the world, and here is a chart showing the trend in sentiment over the past few years:

Chart courtesy www.elliottwave.com Past performance is not a guide to future performance

The top chart of the Large Speculators (managed money hedge funds) follows the market up and down. When prices rise to a peak, their percentage of open interest (size of futures market) rises to a peak. When prices fall off their peaks, open interest percentage falls in line as they take a more bearish view.

Most hedge funds are simple trend followers (momentum chasers) and will only change their stance when the trend has already changed.

They are notoriously consistent in pointing the 'wrong' way at major market turns.

Note the Commercials (considered the 'smart money'), go the opposite way.

Go back to the dark days of 2015/2016 where the hedge funds were heavily net short (expecting the savage bear trend to continue), while the Commercials were net long (expecting shares to recover). True to form, the Commercials got that one right.

• Chart of the week: Proof that you can predict a market top

• Chart of the week: A contrarian call on the FTSE 100

But what is fascinating today is that during the 333-point (11%) October crash, hedge funds actually increased their long positions substantially. In other words, they Bought the Dip with open arms. In fact, one of the bars has made a record high as the S&P plunged. That is contrary to their behaviour in 2015/2016.

So, did they learn something from that earlier experience? And now the market has staged an almighty recovery this month.

What were the Commercials doing last month during the plunge? They were selling like mad into the rally to the hedge funds! So, do they know something the trend-following hedge fund bots don't?

Remember my observation that when hedge funds get too bullish, a top is not far away - and, from this COT data, they are at record bullishness at least over the past four years. We are now in ideal hunting grounds for contrarians – and close to a major top if history is any guide (and it should be!).

John Burford is the author of the definitive text on his trading method, Tramline Trading. He is also a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.