The City's favourite UK bank share

As dust from UK bank results season settles, there are plenty of upgrades, but one stock stands out.

6th November 2019 12:23

by Graeme Evans from interactive investor

As dust from UK bank results season settles, there are plenty of upgrades, but one stock stands out.

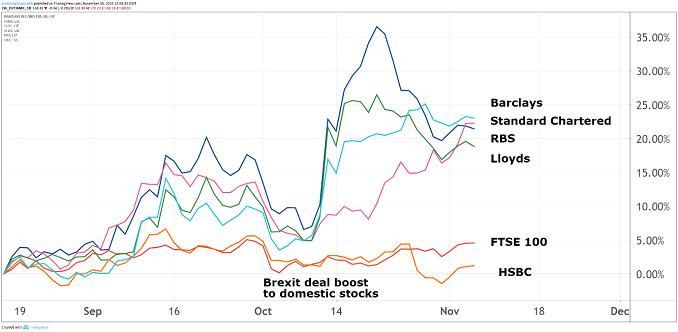

Barclays (LSE:BARC) is the UK bank to watch after a leading City firm turned more positive on the struggling sector with price upgrades for four of the big players, including Lloyds Banking Group (LSE:LLOY).

Deutsche Bank reckons that Barclays has the most to offer investors after upping its price target by 21% to 205p in the wake of recent third quarter results. The bank hasn't traded above 200p since summer 2018, but is heading in that direction following strong recent progress.

The team at Deutsche prefer Barclays over Lloyds, although that's not stopped them becoming a tad more optimistic on the latter after increasing their Lloyds price target to 62p from 53p. UBS analyst Jason Napier has the same target, as we reported earlier this week.

The other UK banks to be upgraded by Deutsche were Royal Bank of Scotland Group (LSE:RBS), up 9% to 235p, and Standard Chartered (LSE:STAN) with a target price increase of 11% to 700p. HSBC is kept at "sell", with an unchanged price recommendation of 520p.

Reduced worries about a no-deal Brexit mean Deutsche now attaches a lower risk premium to UK banking stocks, even if analysts warn that the sector is not yet out of the woods. The cost of equity for UK banks is now seen by Deutsche experts as being at a more normalised 10% level, compared with 12.5% to 13.5% previously.

They said:

"While political uncertainty continues to weigh on economic activity, the risk of a crash Brexit has receded. Hence, we reduce our cost of equity for UK banks resulting in target price upgrades."

This week's note from Deutsche comes after a lacklustre bank reporting season in which Barclays and Standard Chartered outperformed and beat consensus during the period.

Source: TradingView Past performance is not a guide to future performance

Barclays reported the strongest investment banking performance among UK banks, while Standard continues to impress in its financial markets business. On the other hand, HSBC (LSE:HSBA) reported significant declines in its emerging markets-led Global Banking and Markets division, while RBS's NatWest performance was impacted by weaker revenues in Rates.

Only Barclays reported positive operating jaws - the rate of revenue growth over the cost growth rate - whereas revenue declines led to negative jaws at HSBC and RBS.

Other reasons for Deutsche preferring Barclays over Lloyds and RBS include its revenue and geographic diversification, as well as lower structural hedge income.

They said:

"We like Barclays for its resilient, high return domestic business. Additionally, the international operations benefit from market share gains in investment banking, improving momentum in transaction banking and good growth in the Consumer, Cards and Payments franchise."

Deutsche praises Halifax-owner Lloyds for its market-leading position in mortgages, current accounts and deposits in the UK, as well as its efficient operating platform.

However, it expects material pressure on the net interest margin in the near term, partly due to the rolling over its book of standard variable rate mortgages. The bank's analysts added: "While the capital return story remains intact - though impacted by higher PPI charges - we are cautious in the light of ongoing margin pressure."

While UK forward swap curve expectations have rebounded since recent lows, they still remain significantly lower than the end of 2018 and lower than the existing hedge book for all the banks. "As such we would expect margin pressure from lower structural hedge income to continue for some time."

On a more positive note, net interest income for UK banks has been supported by strong volume growth in mortgages as the sector takes advantage of better front book pricing.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.