Coronavirus tips: Winners, losers and how to track them

The impact of coronavirus could be far-reaching, causing recession, credit defaults and profit warnings.

11th February 2020 12:48

by Graeme Evans from interactive investor

The impact of coronavirus could be far-reaching, causing recession, credit defaults and profit warnings.

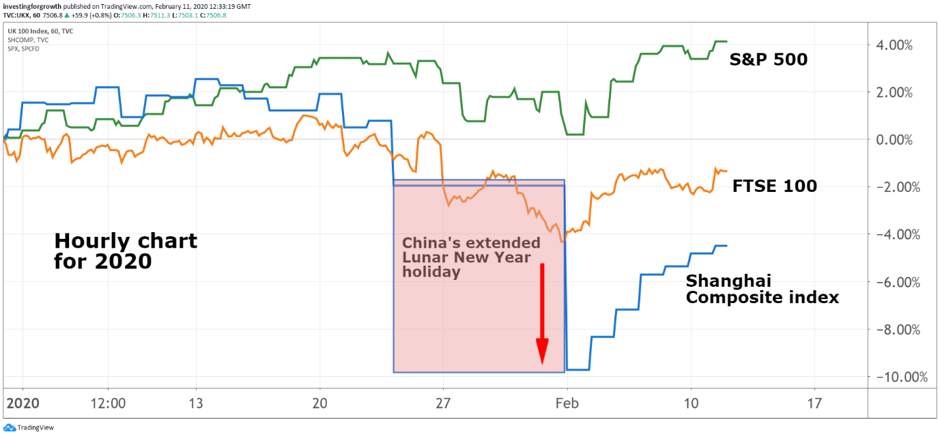

As today's rally for the FTSE 100 index shows, it's the officials at China's National Health Commission driving current market sentiment rather than any economic indicator.

Their daily release of new confirmed and suspicious cases of coronavirus has become the source of market volatility as investors gauge the potential for the outbreak to cause long-term damage to the world economy. There was some encouragement today, with global markets higher on further signs that China's number of new cases is slowing.

The value of monitoring these stats was highlighted by Swiss bank UBS. In a useful note this morning, it tackled the 10 questions its clients want answering about coronavirus and the impact on financial markets.

Source: TradingView Past performance is not a guide to future performance

The UBS analysis says experts are cautioning against calling the peak of the outbreak just yet, given that people returning from the Chinese New Year holidays will need to have gone through the two-week virus incubation period before a more affirmative assessment can be made.

That will take us up to the end of February, during which time UBS will continue to use alternative data to measure the disruption the virus is having on China's economy. This includes a daily transport congestion index for 100 cities, which is a proxy for general activities and reveals a significant decline on rates seen in previous New Year periods.

With more provinces and cities delaying the re-opening of businesses and factories after the holiday, and many localities putting in place restrictive measures to keep people at home, UBS estimates that quarter-on-quarter the China economy could contract by as much as 3%.

- Novacyt confirms big demand for its coronavirus test

- Coronavirus cures: This stock is the current front-runner

Despite the potential for a rebound over the rest of this year, this would result in annual growth slowing to 5% from the 6.1% recorded in 2019 — when the pace of expansion was already the weakest since 1990.

A clearer picture won't emerge until mid-March, when activity data for January and February is released. In the meantime, high frequency indicators on coal consumption and property sales are a good guide to the pace of the slowdown after the New Year holiday.

Source: TradingView Past performance is not a guide to future performance

The consequences of a production shutdown for the global supply chain is another area of concern for UBS clients, given that China accounts for more than 80% of smartphone and notebook production, 55% of global exports of handsets and computers and has a growing export market for its car parts.

A chart from UBS shows how China's role in the global economy has expanded since the SARS outbreak in 2002/03. It now accounts for 50% of global metals demand, compared with 17% previously, while its 27% share of auto production is up from 7% in 2003.

While UBS expects that coronavirus will be controlled in Q1, triggering a v-shaped rebound starting from Q2, it warns there might be longer-lasting consequences for the supply chain as customers reduce their China exposure in order to avoid further disruption.

UBS predicts that the likely response of Beijing policymakers to the crisis will be more liquidity, lower rates and regulatory forbearance, although it warns that China's policy space is more limited than after SARS due to its debt level being much higher, and there being a diminishing pool of good infrastructure projects with which to stimulate activity.

They said:

“One cannot simply expect China's growth recovery to be the same as after SARS, as the external environment, growth trajectory and policy space are all different now than then.”

- Coronavirus cures part two: Can the outsiders race through?

- What if AIM share Novacyt helps defeat coronavirus?

Overall, however, UBS doesn't see the one-off negative shock of coronavirus altering the long-term growth trajectory of China's economy, with GDP likely to rebound close to 6% in 2021.

Globally, the impact on tourism, delays in trade and potential supply chain disruption will mean Q1 sees the slowest global growth rate of recent times. This will include contractions for most Asia economies, while the UBS team in Japan thinks that the outbreak may drive that country's economy into a technical recession.

For the equity market, UBS warned that the impact on cash flows will result in a rise in credit defaults. Travel, airline, hotel, retail and cinemas operators will be the worst hit, with the sectors covering health care, packaged food, online video gaming, and e-commerce most likely to be beneficiaries of the outbreak.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.