What if AIM share Novacyt finds cure for Coronavirus?

Coronavirus testing has triggered a massive rally. Our chartist sees how far it could go.

6th February 2020 09:15

by Alistair Strang from Trends and Targets

Coronavirus testing has triggered a massive rally. Our chartist sees how far it could go.

Novacyt (LSE:NCYT)

A bunch of emails asked about Novacyt (LSE:NCYT), a company we've never come across. A glance at their website gave a pretty solid reason for the interest, "Coronavirus Test" and "infectious disease products" mentioned on their homepage.

The company certainly sound like they may be in the right place at the right time, certainly as far as folk trading shares listed on the AIM are concerned. With media ensuring fear is kept at absurd levels, the share price is not going to need enthusiastic fanboys spamming internet discussion forums about the potentials of their products.

From our perspective, we obviously suggest anyone interested take a hard look at the company and their product range, along with taking cognisance this is an AIM listing, perfectly capable of irrational behaviour in every direction.

- Coronavirus cures: This stock is the current front-runner

- Coronavirus cures part two: Can the outsiders race through?

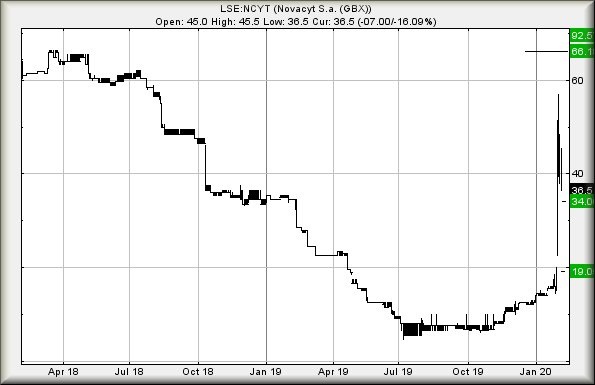

At present, it's trading around 36p, needing above 57p to confirm the potential of movement up to an initial tame 66p. To be fair, even above 48p shall make us sit up and take interest, this giving an early sign the immediate reversal cycle has bottomed.

If 66p is exceeded, things get a lot more interesting as our secondary is at 92p, along with a need to review the tea leaves again.

Equally, we can also mention the absolute highest we can compute is at 124p. But if they've indeed discovered the AIM equivalent of a goose, golden eggs, etc, there is absolutely nothing stopping it going higher.

The immediate reversal cycle, while probably scaring a lot of private AIM traders, should hopefully bottom anytime soon before the 34p level, if our calculations are correct. We're also showing a danger level at 31.5p, movement below this point implying the real risk of reversal to 19p. We cannot calculate below such a level.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.