Coronavirus cures part two: Can the outsiders race through?

While Big Pharma seem disinterested in a cure, these small-caps want to make a name for themselves.

5th February 2020 09:47

by Rodney Hobson from interactive investor

While Big Pharma seem disinterested in a cure, these small-caps want to make a name for themselves.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Large pharmaceutical companies are generally turning up their noses at the possibility of finding a cure for the coronavirus sweeping China. Investors can consider whether it is worth taking a punt on smaller rivals that could earn money as well as gratitude by finding an antidote.

Edmond Jackson yesterday quite rightly suggested that Gilead Sciences (NASDAQ:GILD) is best placed to win the race to produce a cure. The American biotechnology company specialises in antiviral drugs used in the treatment of HIV, hepatitis B, hepatitis C, and influenza.

It is possibly – though by no means certain – that its experimental antiviral drug remdesivir could prove an effective treatment for the new coronavirus.

- Coronavirus cures: This stock is the current front-runner

- These are the US stocks hit hardest by coronavirus

There are other, smaller American companies in the race though. Should investors consider them as alternatives?

It’s important not to be swept up by headlines. Instead, investors need to concentrate on hard facts, even if that sounds heartless when millions of people are caught up in the epidemic and deaths have been reported.

The number of confirmed cases in China has reached 17,000, although the number of actual cases is probably much higher and researchers believe the total is doubling every five or six days. The disease has spread to 20 countries across the globe, from Hong Kong, South Korea and Singapore to the United States and Europe. The death toll has topped 300.

Realists point out that annual flu outbreaks afflict more people and cause more deaths. They argue that the coronavirus deaths so far have been of people who are naturally more prone to succumb to infectious illnesses, such as the old and those with chronic lung diseases. The last coronavirus epidemic, Severe Acute Respiratory Syndrome (SARS) in 2002-03, was a much bigger outbreak with significantly higher death rates.

However, there is no doubting the potential benefits of finding a successful vaccine. Just as people at risk are dosed with a different flu vaccine each year, the successful pharmaceutical company that wins the race for a coronavirus vaccine will be in constant demand as new mutations emerge. The global market for all types of vaccines is about $30 billion annually.

- Tesla delivers massive boost to lucky shareholders

- Want to buy and sell international shares? It’s easy to do. Here’s how

Of the four pharmaceutical giants that dominate vaccines – Pfizer (NYSE:PFE), Merck (NYSE:MRK), GlaxoSmithKline (LSE:GSK), and Sanofi (EURONEXT:SAN) – only Glaxo has shown an interest in pursuing this particular holy grail, and many commentators feel even Glaxo is not really fully committed.

That is a two-edged sword. It indicates that the big players do not think the possible rewards are worth the cost of chasing what could be an expensive pipe dream. They may also feel that the current epidemic will have run its course by the time that any vaccine can be fully tested and put into production.

On the other hand, it does open the way for a smaller, niche player to make a lucrative name for themselves.

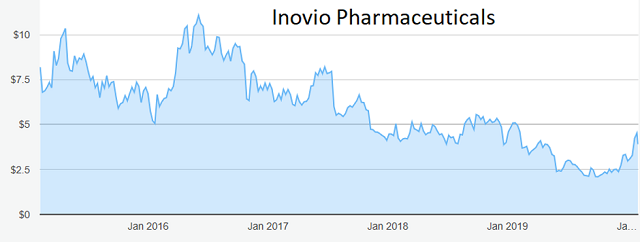

One such is Inovio Pharmaceuticals (NASDAQ:INO), a synthetic vaccine developer, which has a collaboration agreement with Chinese company Beijing Advaccine Biotechnology.

Inovio has been awarded a $9 million grant to work on an experimental coronavirus vaccine. The collaboration could open up Chinese markets for Inovio’s other vaccines even if early stage trials on the new drug come to nothing.

Source: interactive investor Past performance is not a guide to future performance

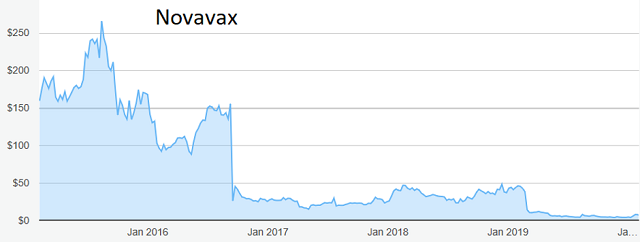

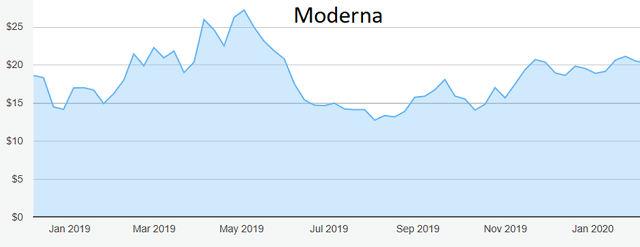

Novavax (NASDAQ:NVAX) and Moderna (NASDAQ:MRNA) are also trying to develop a vaccine for the coronavirus strain, although they are both seen as trying to jump opportunistically on the bandwagon and their hopes of success in this specific field are thought to be slim.

Source: interactive investor Past performance is not a guide to future performance

Moderna announced in January that it was working with the National Institutes of Health, a research centre in the US, to develop a vaccine, claiming its engineering platform could be uniquely suited for rapid response applications such as this, although it has never tested those capabilities or processes previously.

Source: interactive investor Past performance is not a guide to future performance

Shares in small pharmas seen as potential producers of a coronavirus vaccine have performed erratically since the outbreak began. Inovio shot from $3.50 in early January to a peak of $5.30 before falling back just as rapidly to around $3.60; Moderna was $16 in November, peaked at $22.70 in January and has since lost half the gain; Novavax shot from $4 to $9.80 in the space of a week but is now back to $6.70.

Hobson’s choice: Of these three, Inovio looks the best bet for longer term investors, but even this stock is only for those with an appetite for risk. Don’t pay more than $4. Moderna and Novavax probably have further to slip back, so, if you’re tempted, it is probably best to wait for a better opportunity.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.