Countdown to Brexit: Why I'm investing in AIM

As the Brexit saga approaches the end game, the Saltydog analyst names the AIM fund he's just bought.

11th March 2019 13:13

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

As the Brexit saga approaches the end game, the Saltydog analyst names the AIM fund he's just bought.

I offer no apologies for raising the subject of Brexit yet again. With a couple of weeks to go, and potentially three significant votes this week, it's pretty difficult to avoid.

I am totally frustrated by not being able to hear or read an unbiased description of what leaving with Mrs May's deal or leaving with a "hard exit" means for the United Kingdom and the European Union. A "hard exit" I believe means trading under World Trade Organisation (WTO) rules and tariffs, which a large percentage of the rest of the world already uses.

Surely it must be possible to have this laid out in a truthful manner that I and others can understand and clarify what possibly makes it so bad for our future?

To a sterling investor holding some funds which are denominated in dollars, or have assets or earnings in any foreign currency, the conclusion to Brexit is very important. A so called "hard exit" is likely to result in the fall in value of sterling and therefore an increase in the value of dollar denominated investments, and a soft exit would produce the opposite.

In the first case, you would make a financial gain, and in the second a loss. Technology and pharmaceutical funds and any foreign based funds would be affected one way or the other, and these probably sit in most investors' portfolios.

Our portfolios still hold relatively high levels of cash. The funds that we are holding are invested in the UK, US, Technology, the Emerging Markets and gold.

The UK funds might not be affected either way by sterling movements (depending on how much income is derived overseas), but the other funds most certainly will be. However, I believe that they will be the strong sectors in the coming year and the decades that follow. So we might lose in the short term depending on the Brexit result, but they should quickly recover in the future.

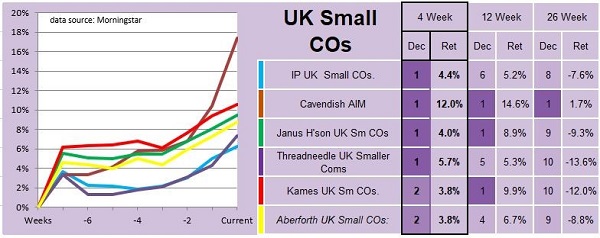

In recent weeks we have been increasing our exposure to funds focusing on the UK, and last week invested in the Cavendish AIM Fund.

Past performance is not a guide to future performance

This fund seems to have done well in the last couple of weeks of February, when the pound was strengthening, and so hopefully will be OK if a similar thing happens after the Brexit votes this week.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.