The country that’s topping the charts in specialist fund sector

Saltydog Investor runs the rule over a fund sector that has a wide variety of investment strategies.

13th September 2021 12:54

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog Investor runs the rule over a fund sector that has a wide variety of investment strategies.

When we do our weekly fund analysis, we start by putting the Investment Association sectors into our own Saltydog Groups so that we can compare funds which have shown similar levels of volatility in the past.

The least volatile sectors, ‘Standard Money Market’ and ‘Short Term Money Market’, fall into our ‘Safe Haven’ Group. They are relatively safe, but are not making any money at the moment. Next up the scale comes the ‘Slow Ahead’ Group, which contains sectors which have been slightly more volatile like some of the bond and mixed investment sectors. Then it is the ‘Steady as She Goes’ Group, and finally the ‘Full Steam Ahead’ Groups which contain the most volatile sectors like Global Emerging Markets and European Smaller Companies.

- How Saltydog invests: a guide to its momentum approach

- Two Baillie Gifford funds giving investors a bumpy ride

- Top-performing funds that are continuing to deliver

There is one sector that we treat separately, because it contains funds that do not naturally fit into the other sectors, and also do not necessarily have anything in common. This is the ‘Specialist’ sector, and it is a bit of a mixed bag. The Investment Association definition is “funds that have an investment universe that is not accommodated by the mainstream sectors. Performance ranking of funds within the sector as a whole is inappropriate, given the diverse nature of its constituents.”

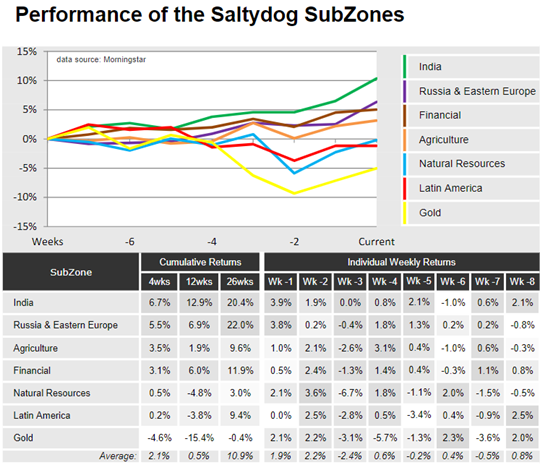

However, some of the funds do invest in similar assets, or geographical regions. We have grouped these together to form our SubZones. Below is an extract from the report that we generated last week, using data up until the end of the previous week.

At the top of the table is the India SubZone with a four-week return of 6.7%. It is also the best performing SubZone over 12-weeks, but Russia and Eastern Europe has done slightly better over 26-weeks.

There are three funds that we analyse in the specialist sector which focus on investing in Indian companies, or companies which do most of their business in India - Liontrust India, Jupiter India and the Stewart Investors Indian Subcontinent fund.

The Liontrust fund, was originally the Neptune India fund, and has been going since 2006. It is relatively small, with assets of around £60 million. The Jupiter fund was launched a couple of years later, but is now considerably bigger - its current value is nearer to £600 million. The Stewart Investors fund is worth just over £400 million.

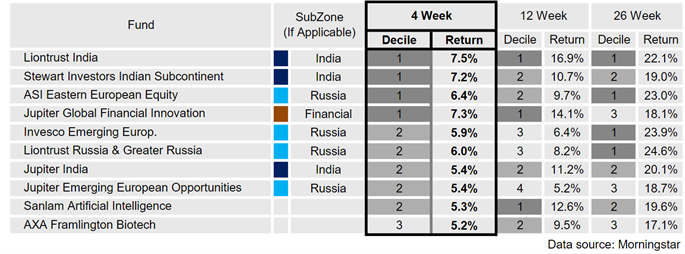

As well as doing our SubZone analysis, we also list the leading 25 funds in the Specialist sector each week. Below are the top 10 from last week’s table.

The three Indian funds feature, as do four funds from the Russia and Eastern Europe SubZone.

In early August our Ocean Liner portfolio invested a small amount into the Jupiter India fund. Since then the other funds from the India SubZone have done better, but sometimes that is just the way it goes. It is still up by more than 5% in just over a month, so we should not complain.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.