Two Baillie Gifford funds giving investors a bumpy ride

31st August 2021 14:27

by Douglas Chadwick from ii contributor

Saltydog Investor is considering making changes on the back of how the two funds have performed over the past two months.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

At the end of June, our ‘Ocean Liner’ portfolio invested in the Baillie Gifford Long Term Global Growth fund. Although it is in the Global sector, and so can pick companies from all over the world, the lion’s share of its investments are in North America. Its largest holding is US pharmaceuticals and biotechnology company Moderna (NASDAQ:MRNA). Other American companies such as Amazon (NASDAQ:AMZN), Tesla (NASDAQ:TSLA), NVIDIA (NASDAQ:NVDA) and Illumina (NASDAQ:ILMN) are also in its top 10.

The following week we invested in the Baillie Gifford American fund, which invests exclusively in North American companies.

- The Baillie Gifford fund we have just bought

- Baillie Gifford: 15 investments you’ve never heard of

- The one fund Baillie Gifford is monitoring after value assessment

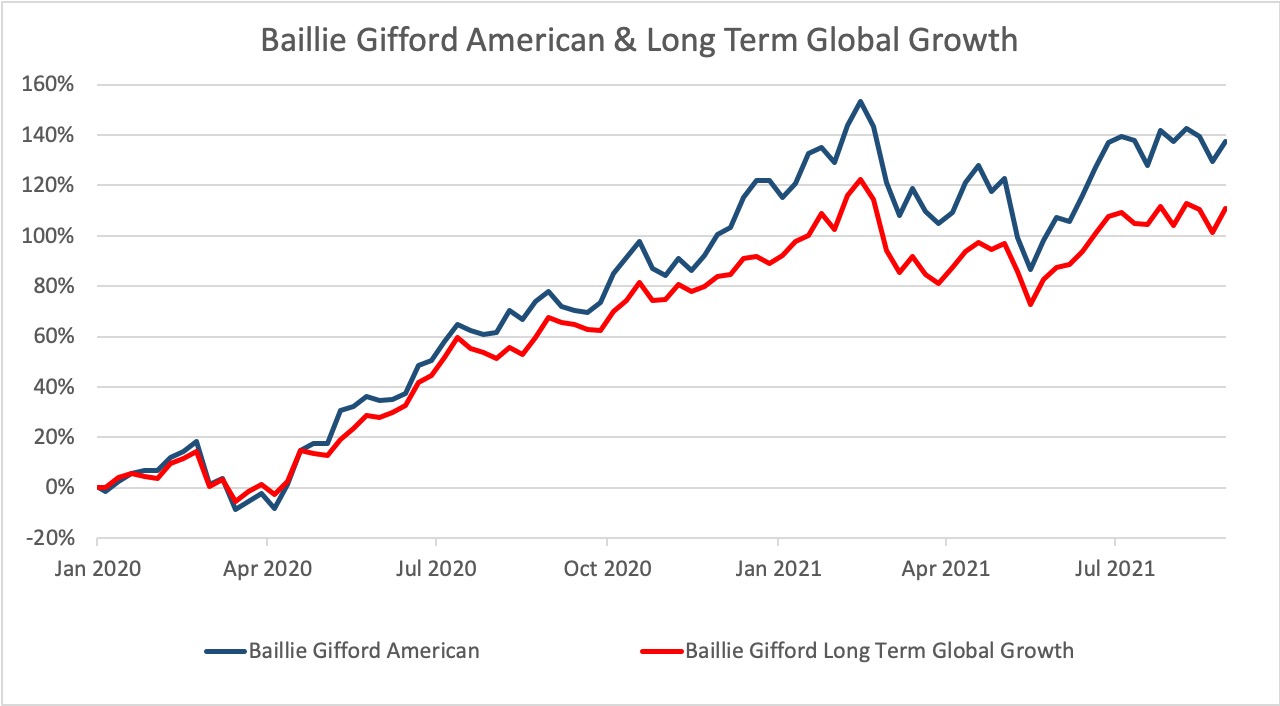

These funds did fantastically well in the second, third and fourth quarters of last year and we were invested in the American fund for some of that time. They continued to do well during January and the first half of February, but then fell quite dramatically.

Past performance is not a guide to future performance.

Since then it has been a bumpy ride. In the first week after we bought it, the Baillie Gifford Long Term Global Growth fund went up by 4.1%, but by the end of July it was only just breaking even. The Baillie Gifford American fund had a poor start, losing 1.4% in its first week, but had recovered by the end of the month.

At Saltydog Investor, we review the performance of thousands of funds each week. As part of our analysis, we put them into groups depending on how volatile the sectors that they are in have been in the past. The groups go from Safe Haven, containing the least volatile funds, through ‘Slow Ahead’ and ‘Steady as She Goes’ up to the most volatile funds in the ‘Full Steam Ahead’ groups.

- How Saltydog invests: a guide to its momentum approach

- Five consistent funds that have doubled in three years

- Four top-performing funds we’ve been buying

Both of the Baillie Gifford funds we are invested in are in the ‘Full Steam Ahead’ group, and in the last few weeks we have seen why. They have either been the best performing funds in the portfolio, or the worst.

When we reviewed our demonstration portfolios on 11 August, both were at all-time highs and I wrote that ‘the best return over the last seven days has come from the Baillie Gifford Long Term Global Growth fund, which has gone up by 5%, followed by the Baillie Gifford American fund, which has made 3.9%’.

A week later and the Baillie Gifford Long Term Global Growth fund had fallen by 6% and the Baillie Gifford American fund had gone down by 5.1%.

That evening the Federal Reserve released the minutes from the Federal Open Market Committee meeting (FOMC), which took place at the end of July. Although the FOMC voted at the meeting to keep interest rates close to zero, they discussed the possibility of reducing their bond-buying programme later this year. They were not talking about stopping the printing presses or trying to reduce the overall debt level, they were just considering how they could slow the rate at which it is going up.

Markets went into a tailspin. The dollar strengthened, while the Dow Jones Industrial Average and S&P 500 fell by 1.1% and the Nasdaq dropped 0.9%. Asian markets followed with the Nikkei 225 losing over 2% in the next couple of days, while the Hang Seng fell by 4%. Closer to home, that Thursday the FTSE 100 dropped by 1.5%, the German DAX lost 1.3% and the French CAC40 was down 2.4%. Not surprisingly, both of the Baillie Gifford funds also went down.

- Check out our award-winning stocks and shares ISA

- Don’t be shy, ask ii...how do I choose which funds to draw down?

As is often the case after a knee-jerk reaction, markets then rallied and last week both the S&P 500 and Nasdaq went on to reach new all-time highs. The Baillie Gifford American fund went up by 3.3% and the Baillie Gifford Long Term Global Growth fund made 4.6%.

Our demonstration portfolios are designed to be relatively cautious and so never invest too much in the most volatile funds. When we do, they need to be providing better returns than the less volatile funds. While that was definitely the case last year, it is debatable whether these two funds are doing it at the moment.

We have given them the benefit of the doubt based on their performance over the last week, but their position in the portfolio is far from secure.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.