Top-performing funds that are continuing to deliver

6th September 2021 12:03

by Douglas Chadwick from ii contributor

Saltydog analyst cheers the return to form of equity-based fund sectors in August, which benefited a number of its fund holdings.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

In July, the best-performing sector was UK Index-Linked Gilts with a one-month return of 6.4%, and other bond sectors also did well. In contrast, the equity-based sectors lagged, although the European Smaller Companies sector did pretty well, gaining 3.9%.

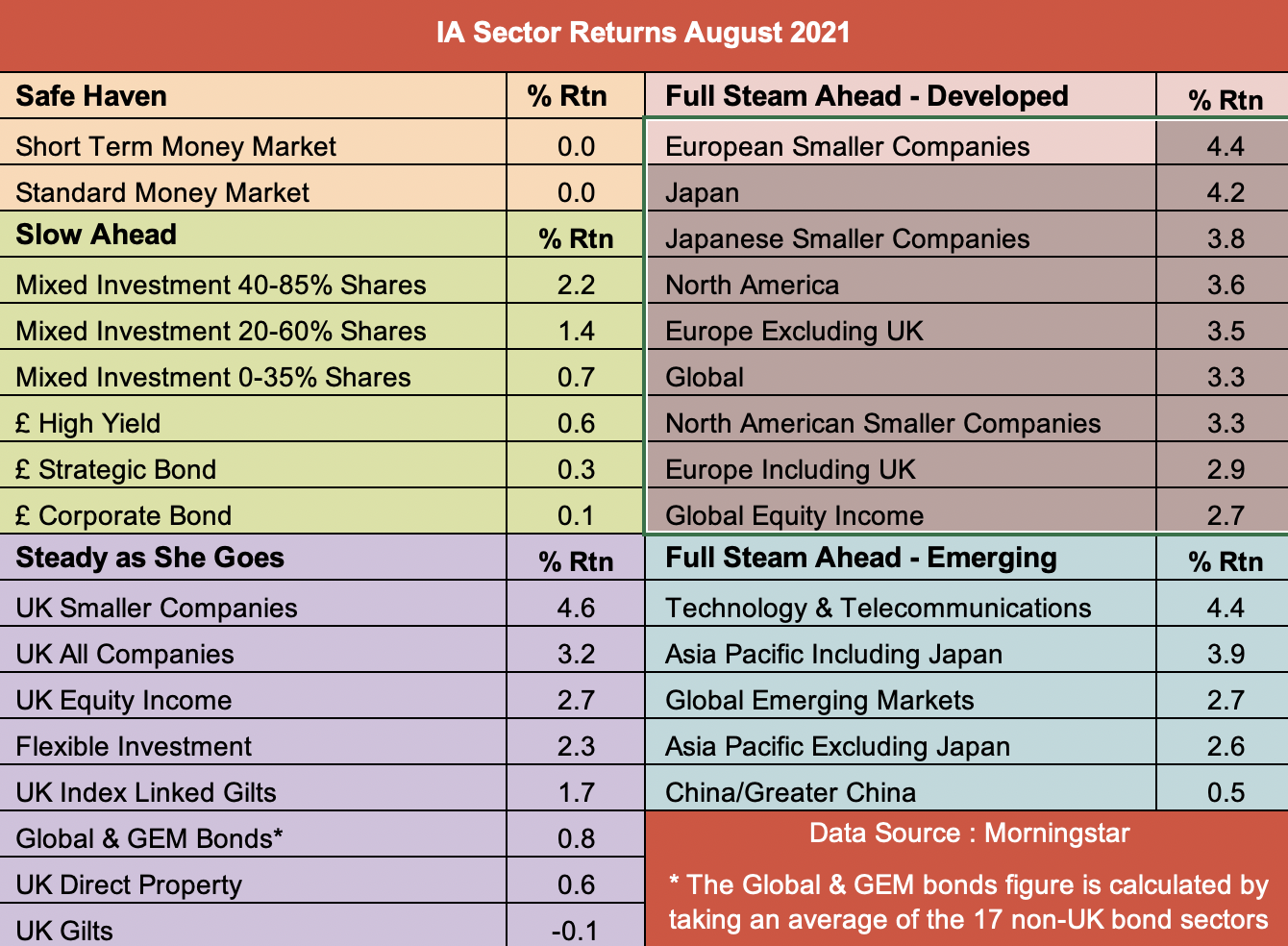

As you can see from the table below, the equity-based sectors had a much better August.

The UK Smaller Companies sector is back in the lead with a one-month return of 4.6%, followed by European Smaller Companies and Technology and Telecommunications, which have both gone up by 4.4%. The leading sector in the Slow Ahead group is Mixed Investment 40-85% Shares.

This has worked in our favour, as these are the main areas that our demonstration portfolios (Ocean Liner and Tugboat) have been invested in.

- How Saltydog invests: a guide to its momentum approach

- Two Baillie Gifford funds giving investors a bumpy ride

- Funds Fan: Scottish Mortgage, Lindsell Train and inflation-proofing

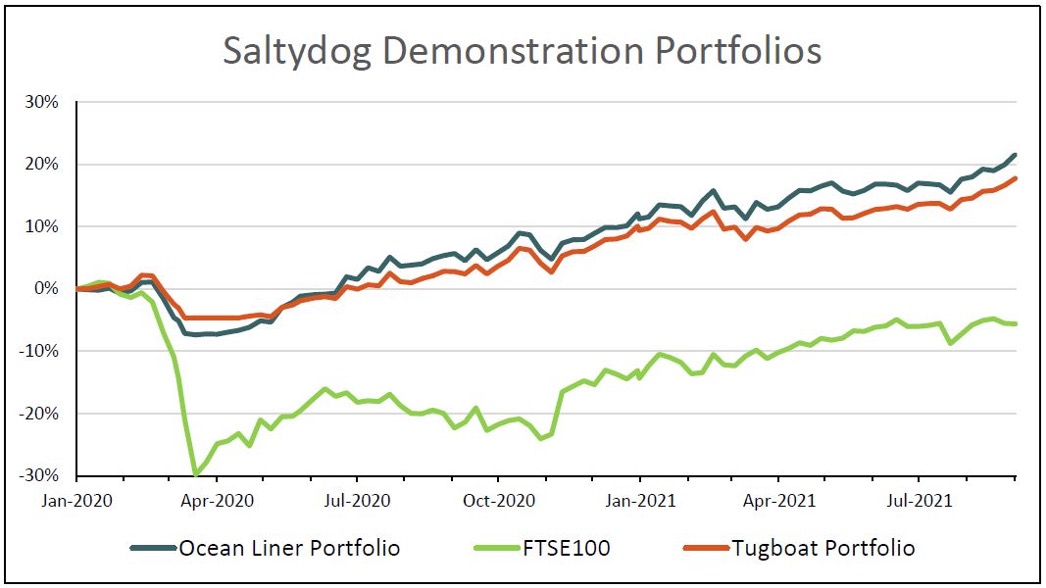

Ocean Liner portfolio is up 20% in 20 months

Both portfolios had a good month. A couple of weeks ago we celebrated the Tugboat portfolio going above £78,000 for the first time. By the end of the month, it had gained a further 1% and was heading towards £79,000 - the next big milestone will be £80,000, at which point we will have doubled our money. The portfolio was launched in November 2010.

During August, our slightly more adventurous Ocean Liner portfolio went up by more than 3% and has now gone up by more than 20% since the beginning of last year. The portfolio was launched in November 2013 and has a current value of £71,064.

Past performance is not a guide to future performance.

I do not like to brag, but as they say, 'if you don't blow your own trumpet, someone else will use it as a spittoon' or, as may be more appropriate at the moment, 'Blow your own trumpet, because blowing someone else's isn't hygienic'.

Things do not always go this well, and I like to think that we are equally humble when our investments struggle. We are not going to get everything right all the time, but hopefully when things are not working out, we can move on before too much damage is done.

Although we review the portfolios every week, and make changes if we have to, it is quite nice when everything is heading in the right direction, and we can leave them alone.

The leading sector in the Slow Ahead Group, based on its four-week return, is Mixed Investment 40-85% Shares, and that is where our largest investments are. We are holding four funds, all of which are in decile one (in the top 10%) based on their four and 12-week returns. Three are also in decile one over 26 weeks, and the other one is in decile two. The funds are Royal London Sustainable World, Janus Henderson Global Responsible Managed, Liontrust Sustainable Future Managed and Baillie Gifford Managed.

- Open an ISA with interactive investor. Click here to find out how

- Subscribe to the ii YouTube channel and catch all our latest interviews and video content

In the Steady as She Goes group, the UK Smaller Companies sector leads over four weeks and we are holding two funds from this sector in our portfolios: FTF Franklin UK Smaller Companies and L&G UK Smaller Companies. The L&G fund is in decile one over four, 12 and 26 weeks; the Franklin fund is decile two over four weeks, but decile one over 12 and 26 weeks.

The top sector in the Full Steam Ahead Developed group is still European Smaller Companies, and so we are holding on to the Schroder European Smaller Companies fund. There are other funds in this sector that have done better and so we could consider switching, but it is up 8.5% since we went into it in mid-June and we are going to stick with it for now.

The leading sector in the Full Steam Ahead Emerging Group is Technology and Telecommunications, and each of our portfolios are holding a fund from this sector. The L&G Global Technology Index fund, in our Tugboat portfolio, is the leading fund in the sector over 26 weeks. The AXA Framlington Global Technology fund, in the Ocean Liner, is mid-table but we are happy to hold on to it for the time being.

Hopefully, these sectors will continue to perform in September.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.