Cutting back on some old fund favourites

Saltydog Investor has reduced exposure to a fund sector that has lately fallen out of form.

15th March 2021 14:52

by Douglas Chadwick from ii contributor

Saltydog Investor has reduced exposure to a fund sector that has lately fallen out of form.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

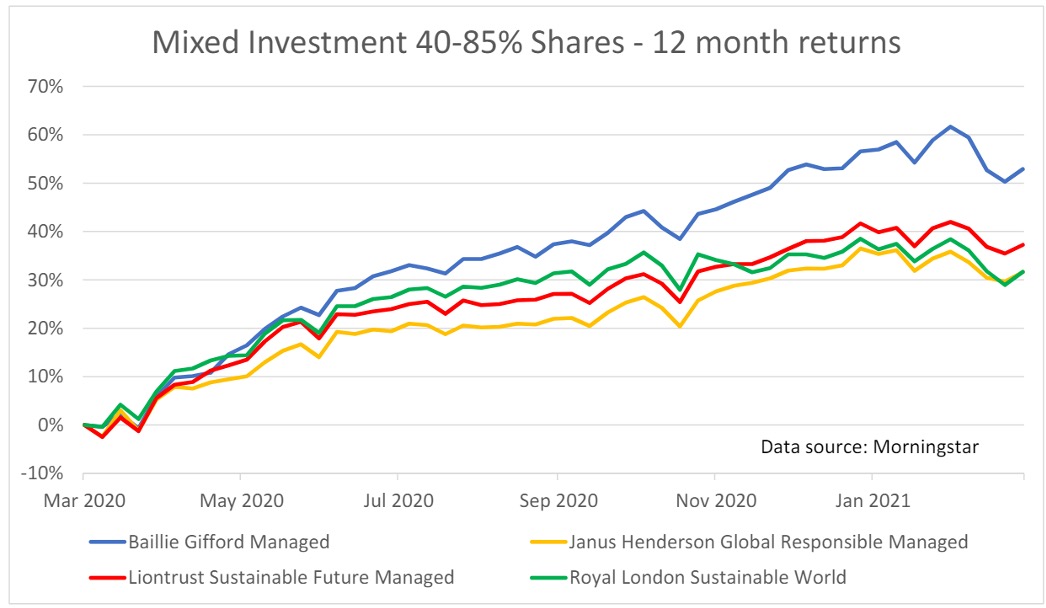

Last week our demonstration portfolios roughly halved their exposure to the funds that they are holding from the Mixed Investment 40-85% Shares sector.

The funds are:

- Baillie Gifford Managed

- Janus Henderson Global Responsible Managed

- Liontrust Sustainable Future Managed

- Royal London Sustainable World

We have been holding some of them since April last year and they have performed well for us, but they have struggled in the last few weeks.

To control the overall volatility of our portfolios, we limit the amount that we invest into the Investment Association (IA) sectors that have shown the most volatility in the past.

Every week we provide our members with performance figures for each of the sectors and highlight the funds which have generated the best returns over the last few weeks and months. To help with the analysis we combine the IA sectors into our own Saltydog groups. The nautical names make it easy to identify the relative volatility of the sectors that they contain.

The groups are:

- Safe Haven

- Slow Ahead

- Steady as She Goes

- Full Steam Ahead (which is split into developed and emerging markets)

The Mixed Investment 40-85% shares sector is in our ‘Slow Ahead’ group. Funds from this sector have made up a significant proportion of our portfolios for the last couple of years.

- How Saltydog invests: a guide to its momentum approach

- Best and worst fund sectors a year on from the Covid-19 sell-off

- One year on from crash, our portfolios have set new all-time highs

On 7 February 2019, we invested in the Janus Henderson Institutional Global Responsible Managed and the Liontrust Sustainable Future Managed funds. A couple of months later, we bought the Royal London Sustainable World fund. When the coronavirus pandemic started weighing heavily on the markets, around this time last year, we sold these funds, along with almost everything else.

However, when we started reinvesting last April, they were the first funds that we selected. We went back into the Royal London Sustainable World fund on 2 April 2020, and later that month added the Janus Henderson Institutional Global Responsible Managed fund. In May, we invested in the Liontrust Sustainable Future Managed fund and in July bought the Baillie Gifford Managed fund.

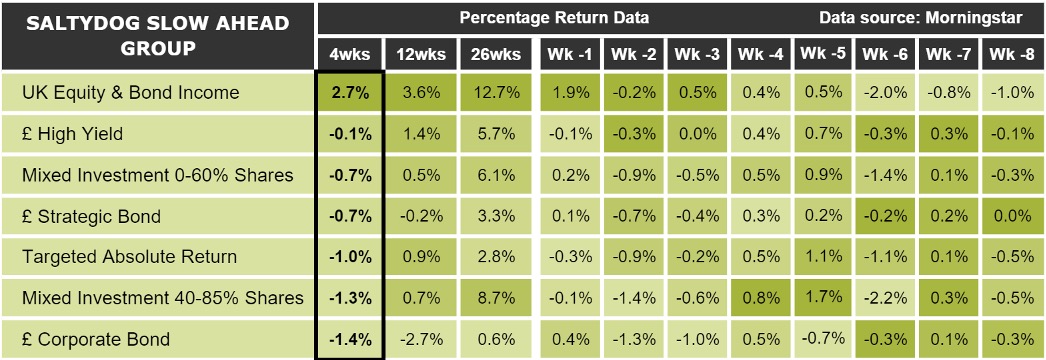

When we looked at our sector analysis last week, nearly all sectors had gone down over the previous four weeks. The notable exceptions were the UK Equity and Bond sector in our ‘Slow Ahead’ group, and the UK All Companies, UK Smaller Companies, and UK Equity Income sectors from the ‘Steady as She Goes’ group.

The ‘Mixed Investment 40-85% Shares’ sector was showing a four-week loss of 1.3%.

Funds in the Mixed Investment 40-85% Shares sector are required to have a range of different investments.

They must have between 40% and 85% invested in shares. A minimum of 50% in established market currencies (US dollar, sterling and euro) of which 25% must be sterling (or hedged back to sterling).

Over the last year, the UK stock market has lagged behind many other countries, especially the US. This has meant that funds from the Mixed Investment 40-85% Shares sector that have taken advantage of their ability to invest overseas have benefited. Within each of the four funds that we hold, the bulk of their investment is in international equities with America taking the lion’s share. This is part of the reason why they have done so well up until now.

In the last four weeks, the combined North America and North American Smaller Companies sector has gone down by 3.4% and the Global sector has lost 4.3%. This will have had a knock-on effect on the funds that we are holding from the Mixed Investment 40-85% Shares sector.

We have reduced our holdings while we wait and see if this trend develops.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.