A cyber share to consider and a TikTok supplier with a problem

Our overseas investing expert analyses potential for big returns from these two tech companies.

18th November 2020 09:26

by Rodney Hobson from interactive investor

Our overseas investing expert analyses potential for big returns from these two tech companies.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

It has been 20 years since the great technology boom and bust sent stock markets into a three-year downward spiral. Once again, tech stocks are attracting the interest of private investors. The big difference this time is that there are genuine products bringing in genuine revenue and, ultimately, genuine profits.

As always, it is important to sift out real prospects from the hangers on, so investors should prefer niche players rather than those that compete directly with other similar tech companies. Those with speciality products that fulfill a genuine need could either be the next big thing or be taken over at a premium by the bigger players. The drawback is that they rarely pay dividends, since cash is needed to be ploughed into the company to avoid being left behind by new developments.

- Want to buy and sell US shares? It’s easy to do. Here’s how

- Moderna, Covid cures and cheap cyclical stocks

One possibility is CrowdStrike (NASDAQ:CRWD), which sells cybersecurity products to protect computers and computer networks from malicious attacks, identify such attacks and mitigate the effects where an attack is successful.

Just read the newspapers to see how many people keep falling for the same, well publicized cyber scams; how much more vulnerable, then, are computers in many workplaces where staff do not have to worry about the consequences of their carelessness.

The hacking of sensitive data does hit the headlines occasionally, but no-one knows how many companies have paid ransom demands from highly skilled hackers who target their victims carefully. It must be cheaper to ward off the attacks in the first place.

CrowdStrike’s third-quarter earnings are due on 2 December. Analysts expect revenue to top $200 million, an increase of two-thirds over last year.

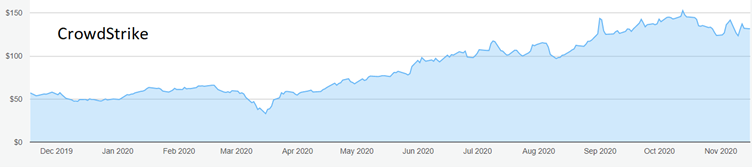

The company was founded in California in 2011 and it went public last year. The shares started trading at $64 and were viewed by investors with some indifference until they dipped just below $40 in March.

Since then they have shot up to $145, but a recent slippage opens up a possible buying opportunity around $138.

Source: interactive investor. Past performance is not a guide to future performance.

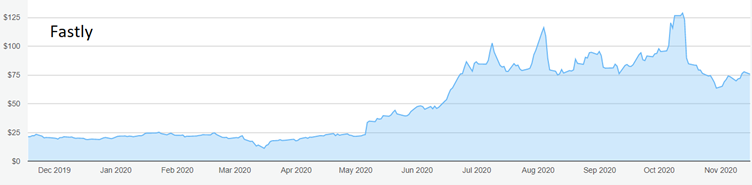

Another tech company starting to go places, though in a different field, is Fastly (NYSE:FSLY), which offers cloud computing services that push data quickly round the internet. It also came to market in June last year.

Customers include digital publishing, media and entertainment, retail, travel, hospitality and financial services. Although that list includes some of the sectors hit hardest by the Covid-19 outbreak, it is a wide list that should ensure at least some customers are thriving at any given time.

The biggest customer, though, is problematic. ByteDance, owner of the Chinese video-sharing service TikTok, has pulled most of its traffic from the Fastly network, a serious blow given that it accounted for about 12% of Fastly’s revenue.

- Tesla entry to S&P 500 sparks shares surge and boost to Scottish Mortgage

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

This has inevitably had an effect on Fastly’s income. A 42% rise in third-quarter revenue compared with the same three months of 2019 was less than previously expected. It now expects to lose 8-12 cents per share in the fourth quarter, at least four times the loss forecast by analysts.

The disappearance of TikTok traffic is a direct result of President Trump’s standoff with the Chinese government. He is threatening to ban the app if it is not sold to a US company.

Source: interactive investor. Past performance is not a guide to future performance.

Fastly chief executive officer Joshua Bixby believes he can attract enough traffic to replace TikTok, but that looks unlikely, certainly in the short term. A better hope is that a deal ByteDance is negotiating for Oracle (NYSE:ORCL) and Walmart (NYSE:WMT) to take stakes in TikTok will come to fruition. It is also possible that incoming President Joe Biden will take a softer stance as he seeks to rebuild trade bridges with overseas countries including China. However, a cloud will hang over Fastly until this hole is filled one way or another.

Hobson’s choice: Buy CrowdStrike up to $140. They could reach a new high soon, while the recent low of $124 is unlikely to be revisited. Fastly is a less tempting option at this stage so I would be reluctant to pay more than $80, which is little higher than the current $78.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.