Dividend good news gives boost to income seekers

More companies have just announced dividend payments, and others might benefit from a summer holiday.

21st May 2020 12:58

by Graeme Evans from interactive investor

More companies have just announced dividend payments, and others might benefit from a summer holiday.

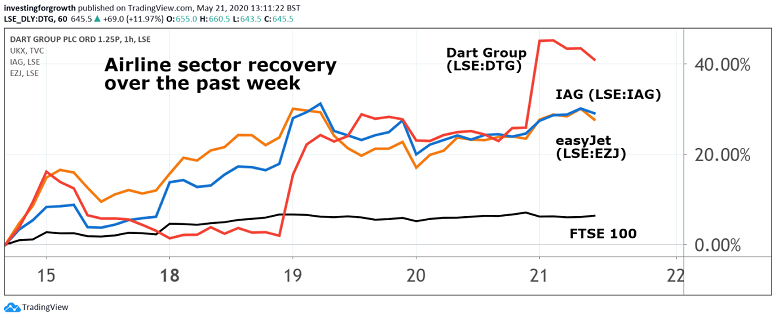

Pockets of dividend cheer and a rebound for airline stocks easyJet (LSE:EZJ) and International Consolidated Airlines Group (LSE:IAG) helped investors during an otherwise tough session for the FTSE 100 index today.

The latest leg of a strong week for the travel sector reflected hopes that some popular tourist destinations, such as Greece, could be ready to reopen as early as next month. EasyJet today set a date of 15 June for some domestic flying in the UK and France, followed by the reopening of further routes as lockdown measures across Europe are hopefully relaxed.

- Jim Slater strategy: 10 small-cap growth stocks on the move

- UK banks: what City experts think of Lloyds, Barclays, RBS and HSBC

The airline was top of the FTSE 100 index risers board, with its 6% gain to 583p taking it 17% higher for this week and reducing the decline since mid-February to 61%. BA owner IAG was on a similar flightpath after rising 4% to 207.40p and by 23% since Monday morning.

Small-cap Dart Group (LSE:DTG), which trades as Jet2holidays, also surged another 13% to 654p as an oversubscribed equity placing raised £172 million for additional headroom to deal with the Covid-19 crisis. Its shares have jumped 45% in just over a week.

There were few other positives for investors in the FTSE 100 index, which fell 1% to just above the 6,000 barrier after weak export figures in Japan set the tone for a risk-off session.

Source: TradingView. Past performance is not a guide to future performance.

Intertek (LSE:ITRK) was one of the blue-chip exceptions today after the quality assurance company confirmed it would pay next month's previously announced final dividend worth £115 million.

Intertek ranks second highest in the FTSE 100 in terms of dividend progression since its IPO in 2002, with the total 2019 pay-out of 105.8p representing a rise of 6.8% year-on-year.

The dividend update came as 130-year-old Intertek reported a robust trading performance for the first four months of this year, with revenues of £882 million being down 4.6% on last year.

Shares jumped 6% to 5,242p, which compares with the target price of 5,350p at Jefferies prior to today's update. The broker's analysts called the performance “surprisingly resilient” and said growth should improve once a tough period in April and May is out the way.

Ex-FTSE 100 stock Tate & Lyle (LSE:TATE) also had some positive news for income investors after its annual results included the payment of an unchanged final dividend of 20.8p a share on 31 July. This will mean the total dividend has nudged up 0.7% on a year earlier to 29.6p a share.

The performance is further evidence of the progress under CEO Nick Hampton, who has overseen Tate's transformation from an ingredients supplier, into a more dynamic company that engages more closely with customers at CEO, R&D and marketing levels.

This was reflected in today's annual results, with profit before tax up 4% to £331 million after its food and beverage solutions division grew revenues in every region.

Trading in April has been mixed due to lockdowns in Europe and the United States, with Tate unable to provide guidance for the current financial year. Its shares were 2% higher at 645.2p.

- 10 equity income gems as Covid dividend cuts bite

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Among other companies with full-year results out today, QinetiQ (LSE:QQ.) saw its shares advance 3% to 313.8p after it reported a fourth consecutive year of top-line growth and its largest annual order intake in almost a decade. Underlying operating profits were up 2%.

Despite entering the 2021 financial year in a “very strong position”, the military supplier said the Covid-19 crisis had created uncertainty over the potential knock-on effect for customer priorities and budgets.

This led to the announcement in early April that it will postpone a decision on a dividend payment until later in the year.

Pets at Home (LSE:PETS) said today it would pay a final dividend of 5p a share on 14 July, making an unchanged total dividend of 7.5p for the year.

This reflected a strong 2019/20 performance in which it benefited from a surge in sales towards the end of the period as pet owners stocked up on supplies before and during the lockdown.

Source: TradingView. Past performance is not a guide to future performance.

But this demand has unwound in the first quarter of the new financial year, while guidelines on social distancing and restrictions on the sale of pet products and grooming services have also depressed normal levels of turnover.

Online sales are still at elevated levels, but this will not be enough to prevent half-year profits from coming in materially below the previous year. Shares tumbled 12% to 204p, wiping out nearly all the gains seen at the retailer since mid-March.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.