Dividend shock: Aviva and insurers bow to inevitable

Income investors have been dealt a fresh blow as another industry regulator gets heavy.

8th April 2020 14:37

by Graeme Evans from interactive investor

Income investors have been dealt a fresh blow as another industry regulator gets heavy.

Aviva (LSE:AV.) blew an even bigger hole in investor incomes today when the high-yielding stock joined several other UK insurers in pulling dividends in the face of regulatory pressure.

The action by Aviva, RSA Group (LSE:RSA), Direct Line (LSE:DLG) and Hiscox (LSE:HSX) comes a week after Lloyds Banking Group (LSE:LLOY) and other lenders agreed they would not make any distributions in 2020.

The banking sector was left in no doubt about the need to suspend pay-outs in the face of Covid-19, whereas insurers have been told by the Prudential Regulation Authority (PRA) and other regulatory bodies to show restraint on their dividend payments.

This has created a situation where Aviva today felt the need to pull the plug on its £839 million final dividend due on 2 June, even though Legal & General (LSE:LGEN) confirmed as recently as Friday that it intended to stick by its previously announced 7% rise in total dividend to 17.57p.

The loss of the Aviva pay-out is particularly significant, given that its 9% yield had been one of the biggest still standing in the FTSE 100 index after housebuilders including Taylor Wimpey and Persimmon cut their pay-outs in order to conserve cash.

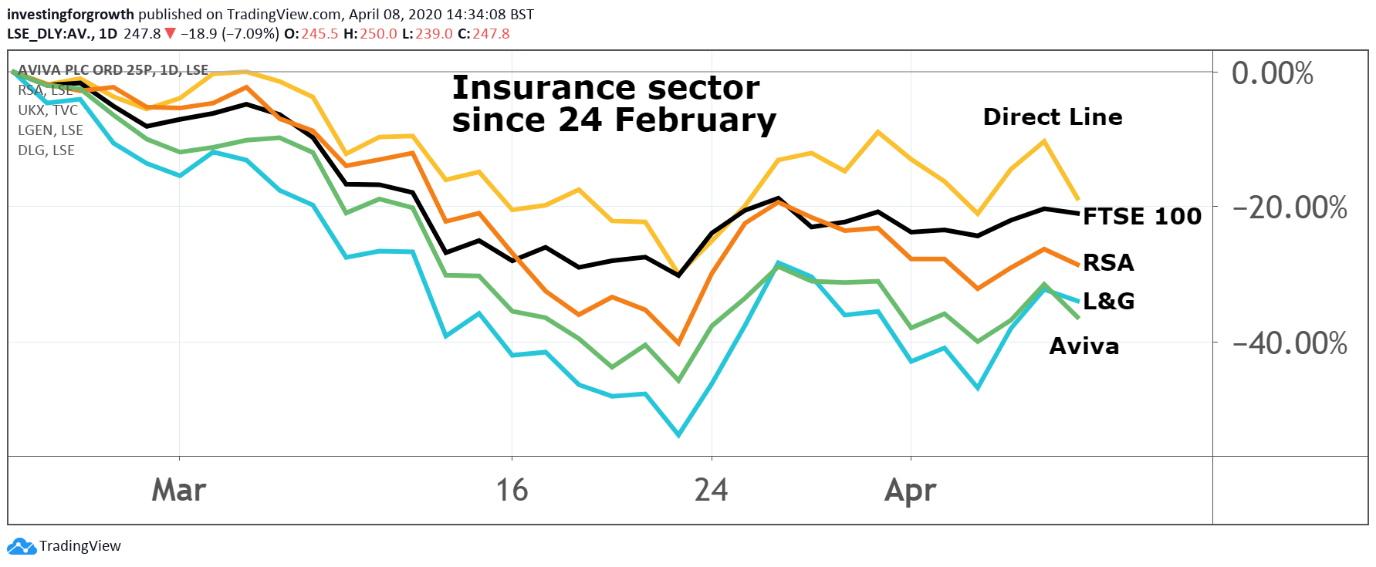

Aviva had been the fifth most-bought stock on the interactive investor platform during the market turmoil in March, with Legal & General the next most popular. Aviva's shares fell back 8% to 245p today, reversing a rebound from just above 200p in mid-March, while Legal & General dropped 3% to 197.6p.

Source: TradingView Past performance is not a guide to future performance

Aviva, which will revisit shareholder distributions in the fourth quarter of 2020, said:

“In light of the significant uncertainties presented by Covid-19, the board agrees with our regulators that it is prudent to suspend dividend payments at this time.”

The insurer had been due to go ex-dividend on 23 April, having announced a more modest 3% rise in dividend compared to the double-digit percentage increases seen in previous years.

By not paying the final dividend, the estimated group capital ratio will increase by about seven percentage points to approximately 182% at mid-March. The estimate does not allow for any increase in insurance claims or changes in experience or assumptions that may arise from Covid-19. A further update is planned for investors in the second half of May.

The advice of the European Insurance and Occupational Pensions Authority not to pay a dividend until the situation on Covid-19 is clearer has been supported by most regulators including the UKs PRA. Germany, however, thinks that a dividend suspension is not necessary.

UBS said:

“Given dividends drive sector share performance, longer term this could test the market's perception of insurance as a resilient dividend sector.”

Direct Line's decision not to recommend its 14.4p a share final dividend at its forthcoming AGM will save it £198 million. It had also been due to carry out a share buy-back of up to £150 million by the end of July.

The company said its Solvency II coverage was estimated to be towards the top of its 140% to 180% risk appetite range at 176%. It said:

“In normal circumstances, the group would be well placed to pay the final dividend, taking the group's solvency to 161%.”

In light of Covid-19 travel restrictions, Direct Line said travel insurance claims totalled £22 million before reinsurance cover of around £18.5 million. However, this is offset by a reduction in claims, particularly in motor, as customers stay at home.

RSA has also suspended its recommendation of a 15.6p full-year 2019 dividend that would have paid £161 million on 14 May. Ahead of a trading update planned for 7 May, the group said its Solvency II coverage was estimated to be within its target range and in excess of 150%.

Chairman Martin Scicluna said:

“No company exists in a vacuum and at this time we judge it to be in the best long term interests of RSA to show forbearance on dividends and maximise our capability to support customers under the terms of their respective policies and play our part in industry initiatives to support relief efforts.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.