Do UK economic stats take interest rate cuts off the table?

Earlier in January, members of the MPC had hinted that they were likely to vote for a rate cut.

28th January 2020 09:49

by Tom Bailey from interactive investor

Earlier in January, members of the MPC had hinted that they were likely to vote for a rate cut. But that was before the latest data.

So far, January has been the strongest month for UK manufacturing and services in over a year, according to the latest Purchasing Managers’ Index (PMI) data.

The composite PMI, which includes both manufacturing and service businesses, rose to 52.4 in January, up from 49.3 in December. The figure also beat the 50.7 consensus estimate of economists.

The services PMI saw an increase to 52.9, from 50.0, also beating the consensus 51.1. Meanwhile, the Manufacturing PMI rose to 49.8, from 47.5. The consensus estimate was 48.8.

PMI readings above 50 represents represent expansion. Therefore, based on the composite reading, the UK economy is currently expanding. This is being led by the service sector, while manufacturing, with a reading of 49.8 is contracting, albeit less so than the month prior.

It is important to note the data for January are “flash readings”, meaning they may be revised up or down at a later date. The December readings are final estimates.

However, for now, the latest readings have generally buoyed confidence about the UK economy, with many now expecting the Bank of England to hold interest rates when the Bank’s Monetary Policy Committee (MPC) meets next week.

Earlier in January, members of the MPC had hinted that they were likely to vote to cut rates.

- 11 shares that could cut their dividend in 2020

- Income hunters can find great funds on ii’s Super 60 recommended list of investments

According to Andy Scott, associate director at JCRA, part of financial risk adviser Chatham Financial: “UK economic data this week has shown a better than expected recovery following the outcome of last month’s election, making a rate cut next week less likely.

“So far, the evidence points to a significant pick up in UK business optimism and consumer confidence following the Conservative’s convincing election victory. We expect this is likely to mean that the Bank of England keeps rates on hold next week, preferring to wait and see whether the economy is starting to reverse the weakening growth trend.”

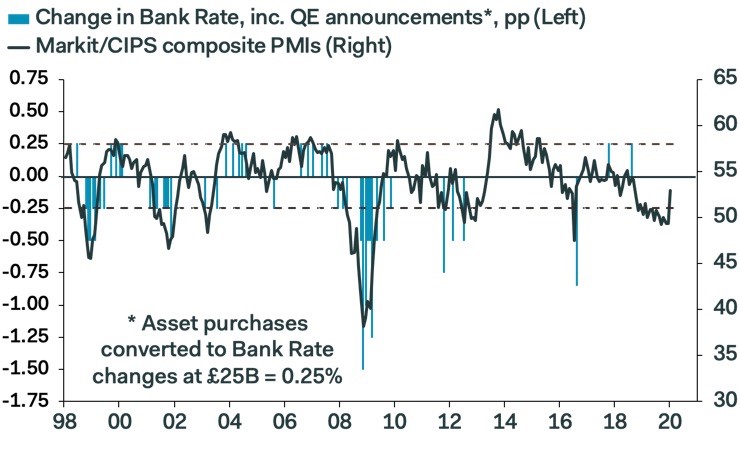

Similarly, economics consultancy Pantheon Macroeconomics argues that a rate cut next week is now unlikely. They note: “The big jump in the composite PMI - the fifth largest month-to-month gain since the survey started in 1998 - makes it likely, though not absolutely certain, that the MPC will pause for thought next week.”

The consultancy provides a chart showing that the PMI index is currently above levels usually seen when the Bank has decided to cut rates.

However, the idea of a rate cut is not completely out the window. According to Nick Wall, co-manager of the Merian Strategic Absolute Return Bond fund, the market is still pricing in a 50/50 chance of a 25 basis point cut next week.

Despite the stronger figures, several factors may push the MPC to vote for a rate cut, argues Wall.

First, inflation is still below the Bank’s 2% target rate, while sterling has stabilised. This gives the Bank room to get ahead of any potential risks to the UK economy.

Wall suggest the Bank may decide to cut rates to counteract global economy’s continued slowdown. Wall also flags up the recent coronavirus outbreak in China as potentially impacting global growth in the near-term.

At the same time, the MPC may feel the need to cut rates to ensure the health of the UK labour market. Wall points out that the job vacancy rate, a reliable forward-looking indicator, has been dropping. A rate cut would help counter this.

With potential risks on the table, Wall notes the MPC may feel the need to step in early, judging that with rates already being so low, a pre-emptive cut may be more effective.

Wall says: “The Bank may judge that, with limited ammunition, you get more bang for your buck if you move early. Prolonging the business cycle arguably requires fewer cuts than fighting a recession and this policy approach is gaining popularity in central banking circles (arguably out of necessity).”

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.