Don’t be shy, ask ii…when is an investment trust premium too high?

1st June 2022 06:20

by Kyle Caldwell from interactive investor

No question is a stupid one, so whether you want to find out what you need to do to start investing or how the stock market works, don’t be shy, ask ii. Email yours to: ask@ii.co.uk

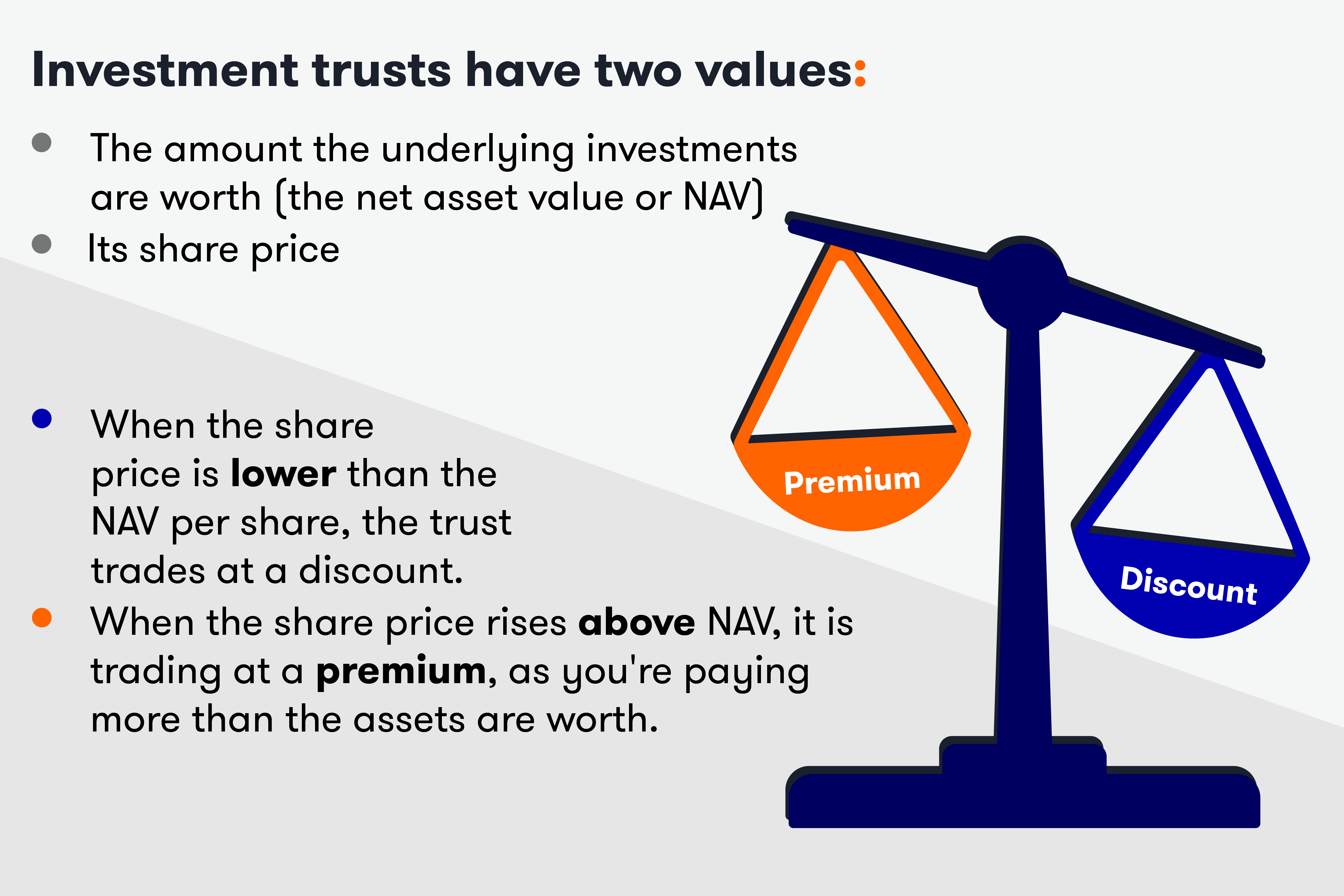

Mr Jays asks:certain trusts have a huge premium, for example Primary Health Properties (LSE:PHP) and, until recently, Tritax Big Box (LSE:BBOX) and its European sibling Tritax EuroBox (LSE:BOXE). For income investors, these look attractive and no doubt the security of the income deserves a premium, but how much is too much when it comes to investment trust premiums?

Kyle Caldwell (pictured above), collectives editor, interactive investor, says: paying more for something than it is worth is rarely a great investment strategy. However, on the other hand, just because something is cheap does not make it a bargain that will prove to be a good investment.

When it comes to investment trust premiums, there’s no magic number that implies the premium has become too high.

Instead, the answer is subjective, and it will vary depending on how the trust invests. For a plain vanilla UK equity trust, it is a rare to see a premium of more than 5%. But for an investment trust that has a certain specialism (such as investing in alternative assets) and is generating a high level of income, it is not uncommon to see premiums reach double-digits when investor demand is high.

However, there are a couple of things private investors can do to assess whether the premium is out of kilter.

- Expert investment tips from £50 to £50,000

- Discover our Don't be shy, ask ii questions here

- Fund and trust alternatives to Scottish Mortgage and Fundsmith Equity

In general, investment trusts have a greater tendency to converge to their mean discount rather than the value of their underlying investments – the net asset value (NAV).

Therefore, it is useful to look at the current premium versus its history – such as one, three and five years. If the premium is much higher today than it has been in the past, this could be a warning sign.

Second, consider how the trust’s premium stacks up against competitors in its respective sector. If the premium stands out like a sore thumb, then it is worth investigating why.

A more mathematical metric private investors can employ is the ‘z-score’ of a trust. This is another way to compare a trust's current discount or premium to its historic level. A positive z-score shows the current value is higher than the mean, while a negative value indicates the opposite. As a rule of thumb, a score of minus 2 or lower suggests the trust is looking cheap, while a positive score of 2 or more suggests it might be expensive.

The most important thing to bear in mind is that high premiums do not tend to be sustainable over the longer term. When conditions change – such as when investors become more cautious – premiums can fall and can turn into a discount.

Investors who buy on a premium that narrows will see their holdings fall in value more than the underlying investments – the NAV.

Therefore, investors buying a trust on a premium need to have a positive view about the outlook for the trust, including how it invests and the region, sector or asset class it invests in. Rather than buying and holding, it is worth keeping an eye on the premium, and consider taking action if conditions change.

- Read more of our content on funds and trusts here

- Don't be shy, ask ii...why do some trusts always trade on a discount?

A rising premium can indicate that investors are anticipating an uplift in the NAV, whereas a declining premium or widening discount can reflect uncertainty over valuations due to a change in the investment environment.

In some cases, large discounts or premiums may be caused by short-term investor sentiment, but they can also be more of a permanent feature for certain trusts.

It is also worth bearing in mind that some investment trust boards attempt to control the discount/premium by buying back their own shares. In turn, this keeps the discount/premium within a tight range. Some trusts will buy their own shares at a certain level. Eagle-eyed investors can take advantage of this, as the risk of the discount or premium widening beyond a certain point is limited.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.