Fund and trust alternatives to Scottish Mortgage and Fundsmith Equity

18th January 2022 10:44

by Jennifer Hill from interactive investor

The most-popular fund and investment trust among British investors continue to see their assets climb. We ask experts to name alternatives.

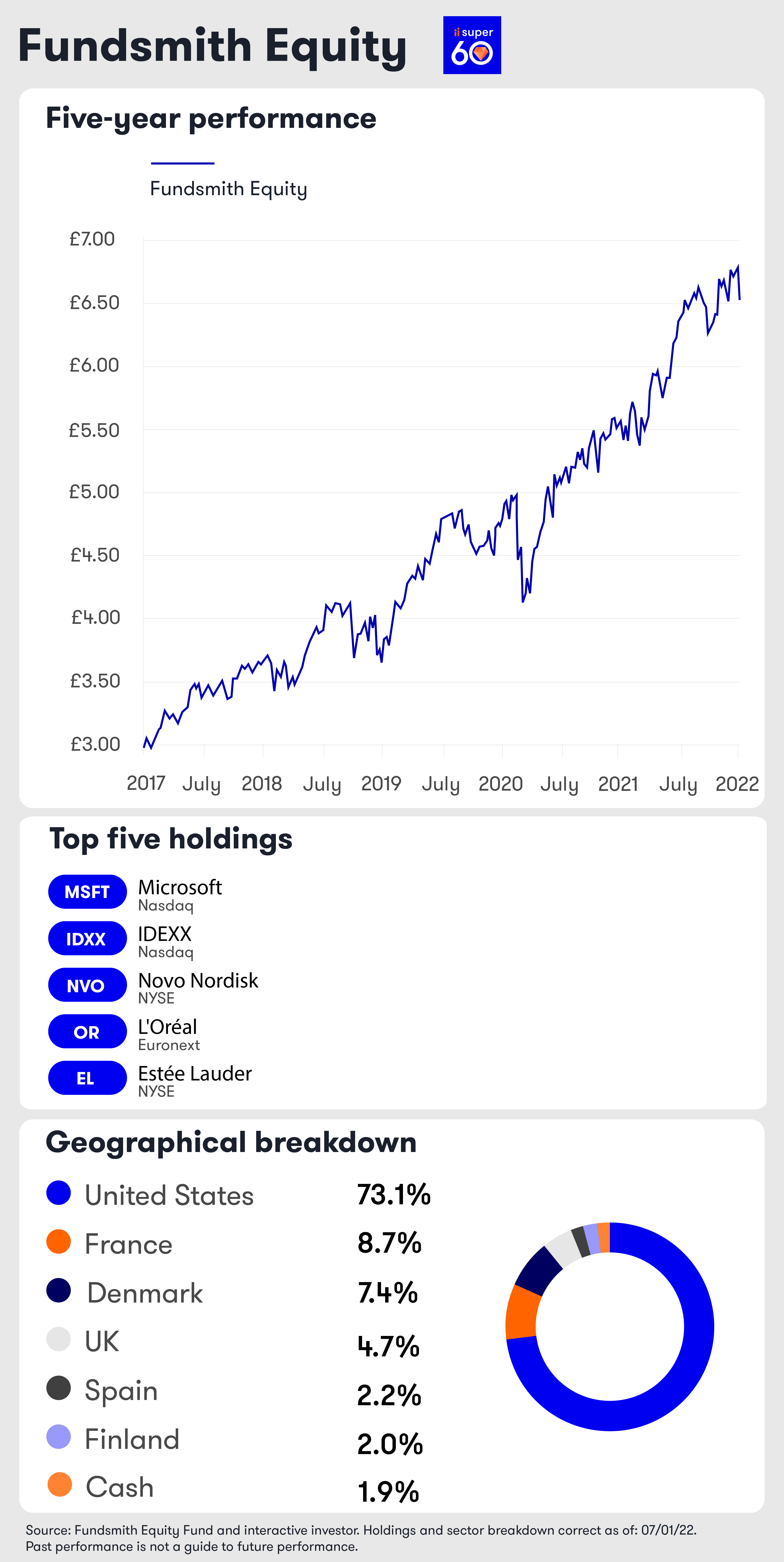

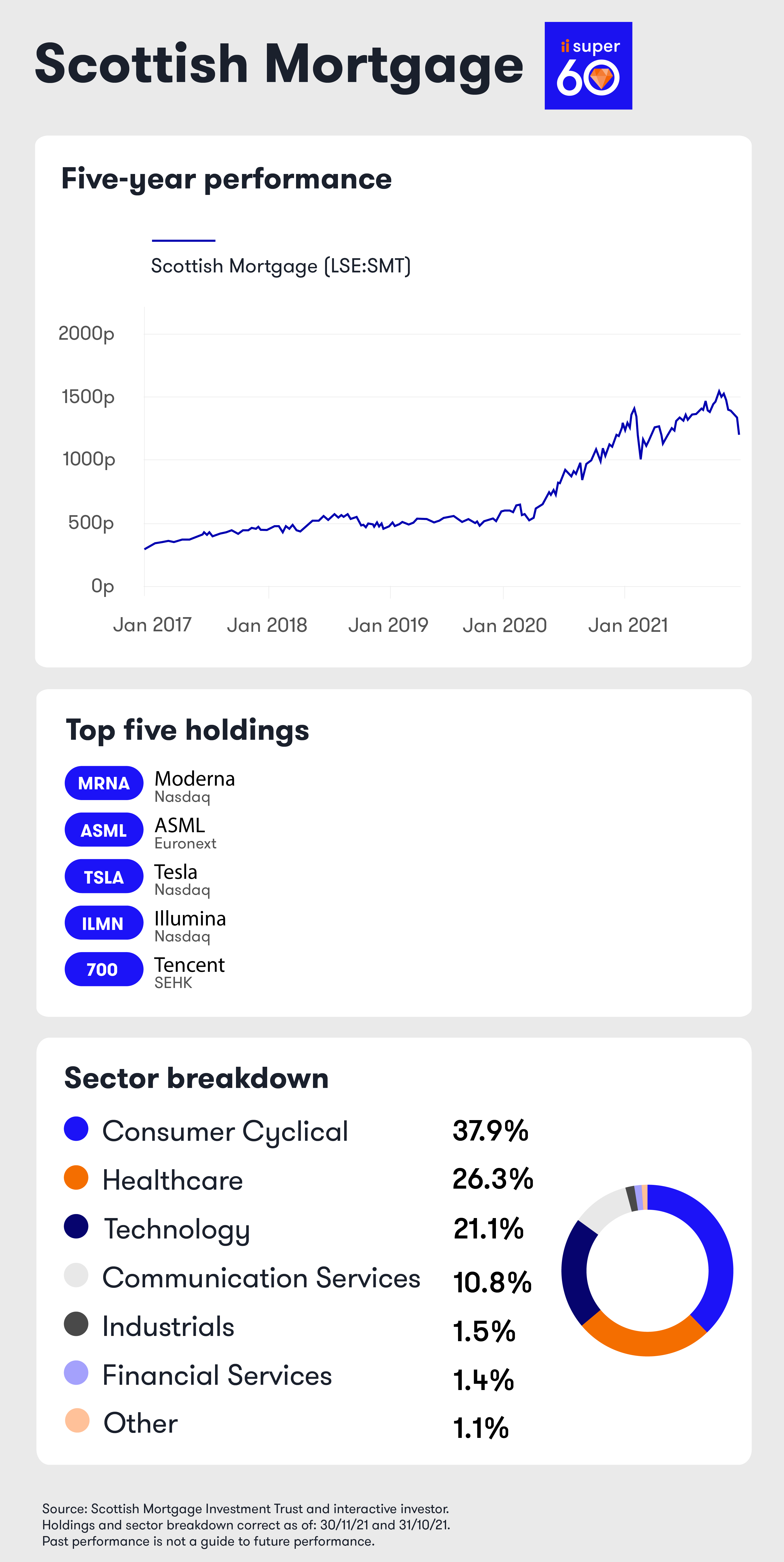

When it comes to investing, it can often pay to go against the grain. We asked a range of fund selectors and analysts for the alternatives they recommend for the most-popular investment trust and fund in the UK – the colossal £23 billion Scottish Mortgage (LSE:SMT) and £29 billion Fundsmith Equity.

Fundsmith Equity invests in high quality, well-established companies. Its fund manager Terry Smith says he does “not seek to find tomorrow’s winners – rather, to invest in companies that have already won”. His approach is to pick a small selection of resilient, global growth companies that are good value, and stick with them.

Scottish Mortgage focuses on disruptive companies that have a technological edge over competitors. Its fund manager – James Anderson and Tom Slarer - believe many of the most exciting companies now wait until their fastest growth period is over before seeking a stock market listing. To that end, they can invest up to 30% of assets in unquoted companies. At the end of November, the portfolio contained 49 private companies, accounting for just under 19.2% of total assets.

- Terry Smith on why Fundsmith Equity fell slightly short in 2021

- Funds and investment trusts: how small is too small?

- Fundsmith Equity just keeps growing, but how big is too big?

Alternatives to Fundsmith Equity

BlackRock Global Unconstrained

Fundsmith Equity has a bias towards quality growth stocks, a part of the market that TAM Asset Management has extensively researched. Of three alternatives it uses, BlackRock Global Unconstrained has outperformed Fundsmith the most.

The firm first bought the fund around the time the fund launched, in January 2020, and is considering increasing exposure. The fund is similarly concentrated with 23 holdings versus Fundsmith’s 28.

“Managed by Alister Hibbert and Michael Constantis, their focus lies solely with great businesses that can sustain high returns over very long periods,” says Dan Babington, a senior fund analyst at TAM. “They admit these are rare, but when found may offer significant alpha.”

BNY Mellon Long-Term Global Equity

BNY Mellon Long-Term Global Equity is akin to Fundsmith but with more diversification. It is a fund that Square Mile Research has rated since December 2020.

It has 48 holdings and is run by Walter Scott & Partners, which is autonomous from BNY Mellon, with an investment committee-based approach and strict investment criteria.

“We like the simple investment approach, driven by a stable team of investors tasked with in-depth fundamental research to build a resilient portfolio of quality businesses,” Ajay Vaid, an investment research analyst at Square Mile. “We expect this fund to deliver a conservative return profile, with defensiveness during periods of stress.”

Dodge & Cox Worldwide Global Stock

Square Mile also likes the Dodge & Cox Worldwide Global Stock fund, which it has rated since December 2017. It also favours quality stocks, but has much greater valuation sensitivity. The resultant portfolio is more diverse than Fundsmith’s, with 83 holdings at present.

“Dodge & Cox as a house has a quality focus…but it is also highly sensitive to valuation risk and wishes to buy companies at below average valuations,” says Vaid.

“With various risks in the market, this fund offers a more balanced approach with a valuation sweetener, which could benefit investors should interest rates rise or highly valued companies see their multiples begin to normalise.”

- Examine more articles on investment funds and trusts

- Watch our new year share tips here and subscribe to the ii YouTube channel for free

FTF Martin Currie Global Unconstrained

Ben Yearsley, a director of Shore Financial Planning, picks out FTF Martin Currie Global Unconstrained. The fund is managed by Zehrid Osmani and Yulia Hofstede.

Like Fundsmith it is a focused 20 to 30 stock portfolio with low turnover and very clear reasons for buying something.

“The team’s much smaller level of funds under management makes the fund more manoeuvrable when changes are needed compared to Fundsmith,” says Yearsley.

“This is a long-term growth fund so best suited to those investors who can buy and tuck away for a decade or more.”

LF Blue Whale Growth

LF Blue Whale Growth has various parallels with Fundsmith. Manager Stephen Yiu runs a concentrated portfolio (25 to 35 stocks), avoids structurally challenged industries or companies and focuses on the highest quality businesses, though he also pays close attention to valuations.

It is a fund that FundCalibre has been following since it launched in September 2017.

“We think it’s an exciting new fund and gave it a ‘Radar’ rating in summer 2020,” says head of research Juliet Schooling Latter. “As soon as it passed its third anniversary, we awarded it a full rating. It makes a good core global fund for clients with a reasonable risk appetite and long-time horizon.”

- Private Investor Index: ii customers beat professional investors in 2021

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

Montanaro Better World

Montanaro Better World is a constituent of interactive investor’s ACE 40 list of rated ethical investments and has been used by Canaccord Genuity Wealth Management since its launch in April 2018. It adopts a similar quality growth approach to Fundsmith, but with a few key differences.

“It’s primarily exposed to international small and medium-sized [SMID] companies, and only invests in companies that make a positive impact on the world – two elements we like,” says investment analyst Kamal Warraich.

“Due to the SMID-cap bias, the fund should be viewed as a driver of alpha. It can be utilised alongside core large-cap holdings – just like Fundsmith, in fact.”

Alternatives to Scottish Mortgage

Baillie Gifford Global Discovery

For FundCalibre, it is “almost impossible” to find an alternative to Baillie Gifford’s Scottish Mortgage. The best Schooling Latter sees is Baillie Gifford Global Discovery, managed by Douglas Brodie (who also manages Edinburgh Worldwide). FundCalibre has rated the open-ended fund since the ratings business began in 2014. “It has a strong growth bias and is aggressive in nature,” she says.

The fund lends itself well to Baillie Gifford’s strengths – namely rigorous company research, with a long-term perspective.

“We think it’s a good addition to a global segment of a portfolio, maybe in addition to a larger cap, less aggressive fund, and would suit investors with a higher tolerance for risk and a long-time horizon,” adds Schooling Latter.

- Bull and bear points for major equity markets at start of 2022

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Edinburgh Worldwide

Also in the Baillie Gifford stable is Edinburgh Worldwide (LSE:EWI). Numis believes it to be an “attractive vehicle and interesting alternative to Scottish Mortgage”.

It shares a focus on disruptive growth companies but is differentiated by investing in less mature companies, typically sub-$5 billion at the time of investment, though Brodie has the scope to run his winners.

“Reflecting the focus on innovation, the portfolio is heavily focused on healthcare, biotech and technology,” says Ewan Lovett-Turner, head of investment companies research at Numis. “New additions have focused on the themes of software-based tools that help companies scale, businesses which explore the possibilities of space and products based on deep molecular or physics insights.”

Brunner

Brunner (LSE:BUT) is a “straightforward swap” for those who want a traditional global growth trust, according to Kepler Trust Intelligence. Manager Matthew Tillet pursues a balanced approach to global equity investing, with exposure to both ‘growth’ and ‘value’ stocks.

“This mix could be attractive to investors at a time when there have been some fairly dramatic swings between growth and value, which are difficult to endure if you are very heavily exposed to one or the other of these themes, especially if the long-term dominance of growth stocks is no longer quite so profound and these swings continue,” says William Heathcoat Amory, Kepler’s head of research.

Polar Capital Technology Trust

How do you replace a unique investment? The strange answer is by not looking to replicate it but by looking for something that has similar characteristics, says Yearsley. He suggests replicating Scottish Mortgage’s heavy tech bias through Polar Capital Technology (LSE:PCT).

“It hasn’t got the unquoted stocks, but so what? It’s still a long-term high growth focused investment from a sector that has been a key driver of returns,” he says.

“Tech isn’t going away, if anything it will become more important so why not have the market leading tech team in your portfolio? I’ve held this for well over a decade.”

Allianz Technology Trust

Another tech trust, and a long-term favourite of Canaccord Genuity, is Allianz Technology Trust (LSE:ATT). Although it doesn’t share the large private equity exposure and broader geographic diversification of Scottish Mortgage, the two strategies have generated very similar returns over the long term.

“We fundamentally believe in the power of transformational technology and back a variety of funds in this area,” says Warraich.

“ATT is a sector specific, pure growth strategy, and as such it should be viewed as the risk element of any portfolio. Investors could combine it with lower volatility offerings, such as quality or value managers.”

- Ian Cowie: winners and losers in my ‘forever fund’ in fourth quarter

- Funds Fan: four predictions for 2022 and Allianz Technology interview

NB Private Equity

Another option is to seek exposure to unquoted companies, which account for 18.8% of Scottish Mortgage’s total assets. For those interested in this area, private equity trusts are worth a look – Heathcoat Amory at Kepler suggests NB Private Equity Partners (LSE:NBPE).

“Private equity markets are still very buoyant, and it continues to be a sellers’ market,” he says. “NBPE’s portfolio of hand-picked co-investment deals still has an attractive maturity profile, with 67% of the portfolio in the 2017-2019 vintage bracket.

“Should the market remain supportive, many of these companies could be approaching the time their private equity sponsor will want to crystallise gains through an exit transaction.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.