easyJet shares remain super volatile after Covid update

From £15 to £4, then back above £6. Our head of markets explains what’s moving the shares this time.

16th April 2020 09:53

by Richard Hunter from interactive investor

From £15 to £4, then back above £6. Our head of markets explains what’s moving the shares this time.

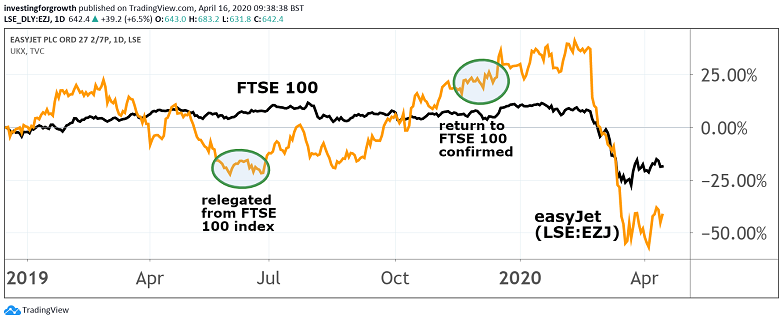

The fact that easyJet (LSE:EZJ) regained its FTSE 100 index status in December, following a previous relegation in June, was testament to the strong trading environment it was enjoying at the time.

Today’s trading update, which covers the six months to the end of March, confirms that the airline was indeed cruising, with revenue per seat up by over 10%, accompanied by an increase in capacity, passenger numbers and the load factor.

In addition, the new Berlin hub and easyJet holidays operation were showing early signs of promise, and the unfortunate demise of Thomas Cook provided more opportunities.

- Lloyds Bank shares cannot afford to close below this level

- Are these retail sector stocks about to run out of cash?

In all, this led to an estimated half-year loss of between £185 million and £205 million, a marked improvement from the previous year’s loss of £275 million.

Remember that airlines typically lose money during the long winter months, making it back, and much more, over the busy summer period.

However, the world has turned upside down of late and, unsurprisingly, the tourism and travel sector was one of the very first in the coronavirus firing line.

With some costs unavoidable and revenues plunging to negligible levels, this crisis will prove to be an existential threat to some.

As such, the most the airlines can manage at the current time is to display the measures they have taken, often at speed, to minimise cash burn.

Source: TradingView Past performance is not a guide to future performance

Indeed, easyJet has been working hard behind the scenes to consolidate its financial position. The dividend, being fixed to earnings, was an inevitable early casualty.

Agreed funding facility measures have added nearly £2 billion to its reserves, the deferral of the purchase of 24 new aircraft – along with other measures – will reduce capex by £1 billion over three years, and the possibility of a further injection of cash of anything up to £550 million following the sale and leaseback of some of its fleet, leaves the company with a notional cash balance of £3.3 billion.

Based on its own figures, this gives the company over nine months’ breathing space should the entire fleet remain grounded, as it has been since the end of March.

Meanwhile, the furlough of staff and lack of airport or fuel charges will ease some financial pressure, and the company remains confident that it could resume operations within a two-week window.

While the fleet is grounded, operational costs of £30-£40 million per week remain, which, while comfortably lower than the usual £125 million, is nonetheless a drain on cash.

Furthermore, the estimated hit of anything up to £185 million, due to the negative effect of “overhedging of fuel,” is another unwelcome development.

- Fund manager survey: bank shares, UK stocks, dash for cash

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The company’s outlook statement is understandably absent, although, perhaps surprisingly, easyJet has reported bookings for the coming winter being well ahead of last year, as customers have inevitably had to change travel plans.

Whether customers’ propensity to travel abroad at all on the other side of the pandemic is lessened does, of course, remain to be seen.

easyJet’s jagged share price performance over the last year has resulted in an overall decline of 49%, which compares to a drop of 25% for the wider FTSE 100.

Within this, the more recent performance has been markedly more painful, with a 60% plunge over the last three months propelling the company into the FTSE 100 relegation spotlight once more.

While the market consensus of the shares still stands at a “hold” – and a strong one based on the company’s prior performance – there is little doubt that for new potential investors, an investment in easyJet would require a monumental leap of faith in the current environment.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.