Election 2019: What do the main political parties offer investors?

We examine the likely impact of the main parties’ pledges on the stock market, tax, pensions and more.

25th November 2019 10:27

by David Prosser from interactive investor

We examine the likely impact of the main parties’ pledges on the stock market, tax, pensions and more.

In these times of momentous political upheaval, old certainties suddenly look less sure. Just ask Christian Schultz, chief UK economist at Citibank, and Oliver Harvey, head of Brexit research and UK macro strategy at Deutsche Bank.

The duo made headlines in September with pronouncements that a Jeremy Corbyn-led Labour government could actually be a safe option for the UK – safer than a no-deal Brexit for sure, and maybe even safer than a Conservative government led by a fiscally profligate Boris Johnson.

These are strange days. The idea that Labour’s self-styled scourge of the bankers might be regarded by some in the City as preferable to the alternatives just underlines the importance of taking nothing for granted.

Still, there is now an opportunity to break the parliamentary deadlock – on Brexit, but also on the direction of travel for the UK across a range of key policy areas neglected during the protracted arguments over departure from the EU.

So what might the parties’ promises mean for your finances in the event that one of them secures a parliamentary majority?

UK stock market

The UK stock market has underperformed global equities by around 10% since the UK voted for Brexit three years ago, according to analysis by Schroders. The most important outcome of December’s election for investors might therefore be that it finally brings some certainty to UK politics, the lack of which has held the UK market back.

However, Tom Stevenson, investment director at Fidelity International, thinks it would be unwise to make a call on the direction of UK equities based on your view of which way the election is likely to go. “Spotting a meaningful connection between the electoral and market cycles is hard,” he warns.

"The performance of markets in the period before elections were called, during the campaign, on the day after the election and in the six months that followed has generally had little to do with which party won."

Joshua Warner, an analyst at spread betting firm IG Index, agrees, particularly since a clear-cut election result is by no means guaranteed. “The general view of financial markets is pretty simple: the Conservatives represent the status quo and are traditionally the party that champions business, while Labour’s socialist-leaning view poses a huge threat to capitalists and businesses,” he says.

“However, as the current state of play suggests that the two main parties will have to reach out to others if they are to secure a majority, it is likely that one or more smaller parties could have a bigger role to play in domestic policy.”

The bottom line, according to Garry White, an analyst at stockbroker Charles Stanley, is that if the election “produces a route out of the current impasse, it can only be regarded as positive.”

This is not to suggest that all sectors of the market will simply ignore the election campaign. Specific proposals from each of the parties will potentially have both positive and negative impacts on certain types of company.

Utilities, transport, energy: The most obvious example of such a proposal is Labour’s plan to bring a range of businesses back under public ownership, particularly as the party has refused to promise that it would buy the shares of such companies at the prevailing market price.

If Labour’s election campaign takes off, look out for a depressive effect on listed water companies, rail businesses, Royal Mail (LSE:RMG) and even defence contractors such as Babcock (LSE:BAB). More positively, Labour’s plans for a ‘green new deal’ could benefit businesses operating in areas such as renewable energy

Healthcare: The main political parties are determined to outdo each other on their commitment to NHS spending; the purse strings are finally loosening after many years of very challenging financial settlements for healthcare. Suppliers to the NHS stand to benefit in the years ahead under all parties.

The big uncertainty is the pharmaceutical industry. Governments are increasingly keen to bear down on drugs prices, with ministers taking an aggressive stance on what they will pay, even for blockbuster drugs. Labour has proposed setting up a state-run generic drugs business to undercut patent holders. Although the idea is fraught with difficulties, the political pressure on big pharma is ratcheting up.

Education: As with health, the end of austerity should mean more funding for the education sector under the next government, whatever its colour. But Labour proposals such as the charging of VAT on private school fees could hit some businesses in the sector. Equally, with Labour planning to abolish university tuition fees and the Liberal Democrats proposing more financial help for those in further education, an expansion in student numbers could benefit businesses such as accommodation providers.

Housing: The government’s Help to Buy scheme has been branded the biggest single public sector intervention in the housing market since the post-Second World War housebuilding boom. But the scheme has come in for increasing criticism from those who argue that it hasn’t helped enough first-time buyers and that it has been hugely profitable for privately owned housebuilders. The debate is nuanced, but both Labour and the Conservatives are now backing away from Help to Buy; the former likely to do so more quickly and aggressively, potentially reducing profitability in the industry.

Infrastructure: While all politicians are committed to investing in the UK’s crumbling infrastructure, they disagree on priorities and the best mechanisms for success. The big-name infrastructure companies face a more uncertain future under Labour, which has been highly critical of the sector, while the Conservatives’ plan to review the High Speed 2 rail link is potentially problematic for rail. As a general rule, the Conservatives’ infrastructure plans are weighted towards the road system, while Labour and the Liberal Democrats are more focused on public transport.

Gambling: Having already enraged the gambling sector with legislation that has reduced the maximum stake on fixed-odds betting terminals (FOBTs) from £100 to £2 – a move William Hill (LSE:WMH) blames for 700 shop closures – the Conservatives have no further plans for reform. But both Labour and the Liberal Democrats want to do more, by lowering the maximum FOBT stake further and introducing new rules on advertising, for example. That could be further bad news in a tough environment for the sector.

Immigration-exposed businesses: Immigration is likely to be a central issue in the election campaign, with the Conservatives taking a much tougher line than Labour and the Liberal Democrats. The Tories are pushing for an Australian-style points system likely to substantially reduce the number of people coming into the UK, particularly to do lower-paid work. That could have a negative impact on sectors such as agriculture, hospitality, retail and care, which may struggle to recruit the staff they need. A Labour victory, meanwhile, could spell trouble for the outsourcing businesses that run detention centres for immigration, which Labour has pledged to close.

Employee share ownership: One final consideration for stock market investors is Labour’s radical plan for inclusive ownership funds. The idea is that any company with more than 250 employees would have to transfer 1% of its shares into a trust fund for its workers each year until the fund holds 10% of total equity. This will happen though purchases of shares in the open market or by issuing shares as a scrip dividend. However, the latter would result in a 10% dilution in dividend payments, while workers would only be entitled to receive £500 a year from their shares, with income above this cap going to the Treasury.

City solicitor Clifford Chance reckons this scheme could cost investors as much as £300 billion over time, undermining stock market valuations across the board. That said, it also thinks the scheme will be very tough to implement legally.

The verdict on the impact of the parties’ proposals on the stock market

Any election that provides greater political certainty is likely to boost UK equities. Concerns about the negative impact of a Labour government may have been overdone, although its nationalisation and employee share ownership ideas will unnerve some investors.

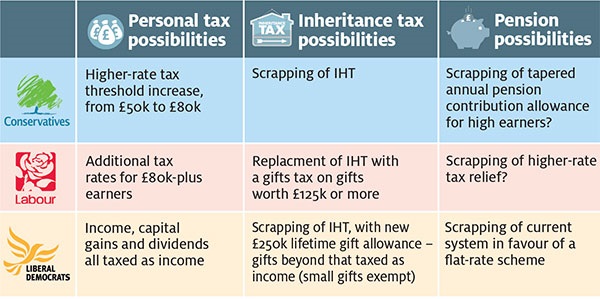

Personal tax

Wealthier people can expect to pay more income tax if Labour wins the election and less if the Conservatives return to power – but the devil is in the detail.

The Conservatives’ income tax proposals focus on the higher-rate band, the level of income where people start paying the 40% higher rate of income tax. Boris Johnson’s long-term aim is to raise this threshold from £50,000 today to £80,000, taking 2.5 million people out of higher-rate tax.

Bear in mind, however, that this goal will only be achieved in stages – and some of the gain will be recouped through higher national insurance contributions for the better off.

Still, the Conservatives’ plan represents clear blue water between it and the opposition. Labour also sees £80,000 as a key threshold, having previously promised that it will not add to the tax bills of those earning below this level. But taxes will rise from that point on.

Labour’s proposals include bringing in the 45% additional rate of income tax at the £80,000 level, down from £150,000 today, and adding a 50% rate above £150,000.

The Liberal Democrats’ income tax plans are less clear, but the party has previously advocated taxing capital gains and dividends through the income tax system. That would mean the abolition of the capital gains tax and dividend tax allowances.

Adrian Lowcock, a chartered wealth manager at financial adviser Willis Owen, says middle-income families look set to do better under all the parties. “This may seem unfair, but middle-income earners have seen their salaries largely frozen since the financial crisis,” he says.

The verdict: the rich will get richer under the Conservatives, but take a hit under a Corbyn government. Still, Labour’s definition of rich may surprise you.

Other taxes

Inheritance tax is one important battleground to watch. In the autumn, the chancellor of the exchequer, Sajid Javid, told the Conservative Party conference that he was considering scrapping the tax altogether. “It’s something that’s on my mind,” he promised delegates.

However, making good on that pledge would currently cost the Treasury more than £5 billion a year, an outlay that may be difficult to finance given the chancellor’s commitment to raising public spending. In the short term at least, tinkering with the system, with further exemptions and allowances, is more likely than outright abolition.

Labour, meanwhile, instinctively wants to raise more from inheritance tax, which it sees as an important tool for reducing inequality. It has floated the idea of replacing inheritance tax with a tax on gifts people make to family and friends above a certain value - probably £125,000 to begin with. That would substantially increase the number of families who pay tax on wealth passing from one generation to the next. It proposes the abolition of the residence nil-rate band as a starting point.

The Liberal Democrats have made similar suggestions, such as a new tax on lifetime gifts worth more than £3,000.

The money raised could be channelled into a £100 billion citizens’ fund targeted at reducing inequality.

One other possibility is capital gains tax (CGT) reform. Labour has previously pledged to reverse Conservative cuts to CGT, which would see basic-rate and higher-rate CGT rise to 20% and 28% respectively (from 10% and 18% today). Much higher rates would apply on profits from the sale of second homes.

The verdict: IHT bills are likely to rise under both Labour and the Liberal Democrats, albeit they will be paid differently. The Conservatives’ instinct is to reduce IHT, although they may struggle to do so.

Savings and investments

If it makes sense for you to use tax-free savings and investment plans, including individual savings accounts (ISAs), venture capital trusts (VCTs) and the enterprise investment scheme (EIS), consider doing so sooner rather than later. It is never a good idea to let the tax tail wag the investment dog, but such plans could be in for a shake-up following the election.

So far none of the parties have set out their intentions in this area of policy. It would be a mistake to fall for hysterical warnings that a Labour government would just abolish schemes designed to encourage savings; indeed, senior Labour figures backed proposals by the Association of Accounting Technicians last year to simplify the ISA system, which has become increasingly confusing.

Still, the cost of ISAs, VCTs and the EIS is rising. For politicians seeking a quick win on the tax take, reducing the generosity of such schemes could prove tempting. “The Liberal Democrats, for example, are likely to continue to drive the policy of removing the lower paid out of the tax system entirely,” says Lowcock.

“They could [help pay for that by] reducing tax reliefs and benefits for the very wealthy – such as VCTs.”

The verdict: No party has shown its hand. Expect tinkering rather than wholesale reform.

Pensions

Treat eye-catching promises on state pensions from all the parties with scepticism. Moreover, look out for changes elsewhere that temper their generosity. Final detail in this area is not yet available, but changes to pension credit and to allowances (ranging from free TV licences for the elderly to winter fuel payments) will all be as important as the headline rates of state pension the parties commit to.

On private pensions, the Liberal Democrats currently look the most radical. They have consistently argued for the abolition of the current system of marginal tax rate-linked reliefs on contributions to private pensions in favour of a flat rate. What that rate would be remains unknown, but such a move would favour basic-rate taxpayers while hitting those on the higher rate of income tax.

Both Labour and the Conservatives have been tight-lipped on this issue. For Labour, simply scrapping higher-rate tax relief might be a tempting proposition, given the windfall it would generate for the Treasury. For the Conservatives, reforms may be more technical in nature.

Having already been forced to intervene to protect doctors from the perverse effects of the tapered annual allowance, which hits higher earners by limiting their pension contributions, the prime minister may want to simplify in this area. Jason Hollands, managing director at Tilney Wealth Management, says:

"Were the Tories to do this, it would enable them to deliver a de facto tax cut for the higher-earning professional classes under the political cover of fixing a problem that is hurting the public sector."

Another issue to consider here is long-term care. Will any party dare to make firm proposals after Theresa May’s ‘dementia tax’ debacle?

The verdict: Welcome pension tax simplification is on offer whoever wins the election, but there will be winners and losers. Bear in mind that in practice governments always find it hard to simplify these rules.

Housing

The prime minister’s support for stamp duty reform, floated in the summer, has been blamed by some analysts for the autumn slowdown in the residential property market – buyers are waiting for the reductions Boris Johnson advocates, they suggest.

They may be in for a long wait: while the prime minister wants to raise the stamp duty threshold from today’s £125,000 to £500,000 and cut the top rate from 12% to 7%, it is doubtful whether such plans are affordable.

Still, centre-right think tank the Centre of Policy Studies has published research suggesting that such changes would boost sales, particularly at the top end, thereby compensating the Treasury for lower income per transaction. Watch this space.

Labour has also set out plans for the property market. Its ideas include a new levy on second homes and the replacement of council tax paid by residents with a land value tax paid by landlords.

The party has also mooted the idea of a right-to-buy scheme for private tenants that would compel private owners to sell their properties in certain circumstances. While the detail of these policies is not yet clear, “such measures would be a further nail in the coffin for buy-to-let property investment”, says Hollands.

The Liberal Democrats, meanwhile, remain tight-lipped on stamp duty, but they have previously advocated the expansion of schemes such as rent-to-own, where tenants gradually build up a stake in the properties they live in.

The verdict: A Conservative election victory could boost the housing market . Labour’s plans spell bad news for buy-to-let investors.

Main parties have set out some tax ideas

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.