eyeQ: opportunities in the gold sector

interactive investor has teamed up with the experts at eyeQ who use artificial intelligence and their own smart machine to generate actionable trading signals. Here’s what it says about these topical investments.

1st February 2024 10:50

by Huw Roberts from eyeQ

"Our signals are crafted through macro-valuation, trend analysis, and meticulous back-testing. This combination ensures a comprehensive evaluation of an asset's value, market conditions, and historical performance." eyeQ

- Discover: eyeQ analysis explained | eyeQ: our smart machine in action | Glossary

Gold, a focal point for investors right now, surged by 14% in the final quarter of 2023. As 2024 unfolds, potential risks like elections, political tension, renewed inflation and looming financial crises could further solidify gold's coveted “safe haven” status.

While exchange-traded funds (ETFs) offer exposure to spot gold prices, professional investors at the big fund houses often explore gold mining companies for a “high beta” (more volatile) play. In simpler terms, when gold rises 1%, these mining stocks can potentially surge two or three times that amount – i.e. a way to get more bang for your buck.

VanEck Gold Miners ETF

- Trading signal: strategic long-term

- Model value: $29.49

- Fair Value Gap (premium/discount to model value): -6.5%

- Model relevance: 78%

Data correct as at 24 January 2024. Please click glossary for explanation of terms.

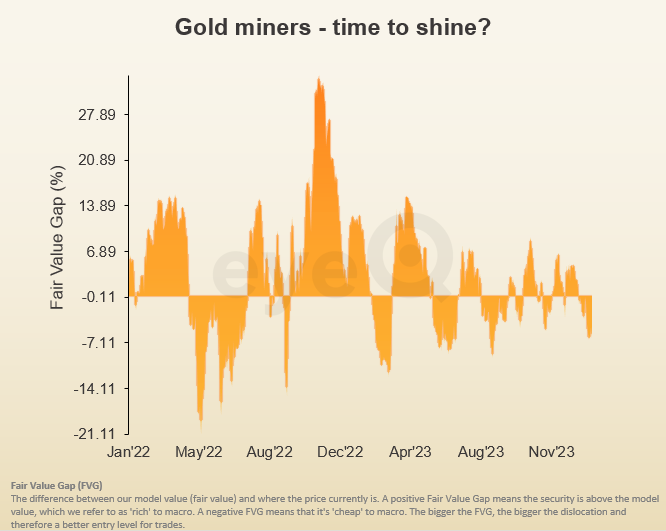

Currently, eyeQ’s smart machine highlights VanEck Gold Miners ETF (LSE:GDX), the ETF giving exposure to global gold miners, as 6.5% undervalued. That’s the bottom end of the recent valuation range.

Endeavour Mining

- Trading signal: strategic long-term

- Model value: 1,756.8p

- Fair Value Gap (premium/discount to model value): -25.2%

- Model relevance: 68%

Data correct as at 24 January 2024. Please click glossary for explanation of terms.

Another intriguing option is Endeavour Mining (LSE:EDV), a West African gold mining company listed in the FTSE 100.

The valuation picture here is even more compelling, with the stock trading at a staggering 25.2% below the indicated level based on broader macro factors like growth, inflation, risk appetite and financial conditions.

For gold bugs, this looks like a great entry level on an alternative way to play upside in precious metals.

These third-party research articles are provided by eyeQ (Quant Insight). interactive investor does not make any representation as to the completeness, accuracy or timeliness of the information provided, nor do we accept any liability for any losses, costs, liabilities or expenses that may arise directly or indirectly from your use of, or reliance on, the information (except where we have acted negligently, fraudulently or in wilful default in relation to the production or distribution of the information).

The value of your investments may go down as well as up. You may not get back all the money that you invest.

Equity research is provided for information purposes only. Neither eyeQ (Quant Insight) nor interactive investor have considered your personal circumstances, and the information provided should not be considered a personal recommendation. If you are in any doubt as to the action you should take, please consult an authorised financial adviser.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.