Favourite FTSE 100 mining shares and ones to sell

21st March 2023 13:12

by Graeme Evans from interactive investor

It’s not been a great 2023 for the global mining sector, and stocks have struggled recently, but City experts think there’s now an opportunity to buy.

Sunken mining valuations have created an “attractive entry point” to buy Glencore (LSE:GLEN) shares and left Anglo American (LSE:AAL) exhibiting “deep value”, a City bank declared this week.

Bank of America yesterday switched both FTSE 100-listed stocks to “buy” recommendations with an upside for Glencore of 34% to 580p and 40% to 3,500p for Anglo American.

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

Higher US interest rates and the potential negative impact from stress in the global banking system have dented valuations over recent weeks, leaving Glencore 30% off its recent January record high of 580p and Anglo American down by a similar level from 3,672p.

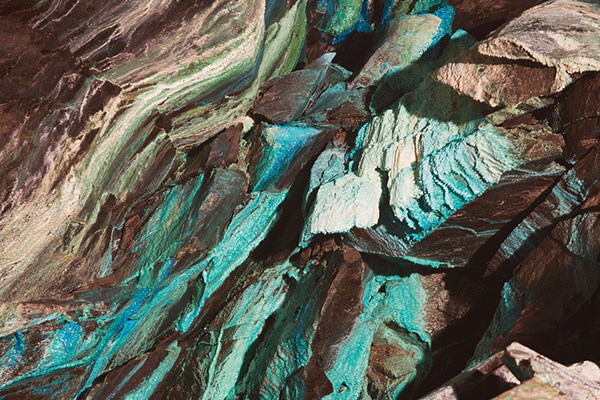

However, the bank is bullish on China’s Covid reopening and highlights the strength of Glencore’s portfolio of decarbonisation metals such as copper, cobalt and nickel.

It also looks for further strength in Asian demand to support Glencore’s coal assets, which should provide “interesting optionality” to higher energy prices later this year.

The bank said: “We think shares now exhibit deep value and, near term uncertainties notwithstanding, we see this as a compelling entry point.”

- Gold: four exciting companies to track this year

- Sylvania Platinum: busy year for this hot stock

- Battery metals: four stocks to follow in 2023

- What you need to know about the battery metals market

It's a view shared by counterparts at UBS after they yesterday switched their recommendation from “neutral” to “buy“ with an unchanged price target of 560p.

UBS noted that Glencore shares had underperformed Rio Tinto (LSE:RIO) and BHP (LSE:BHP) by over 10% since the January high, mainly due to macroeconomic concerns and the weaker thermal coal price.

The bank said: “We believe the risk/reward is again attractive and concerns of further softening in thermal coal and curtailing of cobalt production are priced in.”

UBS, which has sell recommendations on Rio and BHP, looks favourably on Glencore’s commodity mix, its restructuring and organic growth options as well as its strong near-term cash generation and capital discipline.

Glencore is due to post a production update on 26 April, when it may trim cobalt volumes due to inventory build across the industry. The company is currently working through a $1.5 billion buyback programme and UBS sees the potential for the half-year dividend of $0.20 a share or $2.6 billion to be topped up by as much as $5 billion.

UBS has a “sell” recommendation on Anglo American, whereas analysts at Bank of America are more optimistic based on pricing expectations for the company’s five platinum mining operations in South Africa and one in Zimbabwe.

- Stockwatch: bonds, equities or cash – my investing tactics

- Insider: directors buy this resilient best stock idea for 2023

- ISA investing: why Credit Suisse crisis shouldn’t put you off

- Why investors aren’t worried about a repeat of the 2008 bank crash

South Africa accounts for nearly 80% of mined platinum supply but power shortages have disrupted the industry in areas such as smelting, ore processing and ventilation.

Bank of America highlighted recent figures suggesting that the country’s supply of platinum group metals could disappoint by 10%-25%, although it believes Anglo American is relatively better placed thanks to a backlog of concentrate and having an open-pit mine.

As well as a potential price benefit from tighter platinum markets, the bank expects an upside surprise from China’s reopening progress.

About 50% of demand for most metals and mined commodities comes from the country, which increased crude steel output by 6% in the first two months of the year.

The bank said: “We now think shares exhibit deep value and, concerns on South African risks notwithstanding, we see this as a compelling entry point.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.