The Financial Grimes: 18 June 2019

This top City analyst reviews the financial sector stocks making headlines today.

18th June 2019 08:52

by Jeremy Grime from ii contributor

This top City analyst reviews the financial sector stocks making headlines today.

Jeremy Grime spent 15 years as a financial sector analyst, working at Altium Capital, RBC Capital Markets, Panmure Gordon and most recently as Director of Research at finnCap. Jeremy is also a qualified accountant.

Jeremy’s blog is written with more experienced investors in mind. However, we have included a brief glossary at the bottom of the page to help those less familiar with some of the language used. For more on key financial metrics and valuation ratios click here.

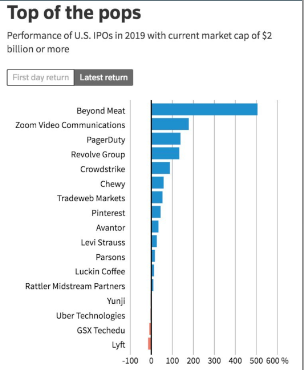

Beyond Meat Inc (NASDAQ:BYND) was up another 12% overnight. $10 billion market cap now. $15 million loss expected this year.

Imitators Agronomics Ltd (LSE:ANIC) carried out a placing at 4.5p a week ago "to invest in the alternative food sector".

Note to self: When you see a bandwagon, don't get on it.

Today – Plus500 (LSE:PLUS) and Rosenblatt (LSE:RBGP) have AGM's today but no announcement out.

1pm – Earnout

Share Price: 41p

Mkt Cap: £36 million

Conflict disclosure: I Hold

1pm (LSE:OPM) offers asset finance to lease business equipment and small business loans to the UK small business sector.

Sometimes a stock gets so cheap no one wants to own it. The market has decided that the money on acquisitions of 2-3 years ago was all wasted. This announcement suggests it wasn’t.Perhaps it will be bid for but I suspect patient investors will get rewarded.

Statement – The invoice finance business "Positive Cashflow" has achieved its earnout targets a year ahead of schedule. In 2016, this invoice finance business made profits of £1.1 million and the earnout was based on PBT growth targets. The payment of the earnout results in the issue of 2.5 million shares at 60p, according to the acquisition announcement in 2017.

Estimates – Forecasts look for a 9.3% revenue growth over the year to May 19 and 13% PBT growth to £8.6 million which is EPS of 6.8p. Given Positive Cashflow is a year ahead, one imagines the pressure on forecasts is on the upside.

Valuation – PER is 6X the year just ended and a yield of 2.2%. ROE is 13.9% and Price/NAV is 0.8, although price/NTAV is 1.8X

Mortgage Advice Bureau – Acquisition

Share Price: 582p

Mkt Cap: £299 million

Conflict disclosure: No holding

Mortgage Advice Bureau (LSE:MAB1) offers expert mortgage advice to UK consumers, both face to face and over the phone

This share has long been expensive but reliable and supported by the dividend.I have recently found myself worrying that over the last two years, as Buy to Let mortgages have declined, the slack had been taken up by first-time buyers and growth in the mortgage switching market. But around two years ago, more mortgages have been moving from two-year fixed to five-year fixed, which could slow the switching market two years later. An acquisition could be what is needed to fill the gap.It looks a little defensive and a dividend cut won't be welcomed.

Acquisition - MAB1 is acquiring 80% of First Mortgage Direct for £16.5 million cash, which is expected to be significantly earnings accretive. First Mortgage has 90 advisers and is based in Edinburgh with 14 shops. From arranging £2 billion mortgages last year it achieved revenue of £10.2 million and PBT of £1.5 million.

Consideration - MAB has obtained a revolving credit facility from Nat West for £12 million which it intends to repay as quickly as possible, aided by reducing the dividend payout from 90% to 75%.

Estimates - December 19 forecasts look for £17.7 million PBT which is EPS of 28.3p and a 26.1p dividend.If we add £1.5 million to the PBT we may get EPS of 30.7p and a 75% payout would be a dividend of 23p. So it looks like a dividend cut in the region of 10%.

Valuation - Pre acquisition PER 19.3X and yield of 4.7%.Acquisition looks c 8% enhancing.

| Glossary | |

|---|---|

| PBT | profit before tax |

| EPS | earnings per share |

| ROE | return on equity |

| EBITDA | earnings before interest, tax, depreciation and amortisation |

| PER | price earnings, or PE ratio |

| Yield | dividend yield |

| FCF | free cash flow |

| NAV | net asset value |

| Price/Book (PB) | a company’s share price versus what it owns |

| Book Value | a company’s worth after subtracting debts and liabilities from assets |

| AUM | assets under management |

| FUM | funds under management |

| OTC | Over-the-counter |

| FCA | Financial Conduct Authority |

| ESMA | European Securities and Markets Authority |

For information about Jeremy's 'deep dive' company analysis, you can email him at jeremy@charltonillingworth.co.uk

Jeremy Grime is an independent equity markets analyst and freelance contributor, not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.