Finsbury Food: Cheap stock grinds out the results, but is it a buy?

30th November 2018 13:41

by Richard Beddard from interactive investor

Like a football team winning game after game by a single goal, Finsbury Food is eeking out small profit gains in a very competitive market. Analyst Richard Beddard gives his view on the shares.

It was a shock melt-up in the price of butter that did it for Grain D'Or, Finsbury Food's London bakery closed at great expense during the financial year that ended this June. The rising prices of other ingredients, and the higher wages of bakery workers added to the bakery's losses.

If we ignore the one-off £13 million expense of shutting two bakeries down, mostly the cost of curtailing leases and contracts, but also redundancies, it was business as usual for Finsbury: pretty gruelling. Revenue fell slightly due to lost sales from Grain D'Or, and profit rose slightly. Include these costs, though, and Finsbury only made £5 million profit, compared to the adjusted figure of £18 million.

You may wonder why I am bothering to score the company. Well, I grudgingly (more on that later) admire its return from the brink during the financial crisis of 2008, and its ability to eek out profit in a very competitive industry. It bakes cakes and bread for supermarkets and coffee shop chains primarily.

As usual I am determining whether Finsbury is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 1

This is what attracts me to Finsbury Food: It wasn't the profitability of the company's operations that got it into trouble in 2008, it had built up so much debt acquiring other bakeries that despite good operating profits, it couldn’t afford the interest.

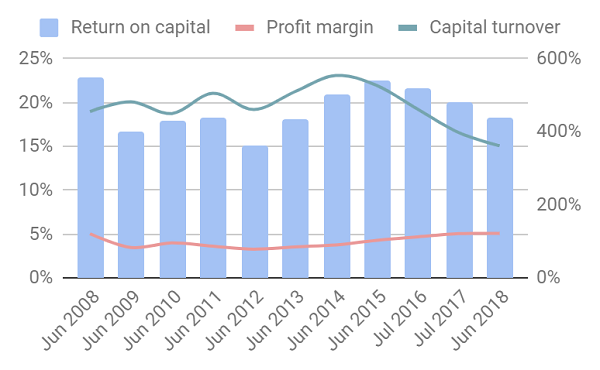

Finsbury has earned an average return on capital of 19% over the last 11 years:

Source: interactive investor Past performance is not a guide to future performance

The chart measures the return on Finsbury's operating capital: the money it has invested in tangible assets: ovens, warehouses, offices, and vehicles for example and purchased intangible assets like software systems. It doesn't include the value of acquired intangible assets, primarily goodwill. Goodwill is an accounting figment required to balance the books. It is created when a company buys another company for more than the value of its tangible assets.

Goodwill is a historical cost not an ongoing one. A business is under no obligation to make more acquisitions, and if it does future deals may be on better terms than past ones. In assessing the level of profitability we can expect from a business in future, it is often best to ignore the goodwill.

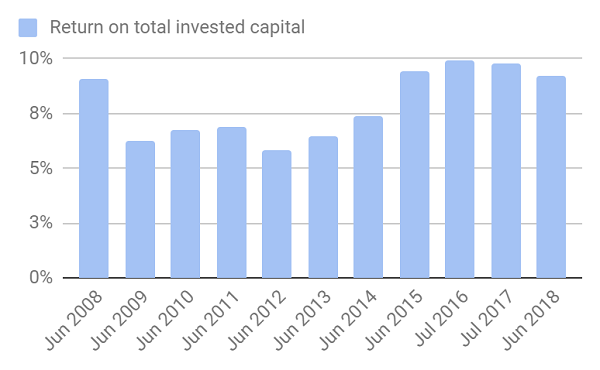

That said, Finsbury Food plans to make more acquisitions, indeed it made one just after the end of the financial year, so I think we need to consider whether Finsbury has been a good acquirer. Include goodwill at cost, and Finsbury Food's average return on total invested capital drops to 8%.

Source: interactive investor Past performance is not a guide to future performance

If the company earns an average return on total invested capital of 8% in future, I would describe profitability as adequate rather than good.

Adaptable: How will it make more money?

Score: 1

The baker does lots of things to make more profit. It is innovating to make its unhealthy products healthier, it licences famous brands like Disney and Mary Berry to make cakes more appealing, it closes down older bakeries and opens more automated ones to be more efficient, but its primary strategic objective is to grow bigger.

Scale should make Finsbury more profitable, allowing its bakeries to operate at capacity, strike a harder bargain with suppliers, and negotiate more effectively with customers, which is particularly important because they are getting bigger too: Tesco has acquired Booker, and subject to a competition investigation, Sainsbury is merging with Asda.

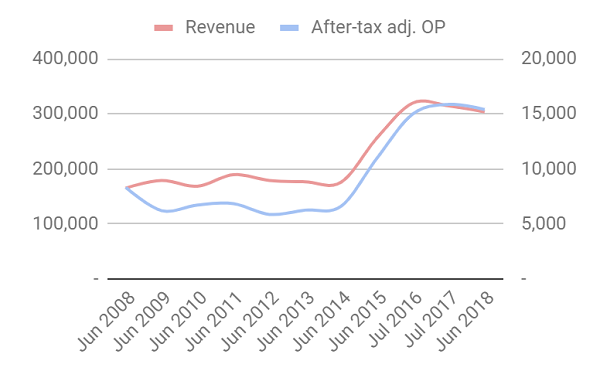

Finsbury doubled its size in 2014 and 2015 when, in 2014, it acquired Kara, which supplies the foodservice industry (coffee chains, and, through wholesalers, restaurants and pubs). Twenty-fifteen was Kara’s first full year contributing to revenue and profit:

Source: interactive investor Past performance is not a guide to future performance

The company helpfully discloses the size of its UK markets, so we can get a sense of how big it is:

| Market | Size (£m) |

|---|---|

| Ambient cake | 950 |

| Retail bread and morning goods | 2,200 |

| UK foodservice cake and sweet treat | 807 |

| UK foodservice bread and morning goods | 691 |

| Total | 4,648 |

Finsbury earned £258 million in the UK (the other £46 million was in Europe) so its UK market share is just under 6%. In some niches of the market, like ambient pre-packaged cake, I believe it is the market leader.

I think the development of Finsbury's revenue and profit over time tells a story, though, and that is without acquisitions it struggles to grow. In judging the firm’s prospects, therefore, we must judge the acquisitions.

Kara doubled Finsbury Food's size in terms of profit, but the company issued more shares to help finance the deal, nearly doubling the share count. Hitherto I think the net benefit to shareholders has been limited.

This September, Finsbury acquired Ultrapharm. Two things mystify me about the deal. Ultrapharm bakes gluten free bread, which Finsbury says is a growth market, but Finsbury disposed of its own gluten-free bakery, called "Free From" in 2013 to pay off debt. Then there is the price Finsbury paid for Ultrapharm, which is £17 million plus a commitment to pay up to £4 million more. Ultrapharm’s latest pre-tax profit was just £0.8 million so the price is steep: potentially a multiple of 26 times pre-tax profit.

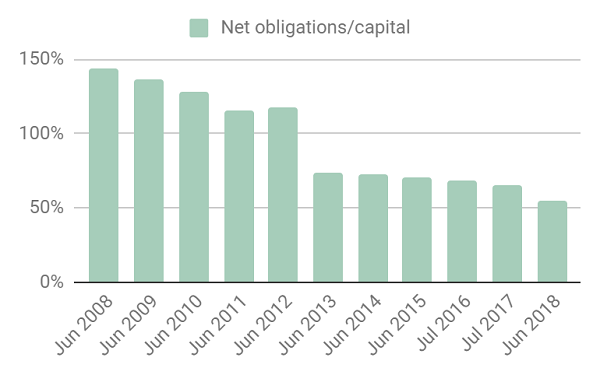

By tapping shareholders for funds, and in the years before 2013 through disposals, the company has at least reduced its financial obligations:

Source: interactive investor Past performance is not a guide to future performance

But it is in investment mode now, and I doubt this trend will continue. In addition to acquisitions, capital expenditure has risen from less than 2% of revenue a year in the years before 2014 to 4% a year in the last three years as the company has upgraded its factories. One of its investments in 2018 was an "automated craft cake line", surely an oxymoron.

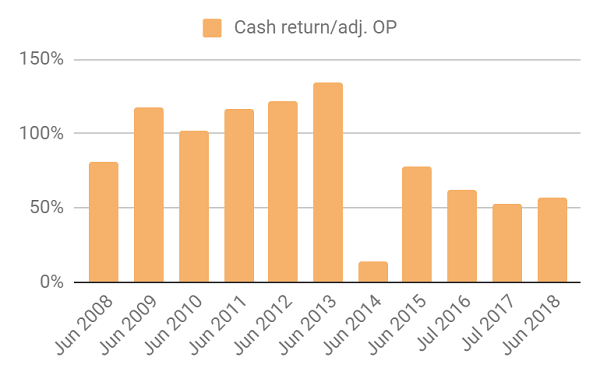

The increase in investment goes some way to explaining why cash flow is less impressive than it was:

Source: interactive investor Past performance is not a guide to future performance

Resilient: What could go wrong?

Score: 1

I think Finsbury Food may be overreaching again by making pricey acquisitions. Productivity gains from increased investment may merely offset higher labour costs and grinding competition, and Brexit also brings a full gamut of risks. Finsbury Food uses low-cost immigrant labour, it sells baked goods in Europe, and imports eggs and butter.

Equitable: Will we all benefit?

Score: 1

Although I respect John Duffy's achievements since he was appointed chief executive in 2009, I still think he is paid too much. Despite forsaking his bonus because of the exceptional costs of closing Grain D'Or, his "single figure of remuneration" in 2018 was mostly made up of a handsome basic pay packet and an extraordinarily generous LTIP, which together netted him £1.2 million (£1.9 million in 2018 including bonus). The finance director does very well too.

The company's "people strategy", which brought in an increased emphasis on training, is in its third year, but reviews of the business by staff on recruitment sites are very mixed, which may reflect the mundanity of work on a production line.

One disgruntled employee could only find one positive, which he qualified: "Free cake (it's not nice though)".

Cheap: Is the firm’s valuation modest?

Score: 2

The market values Finsbury Food at about 12 times adjusted profit, which is relatively low, but I think that is an accurate verdict on the business' prospects. The bakery business is hard work, and though Finsbury Food is grinding out respectable results, a score of 6/10 means I cannot recommend it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.