Five ways to tap into a country with huge potential

Could there be a value opportunity in the stock market for this emerging market country?

9th October 2020 15:00

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

This emerging market is struggling economically – but could there be a value opportunity in the stock market?

Five ways to play Indian equities

Thomas McMahon, senior analyst at Kepler Trust Intelligence.

India is one of the countries hit worst by the coronavirus crisis. In Q2 the country’s GDP fell 23.9%, which compares to an average of -6.9% for the OECD average and growth of 11% for China, following a 10% decline in Q1. India’s government has also definitively lost control of the virus itself.

While other countries can at least claim to be restraining its spread (although that is contentious), India has been continuing with its national unlocking while cases rise rapidly (even if some states have imposed further restrictions). Unfortunately for India, some of the states most affected by the virus are economically very important: Maharashtra, Andhra Pradesh, Tamil Nadu and Karnataka. Below we consider what this means for a long-term investment in India.

An economy in trouble

It’s easy to be bearish on India. On top of the country’s struggles to control the coronavirus, it is also dealing with a slow-motion banking crisis; with the banks set to come under extra pressure due to defaults consequent to the pandemic. Furthermore India’s financial system is still dealing with the fallout of the collapse of IL&FS in late 2018. IL&FS was a major lender to infrastructure projects, and other large financial institutions in India were major shareholders.

The company fell short of cash and defaulted on some loans, leading to contagion in the banking system and regulatory investigation. Yes Bank’s exposure to IL&FS and the collapsed Dewan Housing Finance was a contributory factor to it being placed into administration in March this year. Investor wariness of existing NPLs has led to it becoming harder for banks and non-bank financial institutions to fund themselves, creating a vicious circle. In all three cases senior executives have been accused of fraud.

The weak banking system has had to cope with interest rates which were above 6% last year but have been cut to 4%, with the potential for further cuts to boost the economy. More worrying still is the end of the loan moratorium, which allowed the Indian government to prevent action on bad loans in order to support borrowers through the pandemic.

This ban ended on 31 August. Gavekal Research estimates that if 10% of the loans under moratorium defaulted, non-performing loans in the banking system would increase by almost 40%; wiping out the gains made in reducing NPLs from 11% of loans at its 2018 peak to 8.5% in March 2020. In fact the Reserve Bank of India forecasts that the NPL ratio will rise by 4 percentage points to 12.5% by the end of March 2021, but admits the ratio could go as high as 14.7% if there is “very severe stress.”

In the long run this crisis could be good for the banking system. Modi’s government is looking at selling its large stakes in Punjab & Sindh Bank, Bank of Maharashtra, UCO Bank and IDBI Bank. According to Reuters, Modi has asked officials to speed up the process. The hope is to create a more efficient banking system and raise much needed cash to support the budget deficit. However, with the economic impact of the pandemic yet to be fully felt, the near future for the banks is clearly troubling.

Another worrying development for the country is the confrontation with China. India sees China as a key rival, and there has been lots of anger at China’s role in the pandemic (as in Europe and the US). The two countries share a border, and there were military clashes along it in May of this year. These clashes led to 20 Indian soldiers dying and a reported 43 Chinese casualties, including one dead officer. This is a long-standing area of conflict, and although the uneasy truce seems likely to remain it is an unwelcome tail risk nonetheless.

India wants to use the pandemic to gain a share of global manufacturing from China. India aims to do this by levering foreign companies which have outsourced manufacturing away from China, but want to find alternatives due to the ongoing trade dispute between the US and China, growing Western distrust after the pandemic, or simply the growing labour costs in China.

India has had some success in attracting Samsung to set up the world’s largest mobile phone factory in Noida. In addition, Foxconn is manufacturing the iPhone 11 in Chennai, while Winstron is planning to produce the iPhone SE 2020 in Bengaluru. However of the 56 firms that left China between April 2018 and August 2019, only three shifted to India while 26 went to Vietnam – according to Ritesh Kumar Singh, Chief Economist of Indonomics Consulting and Former Assistant Director of the Finance Commission of India. Furthermore he points out that electronics manufacturing in India, with the exception of that done by Samsung, is essentially all just assembly work. India’s manufacturing is still quite low down the value curve, with only 9% of its manufacturing exports ‘high quality’ compared to 31.5% in China and 40% in Vietnam. Investment in R&D is low by international standards, even when comparing only to developing countries.

Modi’s nationalism can also tend to dominate his liberalisation programme, and India’s attitudes to free trade remain complicated. India has withdrawn from the proposed Regional Comprehensive Economic Partnership (RCEP) between the ten member states of ASEAN and key partners, including India as well as Australia amongst others. India wishes to protect its agricultural sector as well as domestic manufacturers. However, with domestic demand likely to be weak thanks to the pandemic, Indian companies’ relatively limited or difficult access to foreign markets will be unhelpful in the coming months and years.

India still offers huge potential for earnings growth

The current situation is not a pretty picture then, and the India managers we speak to all acknowledge that the short-term outlook for the economy is not good. India still has huge attractions for investors, however. Its population is still young by global standards, which means a greater potential labour force and a lower burden per worker – in terms of non-workers to support.

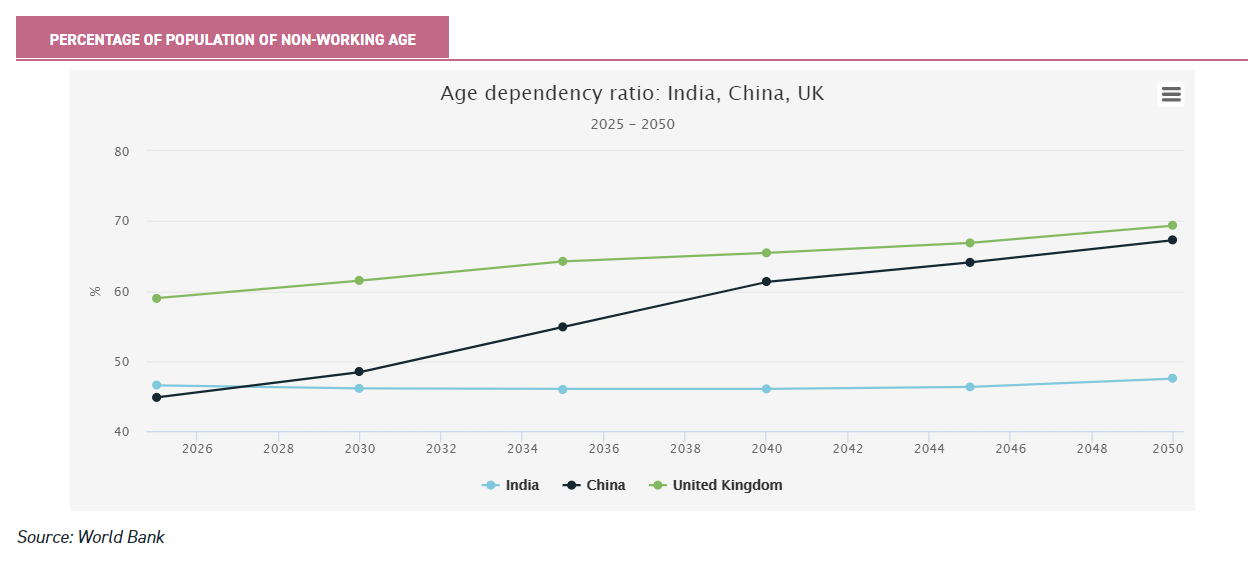

The graph below shows the World Bank’s forecasts of the age dependency ratio in India versus the UK and China. China’s aging population means that by 2050 it will have a similar proportion of non-workers to workers as the UK, which is roughly 65%. India should still have below 50% of its population of working age.

These workers are also potential consumers. India’s lower standard of development than, for example, China, means that there are huge opportunities in the penetration of existing technologies.

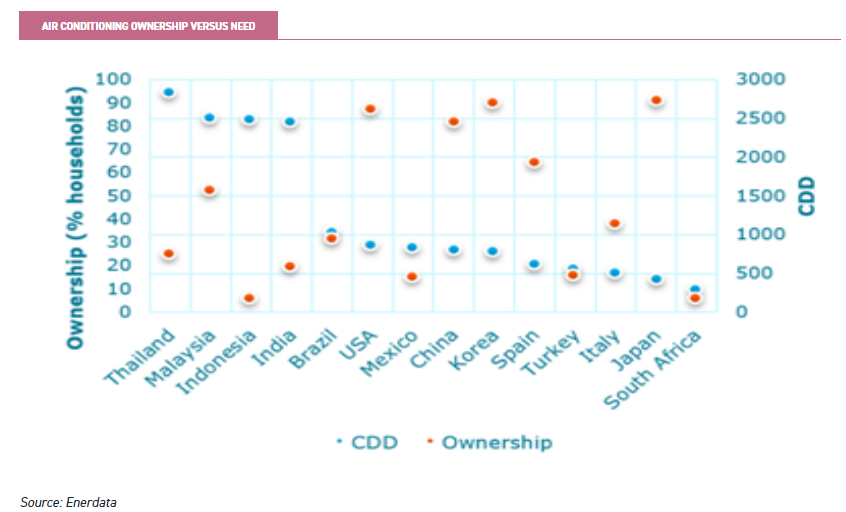

Consulting firm Enerdata has plotted the cooling degree days (a measure of the need for cooling) versus the percentage of households which possess air conditioning.

The below chart shows that only 20% of India’s households have air conditioning, despite the fact they have one of the greatest needs for it. They also calculate that the rise in ownership since 2000 has been extremely small. Another example is television ownership: only 32% of Indian households own a TV, while 89% of Chinese do. Only 37% of Indians use a smartphone, compared to 60% of the Chinese and 83% of Brits.

Finally India also has strong institutions and a reasonable culture of corporate governance. There is plenty of graft in India, and fund managers devote a considerable amount of time to examining the risks from this angle.

There are also plenty of family-owned businesses, some with complicated structures or large voting blocks which need to be understood. However in general managers report finding a higher number of investable and well-run companies in India than many of its emerging market rivals. Nonetheless Transparency International’s Corruption Perceptions Index ranks India level with China on a market level, although still considerably ahead of smaller regional rivals.

How much is in the price?

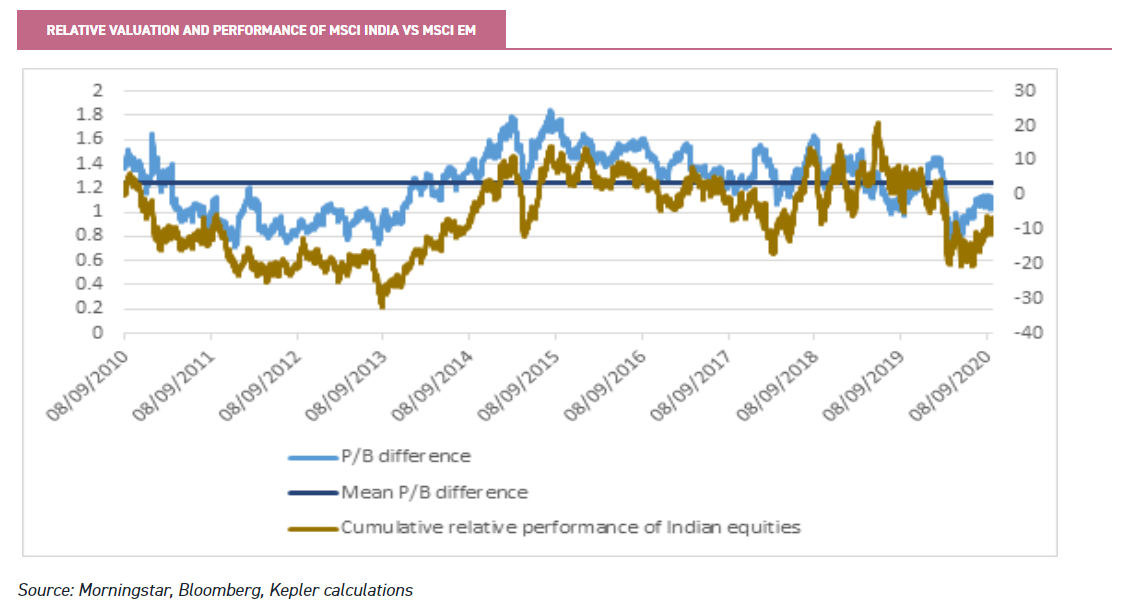

A final point about the Indian market, rather than the Indian economy, is that valuations are not demanding. India tends to trade on a higher valuation than the emerging markets as a whole. In the graph below we have plotted the differential between the MSCI India price to book ratio (P/B) and that of the MSCI Emerging Markets: the mean of this difference is displayed in dark blue.

We have avoided looking at a forward price to earnings, due to the uncertainty about earnings in the current pandemic. Finally we have plotted the cumulative relative performance of the two indices. Indian equities look cheap relative to their history. They are not dramatically cheap: the Z-score of the current differential is only -0.45. Nonetheless they are still cheap and, as the performance chart indicates, the last time Indian equities traded on these levels (in the 2011-2013 period) they outperformed considerably subsequently. However investors had to wait.

The chart below indicates that there has already been some outperformance over the summer, although the P/B differential has still not normalized. It is also worth noting that much of the relative outperformance of the Indian market in 2014 occurred after Modi’s first election win. The political optimism in 2020, however, is much reduced, so focusing on valuations might be misleading in this case.

The real reason to invest in India

Despite India’s poor near-term economic outlook, we still think it has much to offer the long-term investor. Looking past the economy and even the market as a whole, India offers a number of exciting stock-specific opportunities.

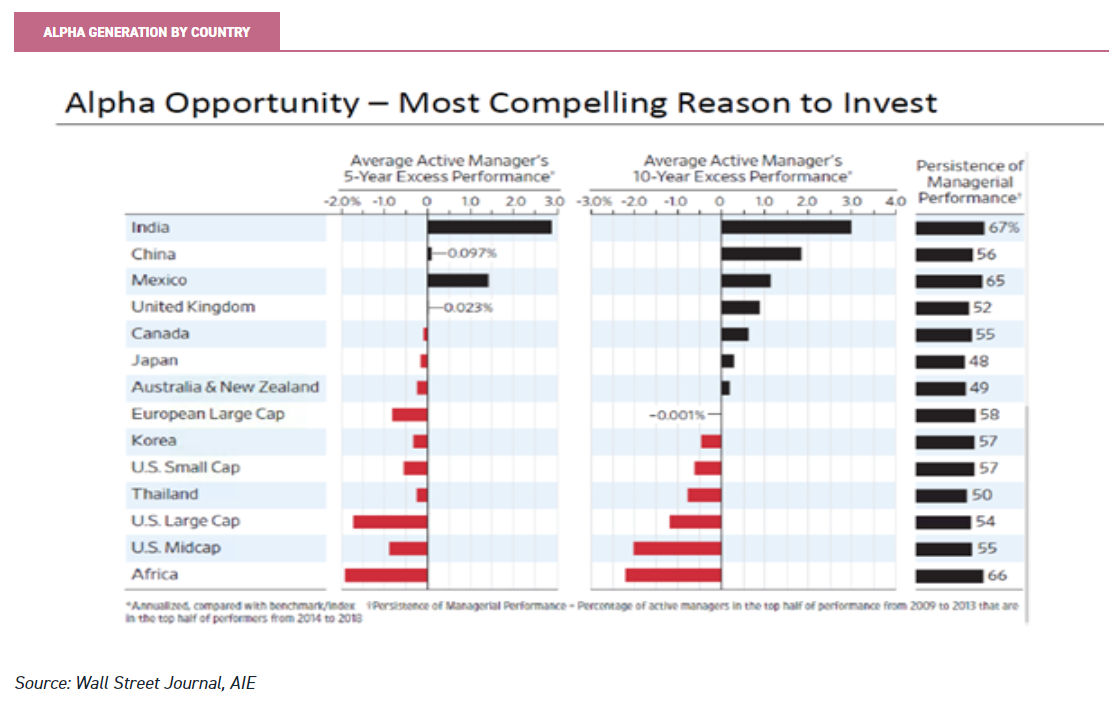

In fact, India is the best market in which to invest for alpha, according to research by the Wall Street Journal. They looked at top-performing managers around the world from 2009 to 2013 and from 2014 to 2018. The Wall Street Journal found that India specialists added the most amount of alpha over five and ten year periods. But they also found that there was the greatest persistence of outperformance, with 67% of managers in India who outperformed in one period managing this in the second.

We would argue this development is because there are plenty of exciting, but under-researched, companies with huge potential in the Indian market. The disparity in quality and returns between the best and worst stocks means that there are huge opportunities for stock pickers. These companies are those most exposed to India’s economic advantage discussed above: a young population with growing demand for more sophisticated goods. Below we have suggested some potentially exciting opportunities and the investment trusts which hold them.

HDFC Bank

HDFC (NYSE:HDB) is a holding of both Aberdeen New India (LSE:ANII) and JPMorgan Indian (LSE:JII). Its share price has doubled over the past five years in local currency terms, while the BSE Sensex is up around 43%. It is India’s largest private sector bank by assets. India’s banking system was liberalised in the 1990s, with new entrants like HDFC growing rapidly since then and stealing market share from the state-owned incumbents.

The current banking crisis will strengthen HDFC Bank’s position in the long run, according to Kristy Fong of the ANII management team, as well as its high-quality peer Kotak Mahindra Bank. Kristy argues the shake out of weaker operators should allow these better-run banks to steal more market share (see our latest note). The under-penetration of financial products should mean that demand for bank accounts, loans and payment services will grow considerably over the coming years, even if the short term sees all banks take a hit from the ailing economy.

Reliance Industries

Reliance Industries (LSE:RIGD) is the largest company on the Indian market, making up c. 15% of the market capitalisation. It is a controversial stock, which has been avoided by a number of managers unsure about its corporate structure and corporate governance.

However, thanks to the excitement about its foray into digital industries, the shares have rallied 50% in 2020 while the Sensex is down for the year.

Reliance is a conglomerate, the core business of which is in petrochemicals, refining and other oil and gas-related businesses. In 2015 it launched a subsidiary, Reliance Jio, to operate in the telecoms space.

Reliance Jio is India’s largest mobile phone operator, and has branched out to offer fibre broadband – as well as delivering television and internet services. It has also developed a series of mobile phones, in addition to numerous apps and services delivered over the internet. Scottish Mortgage (LSE:SMT) is one of the investment trusts to have benefitted from its recent surge.

One concern about Reliance is its valuation, but growth investors like James Anderson of SMT often argue that the growth potential in digital businesses are systematically under-valued by the market. Nevertheless Rajendra Nair, manager of JII, believes that the current valuation is excessive in the short term. Having added to the company earlier in the year, Rajendra is waiting for cheaper valuations to add more. Rajendra also looks for long-term growth, but is more sensitive to near-term valuations than James.

Info Edge

Info Edge is another company operating in the digital sphere, and has also had a strong 2020: shares are up 44% year-to-date. Its core business is online recruitment, where it has a strong leadership position. This business generates healthy cash flows, which have allowed it to branch out into other areas of e-commerce, such as food delivery and insurance.

The managers of ANII have admired the stock for some time, but were not comfortable with the valuation until the arrival of the pandemic saw the market sell off significantly. In their view the company is well-run by its founder and has a highly profitable core business. Info Edge is also held by Ashoka India Equity (LSE:AIE). AIE’s aim is to find high-quality businesses, on what they regard as an attractive valuation, using a bespoke metric we discuss in our latest note.

Specialty chemicals companies

AIE is the top-performing Indian trust of recent years, although it is relatively small in market cap. One area that the management team find particularly interesting is the specialty chemicals sector. While India has struggled to gain manufacturing share overall, this sector is an exception.

The AIE team think that India’s strong adherence to global standards, strong protection for IP and capabilities in complex chemistry puts it in a strong position to gain market share. This position doubled to 4% of the global market between 2006 and 2019, but the team think there is much more growth to come.

They forecast revenues in India will grow at a compound annual growth rate of 13% over the next five years, compared to just 7% for China and a 5% global average. Navin Flourine is a top ten holding for AIE, which holds other companies in the industry too. In our recent note we discussed the managers of AIE’s views on the off-shoring trends.

Blue Star

Blue Star is an air conditioner manufacturer, long-owned by Scottish Oriental Smaller Companies (LSE:SST). Blue Star is a family-owned business which has historically had a strong position in industrial projects, but has moved more and more into the retail market. Revenues have taken a hit because of the pandemic, with sales down 19% in the first half and profits down 66% due to the high operating leverage.

However the long-term growth case should be clear from our discussion above: there is a huge need for air conditioning in India. The manager of SST, Vinay Agarwal, notes that Blue Star has strong positions in some of the smaller cities which have come out of lockdown faster and seen sales rebound. Shares are down 23% year-to-date, but 38% up from their 2020 nadir. Blue Star, like HDFC Bank, could be more sensitive to a recovery in the Indian domestic economy than the digital and e-commerce stocks mentioned above. Vinay’s approach for SST is to aim to find high-quality businesses on attractive valuations and hold for the long term. Blue Star has been in the portfolio for a number of years.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.